225 Laurel Rd Boyertown, PA 19512

Estimated Value: $325,000 - $585,000

4

Beds

3

Baths

3,109

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 225 Laurel Rd, Boyertown, PA 19512 and is currently estimated at $456,033, approximately $146 per square foot. 225 Laurel Rd is a home located in Berks County with nearby schools including Boyertown Area Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 30, 2022

Sold by

Quaintance James A

Bought by

Bish Peter and Bish Marcy

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,000

Outstanding Balance

$202,622

Interest Rate

5.3%

Mortgage Type

New Conventional

Estimated Equity

$253,411

Purchase Details

Closed on

Aug 21, 2009

Sold by

Bish Peter D and Bish Marcy K

Bought by

Quaintance James A and Quaintence Jean L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,537

Interest Rate

5.17%

Mortgage Type

FHA

Purchase Details

Closed on

May 19, 1999

Bought by

Shubert Michael H and Shubert Joan M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bish Peter | $265,000 | -- | |

| Quaintance James A | $245,000 | Penn Title Inc | |

| Shubert Michael H | $40,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bish Peter | $212,000 | |

| Previous Owner | Quaintance James A | $240,537 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,127 | $236,000 | $51,400 | $184,600 |

| 2024 | $9,242 | $236,000 | $51,400 | $184,600 |

| 2023 | $8,867 | $236,000 | $51,400 | $184,600 |

| 2022 | $8,662 | $236,000 | $51,400 | $184,600 |

| 2021 | $8,462 | $236,000 | $51,400 | $184,600 |

| 2020 | $8,257 | $236,000 | $51,400 | $184,600 |

| 2019 | $8,030 | $236,000 | $51,400 | $184,600 |

| 2018 | $7,712 | $236,000 | $51,400 | $184,600 |

| 2017 | $10,318 | $326,100 | $51,400 | $274,700 |

| 2016 | $2,356 | $326,100 | $51,400 | $274,700 |

| 2015 | $2,356 | $326,100 | $51,400 | $274,700 |

| 2014 | $2,356 | $326,100 | $51,400 | $274,700 |

Source: Public Records

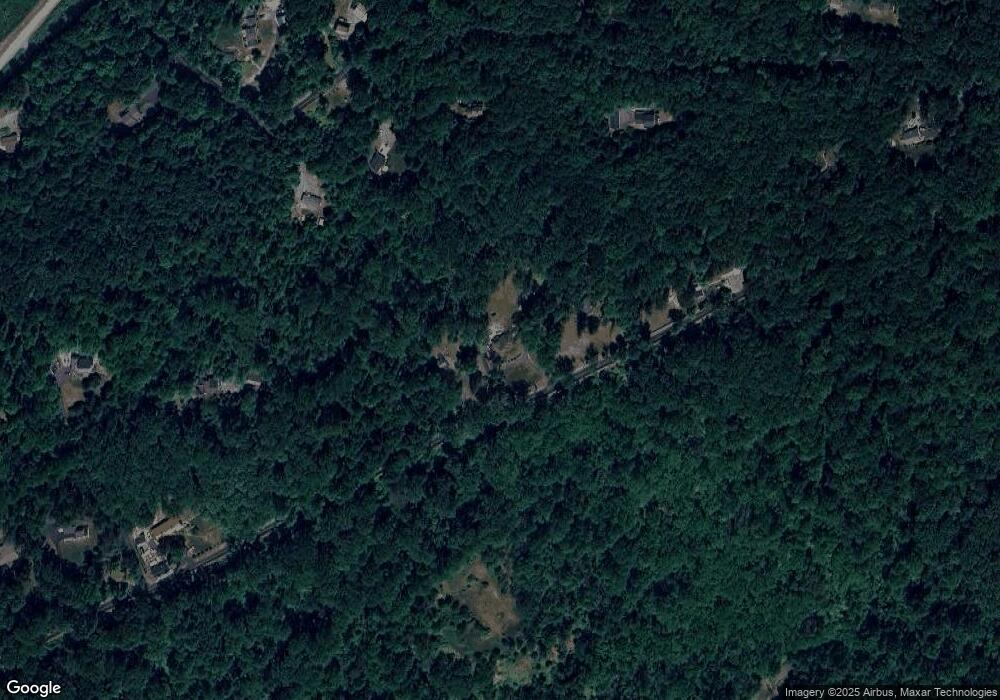

Map

Nearby Homes

- 84 Sunset Hill Rd

- 1034 Manatawny Rd

- 7816 Boyertown Pike

- 16 Kristine Ave

- 2 Machamer Rd

- 108 Highland Ct

- 56 Amity Ave

- 0 Rte 73 Unit PABK2041020

- 35 Winding Creek Dr

- 24 4th St

- 1041 Reading Ave

- 0 Woodchoppertown

- 1008 Reading Ave

- 190 Red Oak Dr

- 280 Indian Ln

- 483 Water St

- 335 Anvil Dr

- 12 Lehland Dr

- 141 Greshville Rd

- 332 S Reading Ave

- 221 Laurel Rd

- 229 Laurel Rd

- 255 Laurel Rd

- 197 A Laurel Rd

- 0 Laurel Rd Unit PABK2007160

- 86 Powerline Rd

- 98 Powerline Rd

- 257 Laurel Rd

- 126 Powerline Rd

- 197 Laurel Rd

- 28 Powerline Rd

- 121 Powerline Rd

- 269 Laurel Rd

- 75 Powerline Rd

- 87 Powerline Rd

- 62 Powerline Rd

- 185 Laurel Rd

- 181 Laurel Rd

- 145 Powerline Rd

- 133 Powerline Rd