22619 Central Prairie San Antonio, TX 78255

Cross Mountain NeighborhoodEstimated Value: $717,000 - $1,078,000

3

Beds

3

Baths

3,770

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 22619 Central Prairie, San Antonio, TX 78255 and is currently estimated at $863,673, approximately $229 per square foot. 22619 Central Prairie is a home located in Bexar County with nearby schools including Aue Elementary School, Garcia Middle School, and O'Connor High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2014

Sold by

Olijslager Diederik

Bought by

Cairo John M and Cairo Patricia

Current Estimated Value

Purchase Details

Closed on

Apr 15, 2014

Sold by

Olijslager Nancy E

Bought by

Olijslager Diederik

Purchase Details

Closed on

Jan 12, 2010

Sold by

Flores Jaime A and Flores Yolanda T

Bought by

Olijslager Diederik and Olijslager Nancy E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

3.75%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 7, 2001

Sold by

Cross Mountain Development Inc

Bought by

Flores Jaime A and Flores Yolanda T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$26,100

Interest Rate

7.19%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cairo John M | -- | First American Title | |

| Olijslager Diederik | -- | None Available | |

| Olijslager Diederik | -- | Chicago Title | |

| Flores Jaime A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Olijslager Diederik | $150,000 | |

| Previous Owner | Flores Jaime A | $26,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,359 | $654,550 | $157,370 | $497,180 |

| 2024 | $6,359 | $654,550 | $157,370 | $497,180 |

| 2023 | $6,359 | $690,000 | $157,370 | $532,630 |

| 2022 | $12,638 | $636,515 | $134,510 | $542,580 |

| 2021 | $11,921 | $578,650 | $116,960 | $461,690 |

| 2020 | $11,520 | $547,370 | $95,800 | $451,570 |

| 2019 | $10,983 | $504,570 | $95,800 | $408,770 |

| 2018 | $10,277 | $472,060 | $80,610 | $391,450 |

| 2017 | $10,408 | $476,550 | $80,610 | $395,940 |

| 2016 | $9,678 | $443,140 | $80,610 | $362,530 |

| 2015 | $9,129 | $490,259 | $80,610 | $428,290 |

| 2014 | $9,129 | $444,785 | $0 | $0 |

Source: Public Records

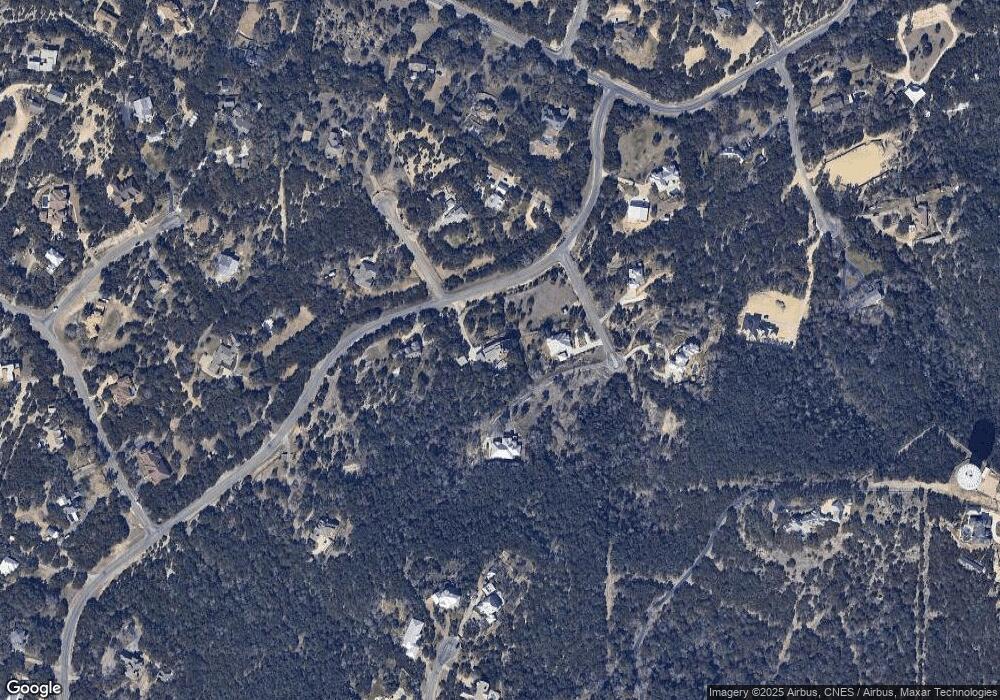

Map

Nearby Homes

- 00 Beartooth Pass

- 22862 Little Hind

- 22211 Ravine Pass

- 22202 Ravine Pass

- 22406 White Doe Pass

- 8602 San Fidel Way

- 8619 San Fidel Way

- 8426 San Fidel Way

- 8615 San Fidel Way

- 8611 San Fidel Way

- 22306 White Doe Pass

- 23019 Prescott Falls

- 8902 Saddle Trail

- 9119 Cap Mountain Dr

- 22840 Scenic Loop Rd

- 8531 Colfax Cove

- 8523 Colfax Cove

- 8535 Colfax Cove

- 23014 Crafty Ridge

- 24003 Verde River

- 22709 Central Prairie

- 9107 Mule Train

- 9115 Mule Train

- 9119 Mule Train

- 9114 Prairie Creek

- 9115 Prairie Creek

- 22610 Central Prairie

- 9108 Mule Train

- 9114 Mule Train

- 9120 Mule Train

- 22729 Central Prairie

- 8966 Cross Mountain Trail

- 8986 Cross Mountain Trail

- 22730 Central Prairie

- 22509 Central Prairie

- 9103 Prairie Creek

- 9103 Fire Water

- 9102 Fire Water

- 9202 Lookout Mesa

- 9108 Fire Water