Estimated Value: $429,000 - $445,000

2

Beds

3

Baths

2,062

Sq Ft

$212/Sq Ft

Est. Value

About This Home

This home is located at 229 Fox Run, Exton, PA 19341 and is currently estimated at $436,496, approximately $211 per square foot. 229 Fox Run is a home located in Chester County with nearby schools including Mary C Howse Elementary School, E.N. Peirce Middle School, and Henderson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2007

Sold by

Hakim Amy

Bought by

Rettew Gregory N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Outstanding Balance

$141,898

Interest Rate

6.67%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$294,598

Purchase Details

Closed on

Apr 7, 2006

Sold by

Hakim Shafi and Hakim Amy

Bought by

Hakim Amy

Purchase Details

Closed on

Nov 21, 2005

Sold by

Barbacane Richard V and Barbacane Alice F

Bought by

Hakim Shafi and Hakim Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,600

Interest Rate

6.14%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jan 29, 1998

Sold by

Fuller Kenneth W and Kaufman Nancy L

Bought by

Barbacane Richard V and Barbacane Alice F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rettew Gregory N | $280,000 | None Available | |

| Hakim Amy | -- | None Available | |

| Hakim Shafi | $282,000 | None Available | |

| Barbacane Richard V | $129,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rettew Gregory N | $224,000 | |

| Previous Owner | Hakim Shafi | $225,600 | |

| Previous Owner | Barbacane Richard V | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,825 | $131,960 | $23,260 | $108,700 |

| 2024 | $3,825 | $131,960 | $23,260 | $108,700 |

| 2023 | $3,655 | $131,960 | $23,260 | $108,700 |

| 2022 | $3,606 | $131,960 | $23,260 | $108,700 |

| 2021 | $3,553 | $131,960 | $23,260 | $108,700 |

| 2020 | $3,529 | $131,960 | $23,260 | $108,700 |

| 2019 | $3,479 | $131,960 | $23,260 | $108,700 |

| 2018 | $3,401 | $131,960 | $23,260 | $108,700 |

| 2017 | $3,324 | $131,960 | $23,260 | $108,700 |

| 2016 | $2,807 | $131,960 | $23,260 | $108,700 |

| 2015 | $2,807 | $131,960 | $23,260 | $108,700 |

| 2014 | $2,807 | $131,960 | $23,260 | $108,700 |

Source: Public Records

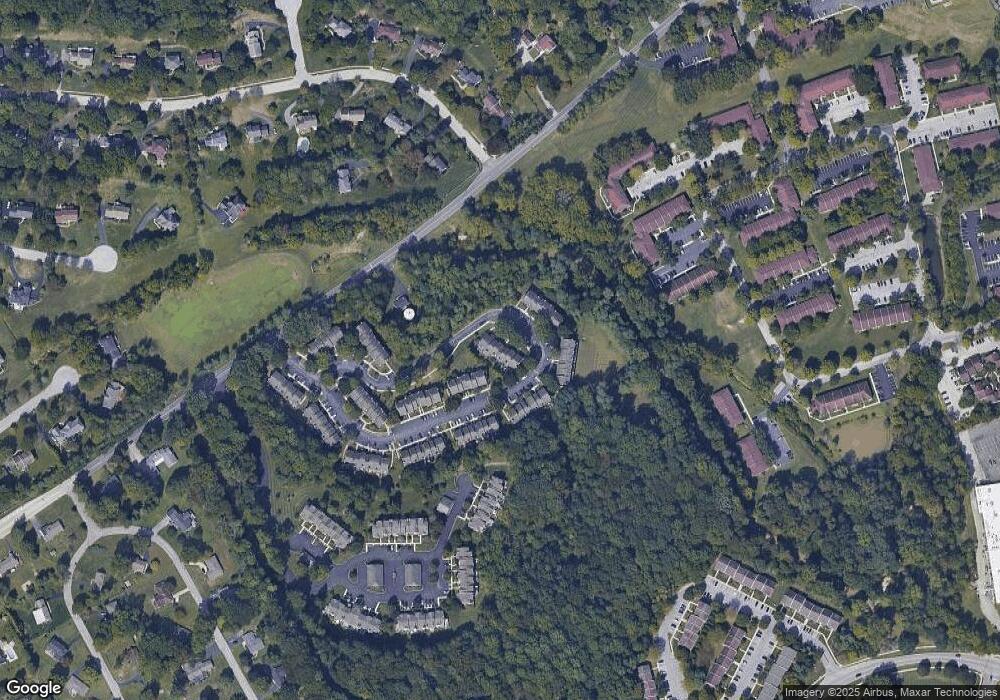

Map

Nearby Homes

- 315 Oak Ln W

- 324 Conner Dr

- 491 Orchard Cir

- 214 Louis Dr

- 208 Morris Rd

- 312 Green Cir

- 218 Hendricks Ave

- 510 Woodview Dr

- 109 Glendale Rd

- 204 Mill Pond Dr

- 534 Pewter Dr

- 17 Buttonwood Dr Unit 17

- 577 Pewter Dr

- 701 Worthington Dr Unit 701

- 233 Birchwood Dr

- 420 Oakland Dr

- 214 Silverbell Ct

- 108 Mountain View Dr

- Santorini Plan at Worthington Farm - Luxury Single-Family Homes

- Monaco Plan at Worthington Farm - Luxury Single-Family Homes