2278 E Carriage Ln Unit 67 Salt Lake City, UT 84117

Estimated Value: $335,000 - $371,000

2

Beds

2

Baths

1,347

Sq Ft

$262/Sq Ft

Est. Value

About This Home

This home is located at 2278 E Carriage Ln Unit 67, Salt Lake City, UT 84117 and is currently estimated at $352,786, approximately $261 per square foot. 2278 E Carriage Ln Unit 67 is a home located in Salt Lake County with nearby schools including Howard R Driggs School, Olympus Junior High School, and Olympus High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2020

Sold by

Thomas Perrero and Thomas Carole Irene

Bought by

Perrero Monica Louise

Current Estimated Value

Purchase Details

Closed on

Dec 28, 2011

Sold by

Perrero Tom

Bought by

Perrero Thomas and Perrero Carole Irene

Purchase Details

Closed on

Aug 29, 2011

Sold by

Pettey Debra Ann Conley

Bought by

Perrero Tom

Purchase Details

Closed on

Sep 13, 2004

Sold by

Conley Jeannine W

Bought by

Conley Jeannine W and The Jeannine W Conley Family Living Trus

Purchase Details

Closed on

Jan 25, 2001

Sold by

Macrae Elizabeth

Bought by

Conley Willard G and Conley Jeannine W

Purchase Details

Closed on

Mar 25, 1998

Sold by

Hardy Kim M and Christensen Scott K

Bought by

Macrae Andrew and Macrae Elizabeth

Purchase Details

Closed on

Nov 20, 1997

Sold by

Dejulio Steven

Bought by

Hardy Kim M

Purchase Details

Closed on

Nov 19, 1997

Sold by

Hardy Kim M

Bought by

Hardy Kim M and Christensen Scott K

Purchase Details

Closed on

Sep 30, 1996

Sold by

Dejulio Douglas P and Dejulio Henrietta B

Bought by

Dejulio Douglas P and Dejulio Steven

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Perrero Monica Louise | -- | None Listed On Document | |

| Perrero Monica Louise | -- | None Available | |

| Perrero Thomas | -- | Accommodation | |

| Perrero Tom | -- | Eagle Gate Title Ins Agcy | |

| Conley Jeannine W | -- | Eagle Gate Title Ins Agcy | |

| Conley Willard G | -- | Associated Title | |

| Macrae Andrew | -- | -- | |

| Hardy Kim M | -- | -- | |

| Hardy Kim M | -- | -- | |

| Hardy Kim M | -- | -- | |

| Dejulio Douglas P | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,557 | $302,600 | $90,800 | $211,800 |

| 2024 | $1,557 | $281,800 | $84,500 | $197,300 |

| 2023 | $1,558 | $274,700 | $82,400 | $192,300 |

| 2022 | $1,609 | $285,100 | $85,500 | $199,600 |

| 2021 | $1,418 | $218,300 | $65,500 | $152,800 |

| 2020 | $1,319 | $201,400 | $60,400 | $141,000 |

| 2019 | $1,332 | $198,000 | $59,400 | $138,600 |

| 2018 | $1,246 | $179,100 | $53,700 | $125,400 |

| 2017 | $1,045 | $158,600 | $47,600 | $111,000 |

| 2016 | $987 | $150,700 | $45,200 | $105,500 |

| 2015 | $1,007 | $143,400 | $43,000 | $100,400 |

| 2014 | $1,013 | $142,000 | $42,600 | $99,400 |

Source: Public Records

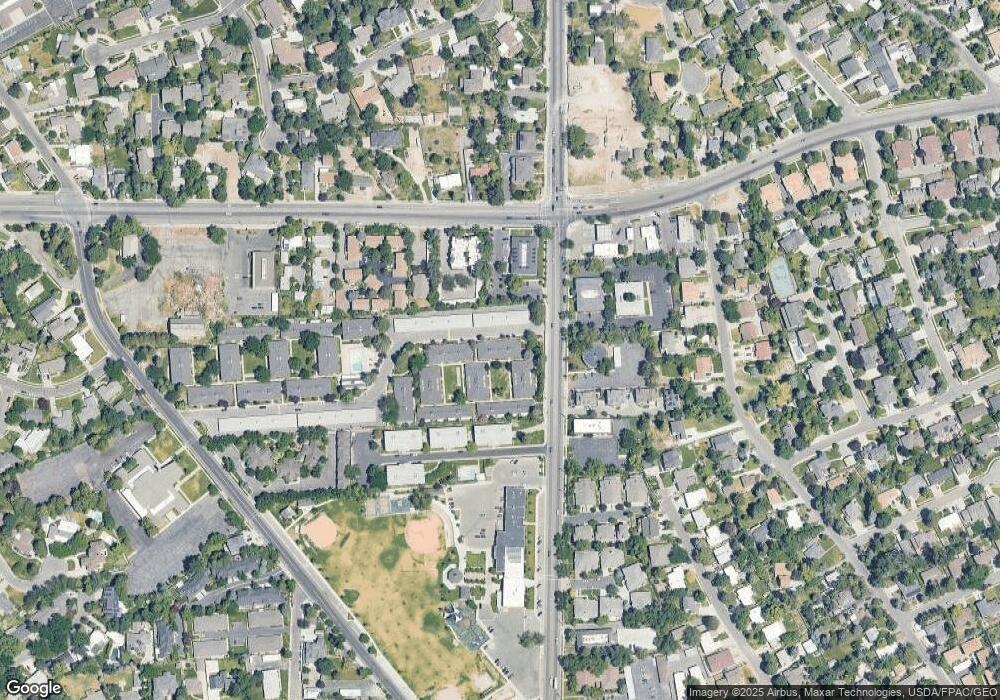

Map

Nearby Homes

- 2262 Carriage Ln Unit 66

- 2270 E 4500 S Unit 6A

- 2321 E John Holladay Ct

- 2263 E 4500 S

- 2219 E Carriage Ln Unit 59

- 4455 Holladay Park Ln

- 2209 E Carriage Ln Unit 42

- 2203 E Carriage Ln Unit 55

- 4442 Holladay Park Ln

- 2172 E Rising Wolf Ln Unit 16

- 2158 E Rising Wolf Ln Unit 22

- 2241 E Melodie Ann Way

- 4380 S Wander Ln

- 2369 E Murray Holladay Rd Unit 107

- 4559 S Kayland Cir

- 2451 E Murray Holladay Rd

- 4318 S 2300 E

- 4340 S Lynne Ln

- 2240 E Laney Ave Unit 302

- 2240 E Laney Ave Unit 102

- 2278 E Carriage Ln Unit 68

- 2286 E Carriage Ln Unit 84

- 2286 E Carriage Ln Unit 85

- 2286 E Carriage Ln Unit 83

- 2286 E Carriage Ln Unit 86

- 2286 E Carriage Ln

- 2286 E Carriage Ln

- 2286 E Carriage Ln Unit 84

- 2286 E Carriage Ln Unit 86

- 2286 E Carriage Ln Unit 83

- 2286 E Carriage Ln Unit 85

- 2278 Carriage Ln Unit 67

- 2278 Carriage Ln Unit 70

- 2278 Carriage Ln Unit 68

- 2278 Carriage Ln Unit 69

- 2278 Carriage Ln

- 2270 E Carriage Ln Unit 81

- 2270 E Carriage Ln Unit 82

- 2270 E Carriage Ln Unit 80

- 2270 E Carriage Ln Unit 79