227 Manor Rd Red Lion, PA 17356

Estimated Value: $127,000 - $170,000

3

Beds

2

Baths

1,120

Sq Ft

$130/Sq Ft

Est. Value

About This Home

This home is located at 227 Manor Rd, Red Lion, PA 17356 and is currently estimated at $145,333, approximately $129 per square foot. 227 Manor Rd is a home located in York County with nearby schools including Larry J. Macaluso Elementary School, Red Lion Area Junior High School, and Red Lion Area Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2020

Sold by

Pennsylvania Housing Finance Agency

Bought by

Ludwig Bradley E

Current Estimated Value

Purchase Details

Closed on

Jan 13, 2020

Sold by

Krebs Catherine A

Bought by

Pennsylvania Housing Finance Agency

Purchase Details

Closed on

Dec 1, 2010

Sold by

Glatfelter Trent A and Glatfelter Tracey

Bought by

Krebs Catherine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,306

Interest Rate

4.22%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 23, 1998

Sold by

Martin Deborah S

Bought by

Glatfelter Trent A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,740

Interest Rate

6.83%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ludwig Bradley E | $55,000 | White Rose Settleent Svcs In | |

| Pennsylvania Housing Finance Agency | $1,871 | None Available | |

| Krebs Catherine A | $119,900 | None Available | |

| Glatfelter Trent A | $87,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Krebs Catherine A | $118,306 | |

| Previous Owner | Glatfelter Trent A | $88,740 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,286 | $73,120 | $34,360 | $38,760 |

| 2024 | $2,196 | $73,120 | $34,360 | $38,760 |

| 2023 | $2,196 | $73,120 | $34,360 | $38,760 |

| 2022 | $2,196 | $73,120 | $34,360 | $38,760 |

| 2021 | $2,134 | $73,120 | $34,360 | $38,760 |

| 2020 | $2,134 | $73,120 | $34,360 | $38,760 |

| 2019 | $2,126 | $73,120 | $34,360 | $38,760 |

| 2018 | $2,115 | $73,120 | $34,360 | $38,760 |

| 2017 | $2,097 | $73,120 | $34,360 | $38,760 |

| 2016 | $0 | $73,120 | $34,360 | $38,760 |

| 2015 | -- | $73,120 | $34,360 | $38,760 |

| 2014 | -- | $73,120 | $34,360 | $38,760 |

Source: Public Records

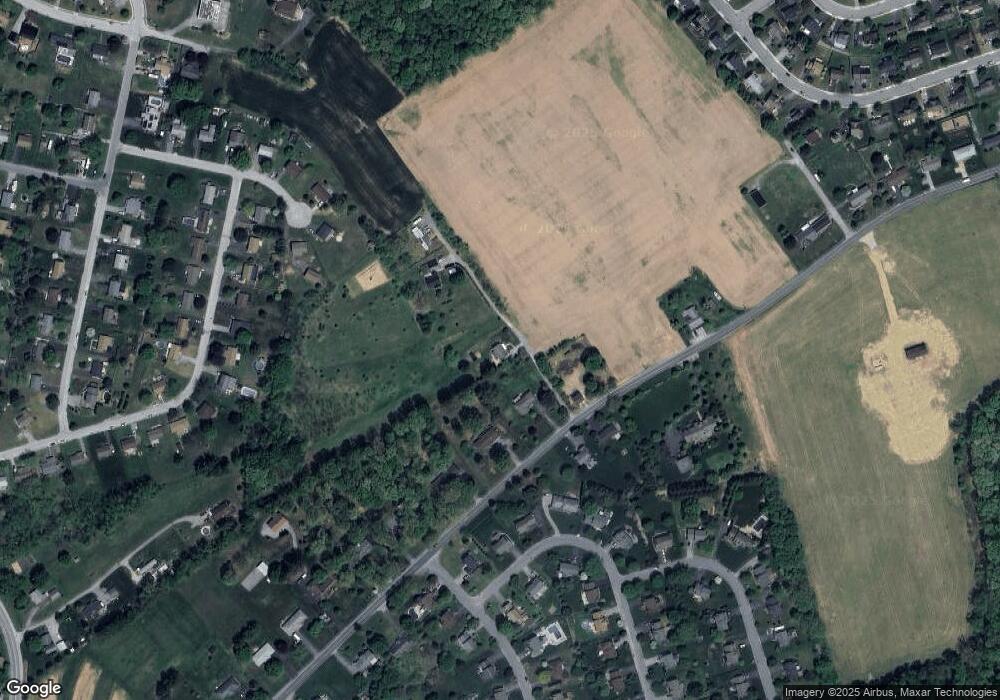

Map

Nearby Homes

- 325 Barclay Dr

- 375 Barclay Dr

- 2 Windsor Acres

- 115 Ava Dr

- 1815 Windsor Rd

- 495 Thomas Armor Dr

- 306 Mohawk Dr

- 37 1st St

- 325 Stabley Ln

- 126 W Main St

- 124 W Main St

- 137 W Main St

- 1012 Woodridge Rd

- Brentwood Plan at Walnut Creek

- Augusta Plan at Walnut Creek

- Arcadia Plan at Walnut Creek

- Magnolia Plan at Walnut Creek

- Sebastian Plan at Walnut Creek

- Nottingham Plan at Walnut Creek

- Savannah Plan at Walnut Creek