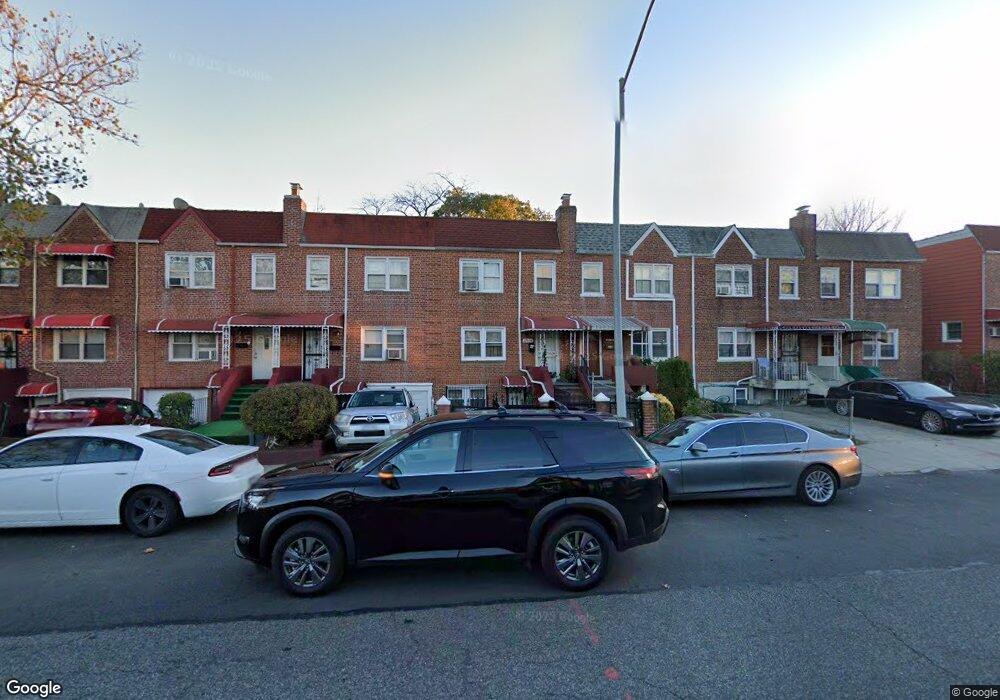

22538 Murdock Ave Queens Village, NY 11429

Queens Village NeighborhoodEstimated Value: $638,002 - $805,000

--

Bed

--

Bath

1,683

Sq Ft

$433/Sq Ft

Est. Value

About This Home

This home is located at 22538 Murdock Ave, Queens Village, NY 11429 and is currently estimated at $728,001, approximately $432 per square foot. 22538 Murdock Ave is a home located in Queens County with nearby schools including P.S./M.S. 147 Ronald Mcnair, I.S. 192 The Linden, and Ss Joachim & Anne School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2025

Sold by

Hewitt-Saunders Althia D and Hewitt-Todd Althia D

Bought by

Althia D Hewitt-Todd Irrevocable Trust and Peta-Gay Robinson As Trustee

Current Estimated Value

Purchase Details

Closed on

May 5, 1999

Sold by

Hewitt Signett and Hewitt Saunders Althia D

Bought by

Hewitt Saunders Althia D

Purchase Details

Closed on

Jul 12, 1996

Sold by

Honore Michael S and Honore Antonia A

Bought by

Hewitt Signett and Hewitt Saunders Althia D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,775

Interest Rate

8.4%

Purchase Details

Closed on

Nov 14, 1995

Sold by

Gevlin Carol and Hughes Agnes

Bought by

Honore Michael S and Honore Antonia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,000

Interest Rate

7.33%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Althia D Hewitt-Todd Irrevocable Trust | -- | -- | |

| Hewitt Saunders Althia D | -- | First American Title Ins Co | |

| Hewitt Saunders Althia D | -- | First American Title Ins Co | |

| Hewitt Signett | $134,500 | -- | |

| Hewitt Signett | $134,500 | -- | |

| Honore Michael S | $95,500 | Commonwealth Land Title Ins | |

| Honore Michael S | $95,500 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hewitt Signett | $127,775 | |

| Previous Owner | Honore Michael S | $55,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,168 | $27,578 | $7,288 | $20,290 |

| 2024 | $5,180 | $27,130 | $7,381 | $19,749 |

| 2023 | $4,905 | $25,822 | $6,844 | $18,978 |

| 2022 | $4,576 | $39,180 | $11,100 | $28,080 |

| 2021 | $4,541 | $32,460 | $11,100 | $21,360 |

| 2020 | $4,569 | $28,980 | $11,100 | $17,880 |

| 2019 | $4,437 | $28,080 | $11,100 | $16,980 |

| 2018 | $4,089 | $21,518 | $8,866 | $12,652 |

| 2017 | $3,838 | $20,300 | $9,805 | $10,495 |

| 2016 | $3,519 | $20,300 | $9,805 | $10,495 |

| 2015 | $2,090 | $19,152 | $11,514 | $7,638 |

| 2014 | $2,090 | $18,840 | $12,300 | $6,540 |

Source: Public Records

Map

Nearby Homes

- 22533 Murdock Ave

- 225-23 Murdock Ave

- 225-53 Murdock Ave

- 22524 Murdock Ave

- 22554 Murdock Ave

- 22343 113th Dr

- 22726 112th Rd

- 22324 Murdock Ave

- 22734 112th Rd

- 22722 112th Ave

- 225-20 111th Ave

- 224-06 114th Rd

- 22117 Murdock Ave

- 225-19 109th Ave

- 114-66 225th St

- 114-67 226th St

- 440 Parkway Dr

- 2334 Belmont Ave

- 11480 226th St

- 223-23 109th Ave

- 22540 Murdock Ave

- 22542 Murdock Ave

- 22536 Murdock Ave

- 22544 Murdock Ave

- 22546 Murdock Ave

- 22534 Murdock Ave

- 22534 Murdock Ave

- 22534 Murdock Ave

- 22546 Murdock Ave

- 22548 Murdock Ave

- 22532 Murdock Ave

- 225-50 Murdock Ave

- 22550 Murdock Ave

- 22530 Murdock Ave

- 22533 113th Dr

- 22537 113th Dr

- 22552 Murdock Ave

- 22529 113th Dr

- 22552 Murdock Ave

- 22526 Murdock Ave