227D Rr 1 Duncan, OK 73533

Estimated Value: $180,000 - $257,000

3

Beds

2

Baths

1,691

Sq Ft

$125/Sq Ft

Est. Value

About This Home

This home is located at 227D Rr 1, Duncan, OK 73533 and is currently estimated at $210,984, approximately $124 per square foot. 227D Rr 1 is a home located in Stephens County with nearby schools including Horace Mann Elementary School, Duncan Middle School, and Duncan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 1, 2021

Sold by

Cowan Mark E and Cowan Chantelle G

Bought by

Waldo Andrew and Waldo Jessika

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,000

Interest Rate

2.28%

Purchase Details

Closed on

Oct 27, 2010

Sold by

Olson Joseph R and Olson Aimee

Bought by

Cowan Mark E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

4.41%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 13, 2009

Sold by

Suitor Johnny D and Suitor Johnny Dale

Bought by

Arvest Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Waldo Andrew | -- | First American Title | |

| Cowan Mark E | $110,000 | None Available | |

| Arvest Bank | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Waldo Andrew | $167,000 | |

| Previous Owner | Cowan Mark E | $110,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,438 | $16,750 | $2,723 | $14,027 |

| 2024 | $1,808 | $19,002 | $2,723 | $16,279 |

| 2023 | $1,722 | $18,098 | $2,723 | $15,375 |

| 2022 | $1,749 | $18,410 | $2,723 | $15,687 |

| 2021 | $0 | $11,606 | $2,076 | $9,530 |

| 2020 | $0 | $10,940 | $2,076 | $8,864 |

| 2019 | $998 | $11,115 | $2,076 | $9,039 |

| 2018 | $1,127 | $12,771 | $2,076 | $10,695 |

| 2017 | $1,118 | $12,075 | $2,076 | $9,999 |

| 2016 | $1,164 | $12,680 | $2,480 | $10,200 |

| 2015 | $863 | $12,310 | $2,442 | $9,868 |

| 2014 | $863 | $11,952 | $2,406 | $9,546 |

Source: Public Records

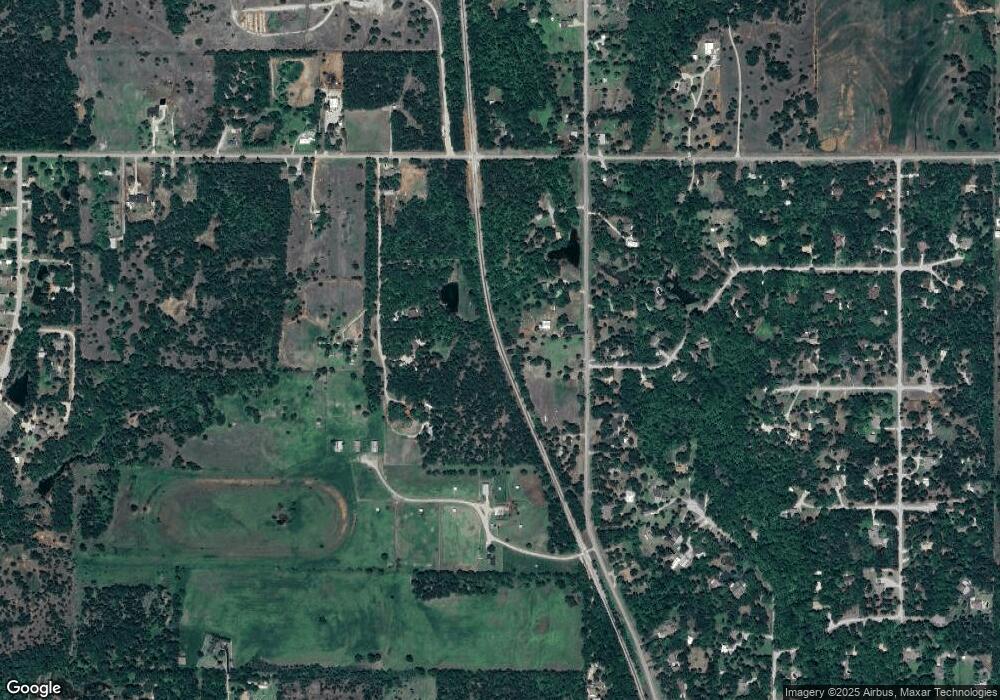

Map

Nearby Homes

- 1377 Drexal Place

- 2086 N 44th St

- 1244 Carriage Dr

- 0 W Beech Ave

- 261 N 29th St

- 3450 W Elk Ave

- 507 N Alice Dr

- 903 N Harville Rd

- 2210 Western Dr

- 209 N 22nd St

- 2622 Highcrest Dr

- 2150 W Main St

- NO ADDRESS W Elk Ave

- 2002 Redbud Ave

- 2006 W Oak Ave

- 413 N 20th St

- 602 Fieldcrest Dr

- 1905 W Ash Ave

- 174831 N 2844 Rd

- 2012 W Randall Ave

Your Personal Tour Guide

Ask me questions while you tour the home.