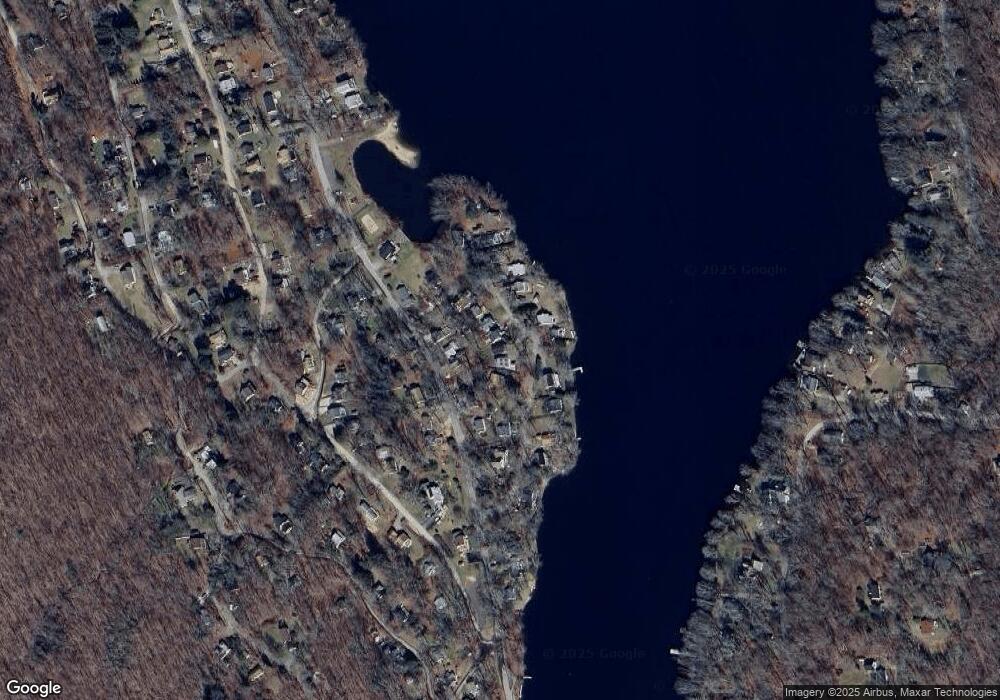

23 Forest Way East Haddam, CT 06423

Estimated Value: $349,561 - $483,000

2

Beds

1

Bath

732

Sq Ft

$554/Sq Ft

Est. Value

About This Home

This home is located at 23 Forest Way, East Haddam, CT 06423 and is currently estimated at $405,390, approximately $553 per square foot. 23 Forest Way is a home with nearby schools including East Haddam Elementary School, Nathan Hale-Ray Middle School, and Nathan Hale-Ray High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 24, 2015

Sold by

Carroll Michael L and Pfeifer Elisabeth A

Bought by

Miller Randall S and Tencza Felicia

Current Estimated Value

Purchase Details

Closed on

Jul 11, 2013

Sold by

Hyla Alan R

Bought by

Carroll Michael L and Pfeifer Elisabeth A

Purchase Details

Closed on

Feb 22, 2005

Sold by

Kirker Elaine M

Bought by

Hyla Alan R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,402

Interest Rate

5.78%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 1, 2002

Sold by

Jacques Frances E Est and Jacques

Bought by

Kirker Elaine M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Randall S | $135,000 | -- | |

| Carroll Michael L | $172,000 | -- | |

| Hyla Alan R | $198,000 | -- | |

| Kirker Elaine M | $125,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kirker Elaine M | $10,525 | |

| Previous Owner | Kirker Elaine M | $196,402 | |

| Previous Owner | Kirker Elaine M | $65,000 | |

| Previous Owner | Kirker Elaine M | $15,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $469 | $16,700 | $3,120 | $13,580 |

| 2024 | $4,709 | $175,990 | $82,260 | $93,730 |

| 2023 | $4,532 | $175,990 | $82,260 | $93,730 |

| 2022 | $2,072 | $65,170 | $56,700 | $8,470 |

| 2021 | $1,984 | $65,170 | $56,700 | $8,470 |

| 2020 | $1,984 | $65,170 | $56,700 | $8,470 |

| 2019 | $1,984 | $65,170 | $56,700 | $8,470 |

| 2018 | $1,933 | $65,170 | $56,700 | $8,470 |

| 2017 | $1,648 | $55,720 | $47,250 | $8,470 |

| 2016 | $3,139 | $106,960 | $47,250 | $59,710 |

| 2015 | $3,068 | $106,960 | $47,250 | $59,710 |

| 2014 | $2,984 | $106,960 | $47,250 | $59,710 |

Source: Public Records

Map

Nearby Homes