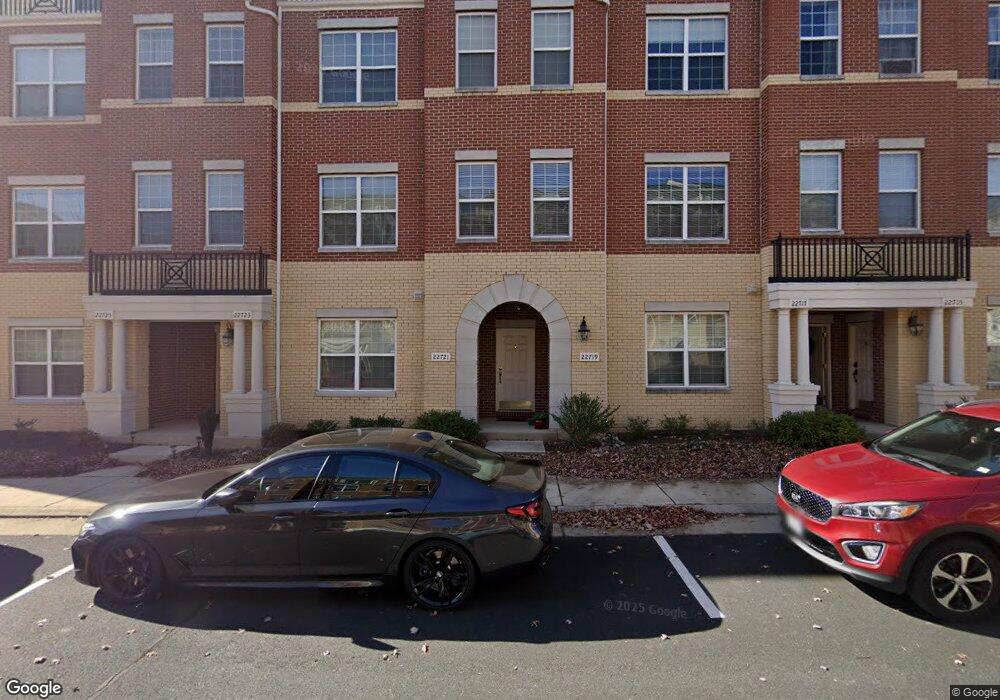

22721 Beacon Crest Terrace Unit 24F Ashburn, VA 20148

Estimated Value: $513,000 - $554,000

3

Beds

3

Baths

2,661

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 22721 Beacon Crest Terrace Unit 24F, Ashburn, VA 20148 and is currently estimated at $531,884, approximately $199 per square foot. 22721 Beacon Crest Terrace Unit 24F is a home located in Loudoun County with nearby schools including Waxpool Elementary School, Eagle Ridge Middle School, and Briar Woods High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 1, 2020

Sold by

Alvarez Alex David and Alvarez Edlira

Bought by

Abouelazm Iman

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$397,700

Outstanding Balance

$352,932

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$178,952

Purchase Details

Closed on

Jul 2, 2013

Sold by

Kirkner Erik D

Bought by

Alvarez Alex D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,000

Interest Rate

3.83%

Mortgage Type

VA

Purchase Details

Closed on

Nov 18, 2009

Sold by

Centex Homes

Bought by

Kirkner Erik D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$337,858

Interest Rate

4.86%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Abouelazm Iman | $410,000 | Psr Title Llc | |

| Alvarez Alex D | $344,000 | -- | |

| Kirkner Erik D | $327,065 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Abouelazm Iman | $397,700 | |

| Previous Owner | Alvarez Alex D | $340,000 | |

| Previous Owner | Kirkner Erik D | $337,858 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,223 | $524,640 | $145,000 | $379,640 |

| 2024 | $4,204 | $486,060 | $135,000 | $351,060 |

| 2023 | $4,013 | $458,620 | $135,000 | $323,620 |

| 2022 | $3,776 | $424,260 | $120,000 | $304,260 |

| 2021 | $3,723 | $379,900 | $95,000 | $284,900 |

| 2020 | $3,777 | $364,900 | $80,000 | $284,900 |

| 2019 | $3,645 | $348,830 | $75,000 | $273,830 |

| 2018 | $3,695 | $340,540 | $75,000 | $265,540 |

| 2017 | $3,738 | $332,240 | $75,000 | $257,240 |

| 2016 | $3,804 | $332,240 | $0 | $0 |

| 2015 | $3,896 | $268,300 | $0 | $268,300 |

| 2014 | $3,805 | $254,470 | $0 | $254,470 |

Source: Public Records

Map

Nearby Homes

- 42539 Mayflower Terrace Unit 204

- 42634 Hollyhock Terrace

- 42481 Rockrose Square Unit 204

- 22691 Blue Elder Terrace Unit 204

- 22687 Blue Elder Terrace Unit 104

- 42455 Hollyhock Terrace

- 42533 Magellan Square

- 22879 Ember Brook Cir

- 22520 Highcroft Terrace

- 22838 Arbor View Dr

- 22796 Breezy Hollow Dr

- 22966 Cabral Terrace

- 22995 Lois Ln

- 22951 Sullivans Cove Square

- 23056 Sullivans Cove Square

- The Rockland Plan at West Park at Brambleton - Knutson at Downtown Brambleton

- 42122 Hazel Grove Terrace

- The Camden Plan at West Park at Brambleton - Knutson

- 22832 Tawny Pine Square

- Bryant Plan at West Park at Brambleton - Solis at West Park

- 22719 Beacon Crest Terrace Unit 24E

- 22725 Beacon Crest Terrace

- 22723 Beacon Crest Terrace

- 22721 Beacon Crest Terrace

- 22719 Beacon Crest Terrace

- 22725 Beacon Crest Terrace Unit 22725

- 22725 Beacon Crest Terrace Unit 24H

- 22719 Beacon Crest Terrace Unit 22719

- 22717 Beacon Crest Terrace

- 22715 Beacon Crest Terrace Unit C

- 22715 Beacon Crest Terrace

- 22715 Beacon Crest Terrace Unit 24C

- 22727 Beacon Crest Terrace

- 22727 Beacon Crest Terrace Unit 24I

- 42542 Cedar Forest Terrace

- 22713 Beacon Crest Terrace

- 22711 Beacon Crest Terrace

- 22712 Ferncrest Terrace

- 22722 Ferncrest Terrace

- 22718 Ferncrest Terrace