229 Plum St Danville, OH 43014

Estimated Value: $205,000 - $224,000

--

Bed

1

Bath

--

Sq Ft

8,712

Sq Ft Lot

About This Home

This home is located at 229 Plum St, Danville, OH 43014 and is currently estimated at $214,500. 229 Plum St is a home located in Knox County with nearby schools including Danville Elementary School, Danville Middle School, and Danville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2013

Sold by

Bartok Dustin and Bartok Erika

Bought by

Alvis Barton L

Current Estimated Value

Purchase Details

Closed on

Jul 7, 2008

Sold by

Hsbc Bank Usa Na

Bought by

Bartok Dustin and Bartok Erica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,043

Interest Rate

6.39%

Mortgage Type

FHA

Purchase Details

Closed on

May 7, 2008

Sold by

Crawford Lee W and Crawford Michelle D

Bought by

Hsbc Bank Usa N A

Purchase Details

Closed on

Feb 25, 2005

Sold by

Butts James and Butts Darlene

Bought by

Frazier Delroyce M and Frazier Evelyn E

Purchase Details

Closed on

Oct 31, 1989

Sold by

Tracy Evelyn

Bought by

Butts James and Butts Darlene

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alvis Barton L | $80,250 | None Available | |

| Bartok Dustin | $60,975 | Multiple | |

| Hsbc Bank Usa N A | $68,000 | None Available | |

| Frazier Delroyce M | $48,750 | None Available | |

| Butts James | $38,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bartok Dustin | $80,043 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $23 | $610 | $610 | $0 |

| 2023 | $23 | $610 | $610 | $0 |

| 2022 | $21 | $490 | $490 | $0 |

| 2021 | $21 | $490 | $490 | $0 |

| 2020 | $20 | $490 | $490 | $0 |

| 2019 | $97 | $2,260 | $650 | $1,610 |

| 2018 | $98 | $2,260 | $650 | $1,610 |

| 2017 | $96 | $2,260 | $650 | $1,610 |

| 2016 | $89 | $2,100 | $610 | $1,490 |

| 2015 | $89 | $2,100 | $610 | $1,490 |

| 2014 | $89 | $2,100 | $610 | $1,490 |

| 2013 | $92 | $2,080 | $570 | $1,510 |

Source: Public Records

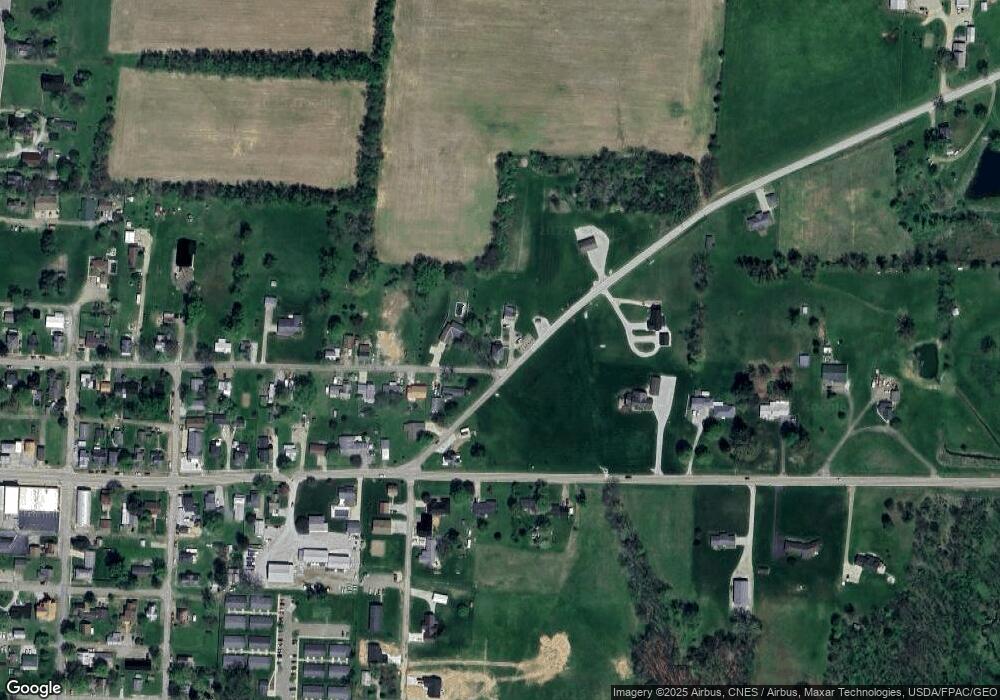

Map

Nearby Homes

- 228 E Walnut St

- 204 S Richards St

- 417 S Market St

- 106 W Rambo St

- 0 Howard-Danville Rd

- 0 Hoover Rd

- 13904 Carey Ln

- 15757 Hunter Rd

- 29575 Hoover Rd

- 13356 Mowery Rd

- 15977 Mohaven Rd

- 26301 Cavallo Rd

- 26083 Coshocton Rd

- 0 King Rd Unit 20250360

- 0 King Rd Unit 225019584

- 143 Grand Ridge Rd

- 733 Grand View Dr

- 0 Grand Valley Dr Unit 5161854

- 0 Westmoreland Dr Unit 225036591

- 0 Westmoreland Dr Unit 225024813