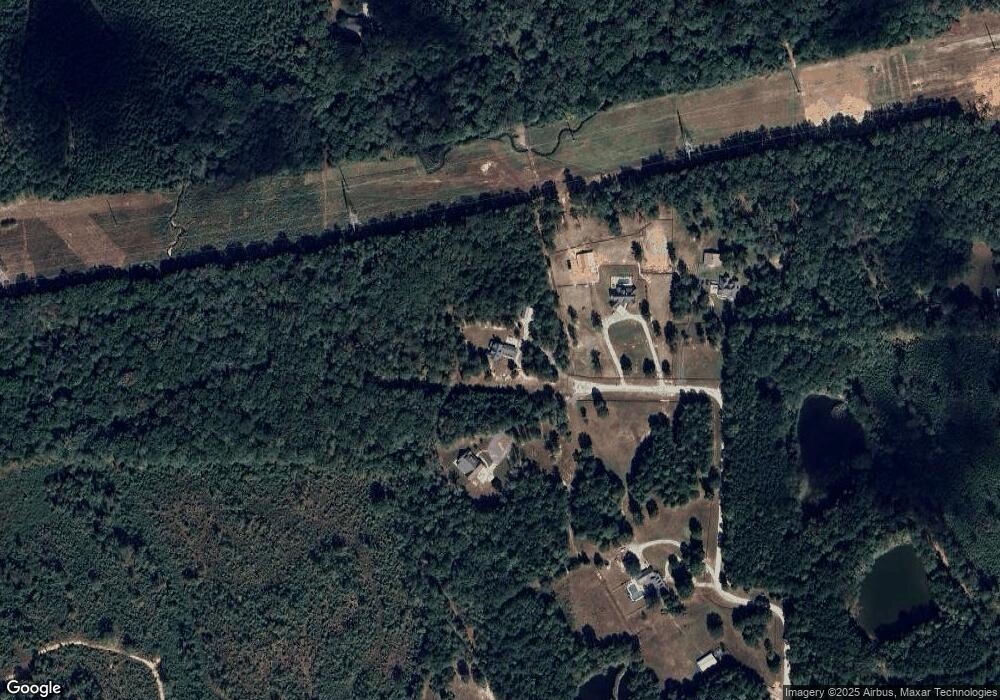

225 Bradleys Line Dr Senoia, GA 30276

Estimated Value: $626,000 - $784,219

4

Beds

3

Baths

2,896

Sq Ft

$240/Sq Ft

Est. Value

About This Home

This home is located at 225 Bradleys Line Dr, Senoia, GA 30276 and is currently estimated at $694,805, approximately $239 per square foot. 225 Bradleys Line Dr is a home located in Coweta County with nearby schools including Poplar Road Elementary School, East Coweta Middle School, and East Coweta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2020

Sold by

Childers Gregory

Bought by

Blount Anthony and Blount Katherine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$408,000

Outstanding Balance

$359,784

Interest Rate

3.5%

Mortgage Type

New Conventional

Estimated Equity

$335,021

Purchase Details

Closed on

Jan 24, 2017

Sold by

Emaus Mark Earl

Bought by

Childers Gregory and Childers Kelly Erin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$329,600

Interest Rate

4.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 15, 2002

Sold by

Emaus Mark E and Emaus Rhond

Bought by

Emaus Mark and Emaus Rhonda Emaus

Purchase Details

Closed on

Mar 25, 1992

Bought by

Dva Corporation

Purchase Details

Closed on

Jan 17, 1992

Bought by

Citizens Bank & Trus

Purchase Details

Closed on

Jun 30, 1985

Bought by

Lassiter Properties

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blount Anthony | $510,000 | -- | |

| Childers Gregory | $412,000 | -- | |

| Emaus Mark | -- | -- | |

| Dva Corporation | $99,500 | -- | |

| Citizens Bank & Trus | $116,300 | -- | |

| Lassiter Properties | $63,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Blount Anthony | $408,000 | |

| Previous Owner | Childers Gregory | $329,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,530 | $318,708 | $91,355 | $227,352 |

| 2024 | $6,070 | $261,476 | $49,962 | $211,514 |

| 2023 | $6,070 | $244,642 | $50,420 | $194,222 |

| 2022 | $5,168 | $209,798 | $45,837 | $163,961 |

| 2021 | $4,689 | $178,112 | $32,096 | $146,016 |

| 2020 | $4,595 | $178,112 | $32,096 | $146,016 |

| 2019 | $3,941 | $139,449 | $45,125 | $94,324 |

| 2018 | $3,860 | $136,416 | $45,125 | $91,291 |

| 2017 | $3,001 | $102,396 | $18,605 | $83,791 |

| 2016 | $539 | $18,606 | $18,606 | $0 |

| 2015 | $530 | $18,606 | $18,606 | $0 |

| 2014 | -- | $18,606 | $18,606 | $0 |

Source: Public Records

Map

Nearby Homes

- 4083 Highway 54

- 0 Cannon Rd Unit 7627017

- 0 Cannon Rd Unit 10566028

- 215 Grey Fairs Ave

- 98 Ryeland Dr

- 136 Ryeland Dr

- 143 Ryeland Dr

- 465 Little Rd

- 2725 Gordon Rd

- 2963 Gordon Rd

- 83 Homesite Slick Ct

- 88 Slick Ct

- 65 Oakhurst Trail

- 69 Oakhurst Trail

- 30 Hunter Farm Dr

- Henry II Plan at Saddleridge

- Emerson II Plan at Saddleridge

- Margaret Plan at Saddleridge

- Lauren II Plan at Saddleridge

- Clarity Plan at Saddleridge

- 211 Bradleys Line Dr

- 224 Bradleys Line Dr

- 124 Bradleys Line Dr

- 191 Bradleys Line Dr

- 162 Cannon Rd

- 140 Cannon Rd

- 198 John Grimes Rd

- 102 Cannon Rd

- 98 Cannon Rd

- 4034 Highway 54

- 1435 Tope Rd

- 1369 Tope Rd

- 49 John Grimes Rd

- 0 Bradley's Line Dr Unit 10091693

- 3950 Highway 54

- 1293 Tope Rd

- 184 Cannon Rd

- 1335 Tope Rd

- 1335 Tope Rd

- 4083 Georgia 54