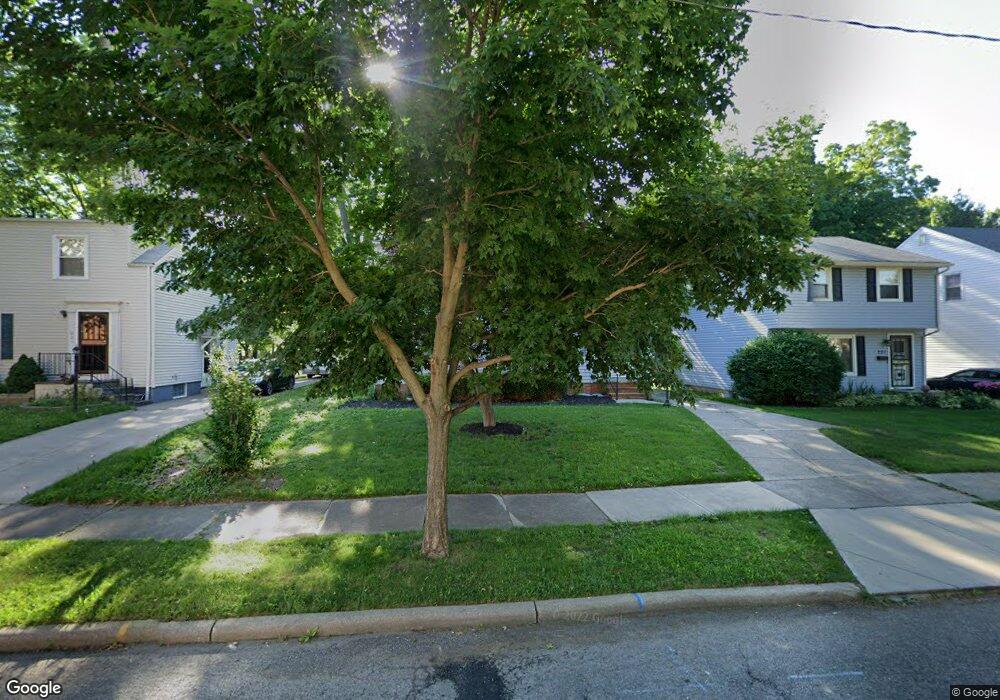

225 E 246th St Unit E Euclid, OH 44123

Estimated Value: $157,000 - $171,000

3

Beds

2

Baths

1,176

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 225 E 246th St Unit E, Euclid, OH 44123 and is currently estimated at $163,492, approximately $139 per square foot. 225 E 246th St Unit E is a home located in Cuyahoga County with nearby schools including Shoreview Elementary School, Euclid High School, and Our Lady Of The Lake School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2025

Sold by

Bismuth Propco Series Llc

Bought by

Jackson Caitlin and Jackson David

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$8,250

Outstanding Balance

$8,250

Interest Rate

6.23%

Mortgage Type

New Conventional

Estimated Equity

$155,242

Purchase Details

Closed on

Nov 1, 2022

Sold by

Perryman Michael

Bought by

Bay Street Homes Llc

Purchase Details

Closed on

Mar 3, 2022

Sold by

Prk 1 Llc

Bought by

Perryman Michael

Purchase Details

Closed on

Nov 7, 2018

Sold by

Kumar Pravikesh

Bought by

Prk 1 Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$443,800

Interest Rate

7.45%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jan 26, 2018

Sold by

Jklmn Llc

Bought by

Kumar Pravikesh

Purchase Details

Closed on

Aug 2, 2011

Sold by

Beneficial Ohio Inc

Bought by

Jklmn Llc

Purchase Details

Closed on

Apr 12, 2011

Sold by

Farmer Tencia

Bought by

Beneficial Ohio Inc

Purchase Details

Closed on

Aug 15, 2001

Sold by

Hayes Joyce A

Bought by

Farmer Teneia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,538

Interest Rate

7.23%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 8, 1989

Sold by

Hayes Clarence E

Bought by

Hayes Joyce A

Purchase Details

Closed on

Jan 25, 1985

Sold by

Hayes Clarence E and J A

Bought by

Hayes Clarence E

Purchase Details

Closed on

Jan 1, 1975

Bought by

Hayes Clarence E and J A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jackson Caitlin | $165,000 | Mainstay National Title | |

| Bay Street Homes Llc | $138,000 | Black Tie Title | |

| Perryman Michael | $104,200 | Ohio Real Title | |

| Prk 1 Llc | -- | None Available | |

| Kumar Pravikesh | $27,000 | Cuyahoga Title | |

| Jklmn Llc | $18,000 | National Real Estate | |

| Beneficial Ohio Inc | $30,000 | None Available | |

| Farmer Teneia | $92,000 | First Partners Title | |

| Hayes Joyce A | -- | -- | |

| Hayes Clarence E | -- | -- | |

| Hayes Clarence E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jackson Caitlin | $8,250 | |

| Open | Jackson Caitlin | $162,011 | |

| Previous Owner | Prk 1 Llc | $443,800 | |

| Previous Owner | Farmer Teneia | $90,538 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,348 | $47,950 | $9,275 | $38,675 |

| 2023 | $2,609 | $29,440 | $6,760 | $22,680 |

| 2022 | $2,551 | $29,440 | $6,760 | $22,680 |

| 2021 | $2,846 | $29,440 | $6,760 | $22,680 |

| 2020 | $3,192 | $27,270 | $6,270 | $21,000 |

| 2019 | $2,603 | $77,900 | $17,900 | $60,000 |

| 2018 | $2,578 | $27,270 | $6,270 | $21,000 |

| 2017 | $2,736 | $23,700 | $5,040 | $18,660 |

| 2016 | $2,743 | $23,700 | $5,040 | $18,660 |

| 2015 | $2,501 | $23,700 | $5,040 | $18,660 |

| 2014 | $2,501 | $23,700 | $5,040 | $18,660 |

Source: Public Records

Map

Nearby Homes

- 368 E 248th St

- 24891 Zeman Ave

- 25151 Zeman Ave

- 110 E 252nd St

- 340 E 257th St

- 464 E 250th St

- 110 E 238th St

- 244 E 238th St

- 355 E 257th St

- 325 E 257th St

- 25401 Farringdon Ave

- 25731 Zeman Ave

- 25671 Farringdon Ave

- 303 E 235th St

- 334 E 238th St

- 323 E 235th St

- 324 E 235th St

- 571 E 260th St

- 25751 Briardale Ave

- 25700 Briardale Ave

- 231 E 246th St

- 221 E 246th St

- 233 E 246th St

- 235 E 246th St

- 246 E 248th St

- 244 E 248th St

- 241 E 246th St

- 250 E 248th St

- 242 E 248th St

- 24570 Lakeshore Blvd

- 252 E 248th St

- 245 E 246th St

- 234 E 246th St

- 24570 Lake Shore Blvd

- 251 E 246th St

- 264 E 248th St

- 240 E 246th St

- 24560 Lake Shore Blvd

- 253 E 246th St

- 244 E 246th St