23-5 Heather Heights Reading, PA 19606

Estimated Value: $224,000 - $246,000

3

Beds

3

Baths

1,594

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 23-5 Heather Heights, Reading, PA 19606 and is currently estimated at $232,668, approximately $145 per square foot. 23-5 Heather Heights is a home located in Berks County with nearby schools including Lorane Elementary School, Exeter Township Junior High School, and Exeter Township Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 30, 2010

Sold by

Vist Bank

Bought by

Bampton Ii Calvin and Bampton Robin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,400

Outstanding Balance

$44,373

Interest Rate

4.37%

Mortgage Type

New Conventional

Estimated Equity

$188,295

Purchase Details

Closed on

Nov 12, 2010

Sold by

Miller Eric Joseph and Zeppos Toula Peter

Bought by

Vist Bank

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,400

Outstanding Balance

$44,373

Interest Rate

4.37%

Mortgage Type

New Conventional

Estimated Equity

$188,295

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bampton Ii Calvin | $83,000 | None Available | |

| Vist Bank | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bampton Ii Calvin | $66,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,039 | $75,200 | $6,000 | $69,200 |

| 2024 | $3,571 | $75,200 | $6,000 | $69,200 |

| 2023 | $3,454 | $75,200 | $6,000 | $69,200 |

| 2022 | $3,416 | $75,200 | $6,000 | $69,200 |

| 2021 | $3,364 | $75,200 | $6,000 | $69,200 |

| 2020 | $3,327 | $75,200 | $6,000 | $69,200 |

| 2019 | $8,286 | $75,200 | $6,000 | $69,200 |

| 2018 | $3,280 | $75,200 | $6,000 | $69,200 |

| 2017 | $3,233 | $75,200 | $6,000 | $69,200 |

| 2016 | $806 | $75,200 | $6,000 | $69,200 |

| 2015 | $789 | $75,200 | $6,000 | $69,200 |

| 2014 | $761 | $75,200 | $6,000 | $69,200 |

Source: Public Records

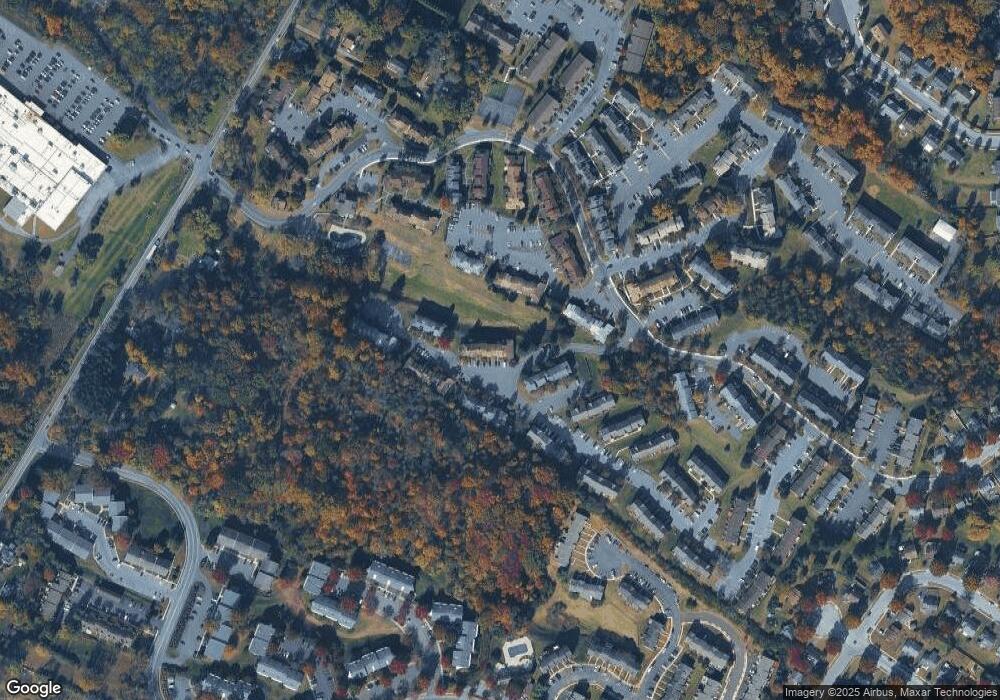

Map

Nearby Homes

- 45-8 Holly Dr

- 92 Christine Dr

- 50 7 Holly Dr

- 52 4 Holly Dr

- 4482 Heron Dr

- 0 Perkiomen Ave Unit PABK2061892

- 15 Courtleigh Place

- 3505 Circle Ave

- 10 Klapperthal Rd

- 101 Killian Dr

- 4981 Persimmon Dr

- 30 Estates Dr

- 9 W 35th St

- 222 Poplar Dr

- 3024 Oley Turnpike Rd

- 3726 Patton St

- 2638 Fairview Ave

- 17 Bordic Rd

- 2715 Perkiomen Ave

- 313 Bordic Rd

- 23-4 Heather Heights

- 23-6 Heather Heights

- 23-3 Heather Heights Unit 23

- 22 Heather Ct

- 9 Heather Heights Ct

- 23-2 Heather Heights Unit 23

- 24 Heather Ct

- 23-1 Heather Heights

- 23 Heather Heights Ct

- 22-1 Heather Heights

- 22-2 Heather Heights

- 9 Heather Heights 3

- 22-3 Heather Heights

- 22-4 Heather Heights

- 9-3 Heather Heights

- 9-3 Heather Heights Unit 6

- 9-1 Heather Heights Unit 9

- 9-2 Heather Heights

- 38 Cranberry Ridge Unit 5

- 38 Cranberry Ridge Unit 1