227 Rr 1 Duncan, OK 73533

Estimated Value: $87,012 - $145,000

2

Beds

1

Bath

1,024

Sq Ft

$110/Sq Ft

Est. Value

About This Home

This home is located at 227 Rr 1, Duncan, OK 73533 and is currently estimated at $112,503, approximately $109 per square foot. 227 Rr 1 is a home located in Stephens County with nearby schools including Empire High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2017

Sold by

Fullerton David Arthur and Fullerton Alice Elaine

Bought by

Fullerton David L and Fullerton Rhonda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,131

Outstanding Balance

$52,548

Interest Rate

3.78%

Mortgage Type

New Conventional

Estimated Equity

$59,955

Purchase Details

Closed on

Mar 24, 2009

Sold by

Fullerton David A and Fullerton David Arthur

Bought by

Fullerton David Arthur and Fullerton Alice Elaine

Purchase Details

Closed on

Nov 20, 2002

Sold by

Morrow Betty and Morrow Perry

Purchase Details

Closed on

Mar 30, 2001

Sold by

Suitor Johnny Dale

Purchase Details

Closed on

Nov 5, 1998

Sold by

Suitor Ronnie Cy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fullerton David L | $62,500 | Stephens Co Abstract Co | |

| Fullerton David Arthur | -- | None Available | |

| Fullerton David A | $30,000 | None Available | |

| -- | -- | -- | |

| -- | -- | -- | |

| -- | $7,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fullerton David L | $63,131 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $547 | $6,951 | $693 | $6,258 |

| 2024 | $547 | $6,748 | $673 | $6,075 |

| 2023 | $547 | $6,748 | $684 | $6,064 |

| 2022 | $509 | $6,551 | $691 | $5,860 |

| 2021 | $493 | $6,176 | $596 | $5,580 |

| 2020 | $480 | $6,014 | $596 | $5,418 |

| 2019 | $504 | $6,106 | $596 | $5,510 |

| 2018 | $582 | $6,908 | $596 | $6,312 |

| 2017 | $406 | $4,225 | $596 | $3,629 |

| 2016 | $382 | $3,832 | $660 | $3,172 |

| 2015 | $411 | $3,832 | $660 | $3,172 |

| 2014 | $411 | $3,832 | $660 | $3,172 |

Source: Public Records

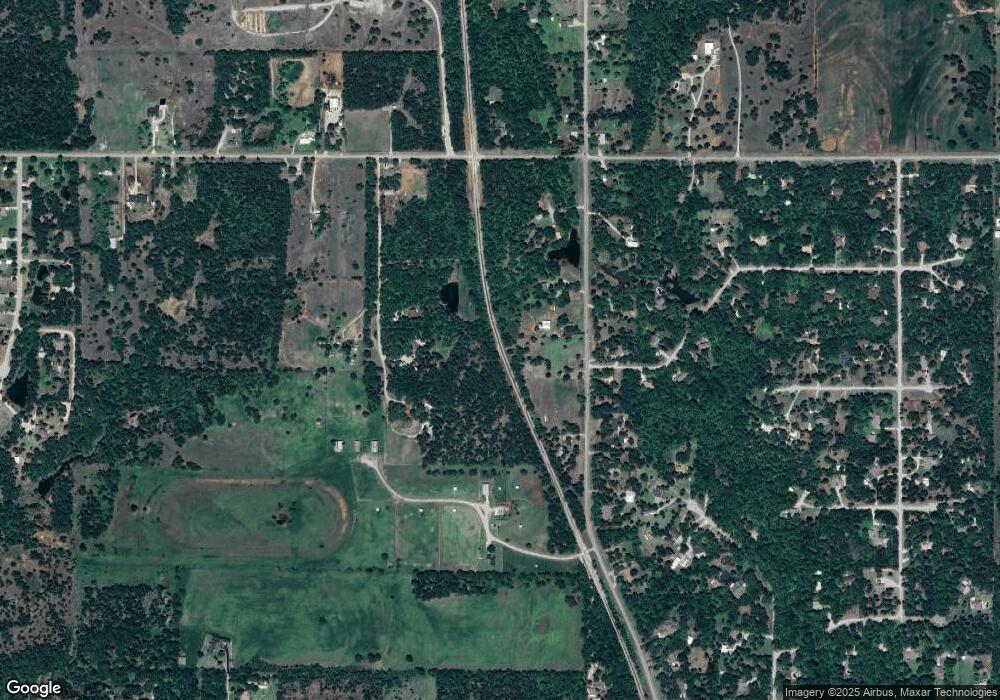

Map

Nearby Homes

- 174085 N 2770 Rd

- B1L4A Trail Side Dr

- B2L5 Trail Side Dr

- 172789 Trail Side Dr

- 172931 Prospectors Ridge Dr

- B4 L11 Prospectors Ridge Dr

- B3L9 Prospectors Ridge Dr

- 278045 Hidden Creek Dr

- 278590 E 1730 Rd

- 1317 S 58th St

- 1105 N 60th St

- 3655 Lovegrass Ln

- 4705 W Seminole Rd

- 1715 S 42nd St

- 2086 N 44th St

- 701 Drexal Place

- 5204 Kevin Dr

- 1385 Smith Rd

- 210 N 31st St

- 177914 177914 N 2770