22928 E 730 Rd Tahlequah, OK 74464

Estimated Value: $288,000 - $511,101

3

Beds

3

Baths

2,564

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 22928 E 730 Rd, Tahlequah, OK 74464 and is currently estimated at $403,025, approximately $157 per square foot. 22928 E 730 Rd is a home with nearby schools including Cherokee Elementary School, Greenwood Elementary School, and Tahlequah Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 31, 2021

Sold by

Hughes Jim

Bought by

Buford Jace and Buford Kelsey

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$34,400

Outstanding Balance

$6,659

Interest Rate

2.7%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$396,366

Purchase Details

Closed on

Dec 17, 2020

Sold by

Buford Jace and Buford Kelsey L

Bought by

Buford Jace and Buford Kelsey L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,108

Interest Rate

2.8%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Buford Jace | $43,000 | Infinity Title Llc | |

| Buford Jace | -- | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Buford Jace | $34,400 | |

| Previous Owner | Buford Jace | $195,108 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,550 | $28,745 | $367 | $28,378 |

| 2024 | $2,550 | $27,908 | $356 | $27,552 |

| 2023 | $2,550 | $27,095 | $317 | $26,778 |

| 2022 | $2,348 | $26,305 | $0 | $0 |

| 2021 | $2,285 | $25,539 | $0 | $0 |

| 2020 | $2,459 | $26,941 | $2,860 | $24,081 |

| 2019 | $2,364 | $26,156 | $2,860 | $23,296 |

| 2018 | $2,391 | $26,156 | $2,860 | $23,296 |

| 2017 | $2,553 | $27,907 | $2,585 | $25,322 |

| 2016 | $2,569 | $27,907 | $2,585 | $25,322 |

| 2015 | -- | $2,585 | $2,585 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

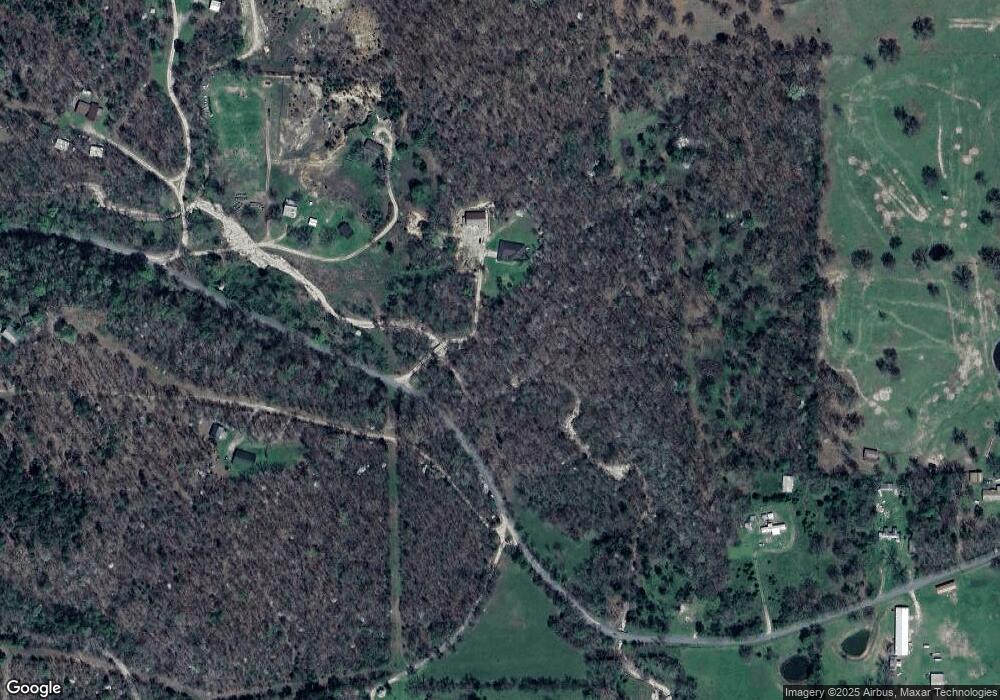

Map

Nearby Homes

- 22678 Sunrise Ridge Dr

- 24500 E 741 Rd

- 912 Summit Ridge Ct

- 0 Alder Way

- 202 Alder Way

- 206 Alder Way

- 105 Summit Ridge Dr

- 16527 N Highway 10

- 8147 N 544 Rd

- 13468 Hwy 10

- 13468 Oklahoma 10

- 17022 S 579 Rd

- 21088 E Steely Hollow Rd

- 0 Hwy 10 N Unit 2514793

- 0 S Cary Ln

- 20596 E Whipperwill Rd

- 13725 N 527 Rd

- 20455 E Whipperwill Rd

- 1390 N Legion Dr

- 2205 Oakridge Dr