22990 W Swallow Ct Deer Park, IL 60010

Estimated Value: $935,000 - $1,187,000

--

Bed

3

Baths

3,752

Sq Ft

$271/Sq Ft

Est. Value

About This Home

This home is located at 22990 W Swallow Ct, Deer Park, IL 60010 and is currently estimated at $1,017,730, approximately $271 per square foot. 22990 W Swallow Ct is a home located in Lake County with nearby schools including Arnett C. Lines Elementary School, Barrington Mdle School- Prairie Cmps, and Barrington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2011

Sold by

Smith Terrence R and Smith Kimberly S

Bought by

Smith Kimberly S and Kimberly S Smith Trust

Current Estimated Value

Purchase Details

Closed on

Jul 19, 2002

Sold by

Heider Stephen and Heider Michelle

Bought by

Smith Terrence R and Smith Kimberly S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Outstanding Balance

$147,530

Interest Rate

6.63%

Estimated Equity

$870,200

Purchase Details

Closed on

Jun 17, 1994

Sold by

Johnson Gregory and Johnson Elaine T

Bought by

Heider Stephen and Heider Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Interest Rate

4.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Kimberly S | -- | None Available | |

| Smith Terrence R | $585,000 | Chicago Title Insurance Co | |

| Heider Stephen | $370,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smith Terrence R | $350,000 | |

| Previous Owner | Heider Stephen | $296,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $17,287 | $286,488 | $43,764 | $242,724 |

| 2023 | $15,710 | $270,674 | $41,349 | $229,325 |

| 2022 | $15,710 | $243,346 | $40,549 | $202,797 |

| 2021 | $15,366 | $237,110 | $39,510 | $197,600 |

| 2020 | $15,004 | $237,110 | $39,510 | $197,600 |

| 2019 | $14,299 | $235,041 | $39,165 | $195,876 |

| 2018 | $13,953 | $232,885 | $42,131 | $190,754 |

| 2017 | $13,708 | $230,078 | $41,623 | $188,455 |

| 2016 | $13,710 | $222,793 | $40,305 | $182,488 |

| 2015 | $13,076 | $202,605 | $38,389 | $164,216 |

| 2014 | $13,575 | $191,309 | $44,055 | $147,254 |

| 2012 | $13,000 | $199,811 | $49,054 | $150,757 |

Source: Public Records

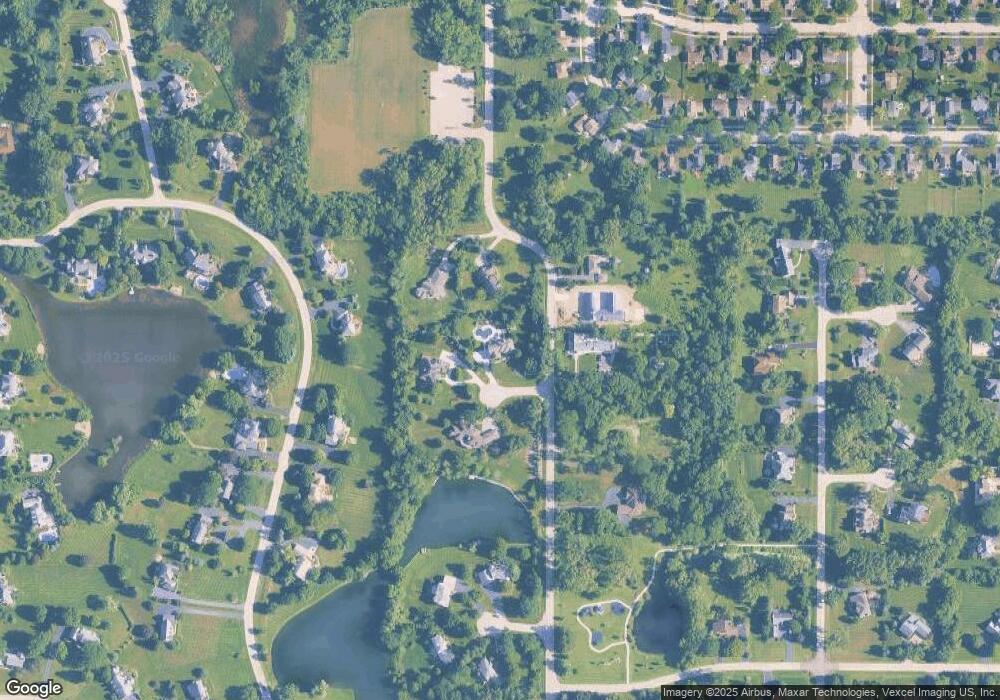

Map

Nearby Homes

- 23036 W Long Grove Rd

- 20633 N Primrose Ct

- 21355 N Bobwhite Ln

- 20358 N Wallingford Ln

- 822 Woodbine Cir

- 21326 N Elder Ct

- 1202 Tracie Dr

- 555 Waterford Dr

- 21186 W Preserve Dr

- 20992 W Preserve Dr

- 36 Ferndale Rd

- 20688 N Oliver Ct

- 1254 Tracie Dr

- 20678 N Oliver Ct

- 22145 W White Pine Rd

- 21725 N Ashley St

- 21742 N Ashley St

- 21 Ferndale Rd

- 21763 Deerpath Rd

- 44 Oak Ridge Ln

- 20966 Deerpath Rd

- 23008 W Swallow Ct

- 20933 Deerpath Rd

- 20959 Deerpath Rd

- 20990 Deerpath Rd

- 23005 W Swallow Ct

- 20975 Deerpath Rd

- 20933 N Laurel Dr

- 20975 N Laurel Dr

- 20895 Deerpath Rd

- 20899 N Laurel Dr

- 126 W Harbor Dr

- 22988 W Thornhill Ct

- 124 W Harbor Dr

- 20855 N Laurel Dr

- 128 W Harbor Dr

- 122 W Harbor Dr

- 20964 N Laurel Dr

- 20910 N Laurel Dr

- 130 W Harbor Dr