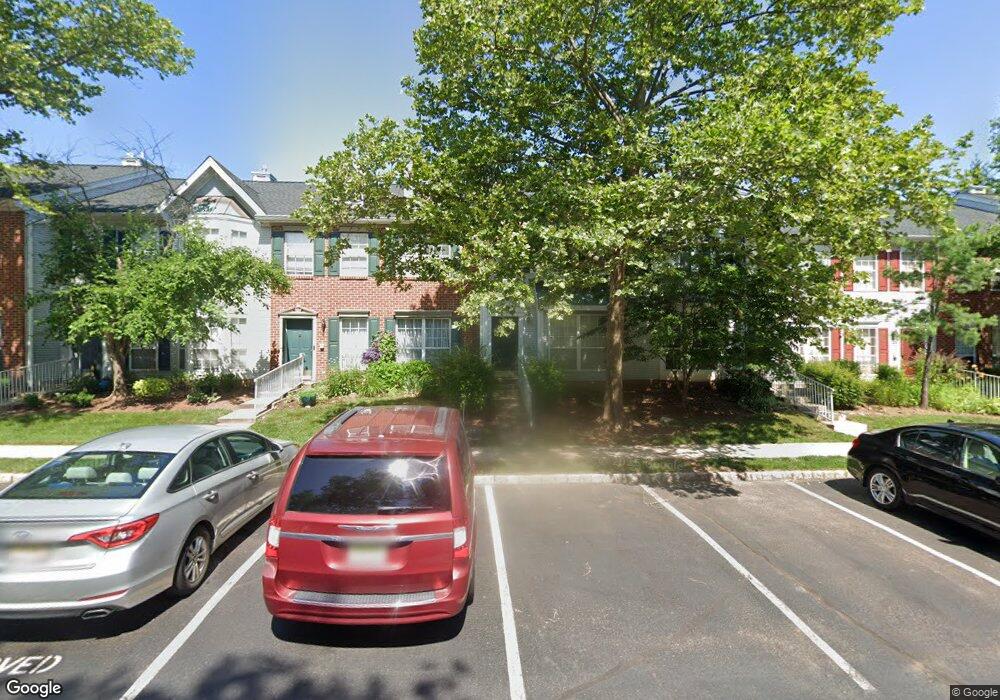

23 Hudson Ct Unit 23D Franklin Park, NJ 08823

Estimated Value: $438,487 - $460,000

--

Bed

--

Bath

1,444

Sq Ft

$312/Sq Ft

Est. Value

About This Home

This home is located at 23 Hudson Ct Unit 23D, Franklin Park, NJ 08823 and is currently estimated at $450,372, approximately $311 per square foot. 23 Hudson Ct Unit 23D is a home located in Somerset County with nearby schools including Franklin High School, St. Augustine of Canterbury School, and Guidepost Montessori at Kendall Park.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 30, 2009

Sold by

Gonzales Richardo N and Gonzales Mary Jean

Bought by

Wong Jessica S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,400

Outstanding Balance

$120,998

Interest Rate

5.2%

Mortgage Type

New Conventional

Estimated Equity

$329,374

Purchase Details

Closed on

Jan 29, 1999

Sold by

Broderick Joseph

Bought by

Gonzalez Ricardo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,490

Interest Rate

6.74%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 9, 1995

Sold by

Williams John

Bought by

Brown Angel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,000

Interest Rate

8.27%

Purchase Details

Closed on

Apr 23, 1993

Sold by

K Hovnanian At Somerset Viii Inc

Bought by

Broderick Joseph M and Broderick Cathy J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wong Jessica S | $238,000 | First American Title Insuran | |

| Gonzalez Ricardo | $114,000 | -- | |

| Brown Angel | $111,500 | -- | |

| Broderick Joseph M | $111,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wong Jessica S | $190,400 | |

| Previous Owner | Gonzalez Ricardo | $110,490 | |

| Previous Owner | Brown Angel | $106,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,514 | $418,600 | $190,000 | $228,600 |

| 2024 | $6,514 | $361,300 | $190,000 | $171,300 |

| 2023 | $5,983 | $311,300 | $140,000 | $171,300 |

| 2022 | $5,908 | $291,300 | $120,000 | $171,300 |

| 2021 | $5,877 | $266,300 | $95,000 | $171,300 |

| 2020 | $5,790 | $256,300 | $85,000 | $171,300 |

| 2019 | $5,862 | $256,300 | $85,000 | $171,300 |

| 2018 | $5,593 | $242,100 | $75,000 | $167,100 |

| 2017 | $5,151 | $222,100 | $55,000 | $167,100 |

| 2016 | $5,078 | $217,100 | $50,000 | $167,100 |

| 2015 | $4,811 | $207,100 | $40,000 | $167,100 |

| 2014 | $4,853 | $212,100 | $45,000 | $167,100 |

Source: Public Records

Map

Nearby Homes

- 32 Columbus Dr Unit 215

- 32 Columbus Dr

- 47 Cabot Way

- 253 Columbus Dr

- 22 Balboa Ln Unit 3806

- 19 Desoto Dr

- 139 Gregory Ln

- 101 Timberhill Dr

- 22 Arthur Glick Blvd Unit 2506

- 124 Edward Dr

- 3241 Route 27

- 13 Roberts St

- 21 Gregory Ln Unit F1

- 8 Amethyst Way

- 89 Lindsey Ct Unit 4021

- 167 Rachel Ct

- 147 Rachel Ct

- 139 Rachel Ct Unit D1

- 107 Rachel Ct

- 205 Rachel Ct

- 21 Hudson Ct Unit 23C

- 25 Hudson Ct

- 19 Hudson Ct Unit 23B

- 27 Hudson Ct

- 17 Hudson Ct Unit 23A

- 17 Hudson Ct Unit 2301

- 29 Hudson Ct

- 31 Hudson Ct Unit 23H

- 15 Hudson Ct Unit 15

- 15 Hudson Ct

- 13 Hudson Ct

- 33 Hudson Ct

- 16 Hudson Ct

- 11 Hudson Ct

- 14 Hudson Ct

- 18 Hudson Ct

- 12 Hudson Ct

- 20 Hudson Ct

- 35 Hudson Ct

- 10 Hudson Ct Unit 24D