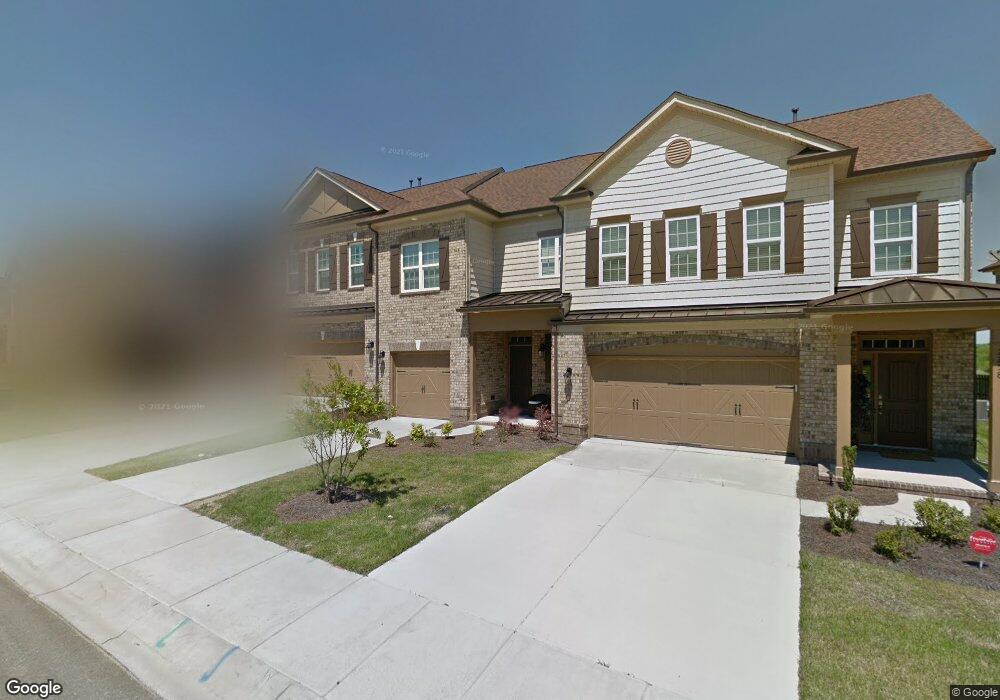

2262 Eversham Dr NW Unit 482 Concord, NC 28027

Estimated Value: $370,885 - $408,000

3

Beds

3

Baths

1,661

Sq Ft

$239/Sq Ft

Est. Value

About This Home

This home is located at 2262 Eversham Dr NW Unit 482, Concord, NC 28027 and is currently estimated at $396,471, approximately $238 per square foot. 2262 Eversham Dr NW Unit 482 is a home located in Cabarrus County with nearby schools including Cox Mill Elementary School, Harold E. Winkler Middle School, and Cox Mill High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2020

Sold by

Roisin Terra E

Bought by

Chappell Paula

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,260

Outstanding Balance

$222,250

Interest Rate

3.3%

Mortgage Type

New Conventional

Estimated Equity

$174,221

Purchase Details

Closed on

Jan 13, 2014

Sold by

Crriage Town At Christenbury Llc

Bought by

Roisin Terra E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,131

Interest Rate

4.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jun 1, 2013

Sold by

Christenbury Land Investments

Bought by

Carriage Towns At Christenbury

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chappell Paula | $258,000 | None Available | |

| Roisin Terra E | $175,000 | None Available | |

| Carriage Towns At Christenbury | $140,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chappell Paula | $250,260 | |

| Previous Owner | Roisin Terra E | $166,131 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,539 | $355,310 | $92,500 | $262,810 |

| 2024 | $3,539 | $355,310 | $92,500 | $262,810 |

| 2023 | $2,923 | $239,560 | $63,000 | $176,560 |

| 2022 | $2,923 | $239,560 | $63,000 | $176,560 |

| 2021 | $2,923 | $239,560 | $63,000 | $176,560 |

| 2020 | $2,828 | $231,830 | $63,000 | $168,830 |

| 2019 | $2,218 | $181,770 | $48,000 | $133,770 |

| 2018 | $2,181 | $181,770 | $48,000 | $133,770 |

| 2017 | $2,145 | $181,770 | $48,000 | $133,770 |

| 2016 | $1,272 | $173,170 | $45,000 | $128,170 |

| 2015 | $531 | $173,170 | $45,000 | $128,170 |

| 2014 | $531 | $173,170 | $45,000 | $128,170 |

Source: Public Records

Map

Nearby Homes

- 9595 Ledbury Ct NW

- 9655 Camberley Ave NW

- 2346 Donnington Ln NW

- 9212 Delancey Ln NW Unit 63

- 2134 Barrowcliffe Dr NW Unit 6

- 2377 Maple Grove Ln NW

- 2251 Barrowcliffe Dr NW

- 2506 Susie Brumley Place NW

- 2414 Riders Glen Ct

- 9509 Pacing Ln NW

- 9516 Pacing Ln NW

- 2111 Elendil Ln

- 2277 Elendil Ln

- 3155 Golden Dale Ln

- 3561 Calpella Ct

- 3549 Calpella Ct

- 2055 Solway Ln

- 3516 Calpella Ct

- 1930 Wilburn Park Ln NW

- 3930 Kalispell Ln

- 2262 Eversham Dr NW

- 2258 Eversham Dr NW

- 2258 Eversham Dr NW Unit 483

- 2266 Eversham Dr NW Unit 481

- 2270 Eversham Dr NW

- 2270 Eversham Dr NW Unit 480

- 2274 Eversham Dr NW Unit 479

- 2248 Eversham Dr NW Unit 484

- 2278 Eversham Dr NW Unit 478

- 2242 Eversham Dr NW Unit 485

- 2245 Donnington Ln NW

- 2282 Eversham Dr NW Unit 477

- 2238 Eversham Dr NW Unit 490

- 2263 Eversham Dr NW

- 2259 Eversham Dr NW

- 2290 Woburn Abbey Dr NW Unit B

- 2267 Eversham Dr NW Unit 2267

- 2267 Eversham Dr NW Unit 555

- 2286 Eversham Dr NW

- 2286 Eversham Dr NW Unit 476