23 Manchester Ct Unit F23 Berwyn, PA 19312

Estimated Value: $754,000 - $1,128,000

2

Beds

3

Baths

3,203

Sq Ft

$265/Sq Ft

Est. Value

About This Home

This home is located at 23 Manchester Ct Unit F23, Berwyn, PA 19312 and is currently estimated at $849,848, approximately $265 per square foot. 23 Manchester Ct Unit F23 is a home located in Chester County with nearby schools including Beaumont Elementary School, Tredyffrin-Easttown Middle School, and Conestoga Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2007

Sold by

Mattison Virginia S and Mattison Priscilla J

Bought by

Brown Edward D and Brown Barbara S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,000

Outstanding Balance

$214,476

Interest Rate

6.41%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$635,372

Purchase Details

Closed on

Apr 17, 2002

Sold by

Mattison Virginia S and Mattison Priscilla J

Bought by

Mattison Virginia S and Mattison Priscilla J

Purchase Details

Closed on

Oct 14, 1997

Sold by

Venn Michael F

Bought by

Mattison Verne S and Mattison Virginia S

Purchase Details

Closed on

Feb 15, 1995

Sold by

Venn Michael F and Holton Sandra M

Bought by

Venn Michael F and Holton Sandra M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brown Edward D | $576,000 | T A Title Insurance Company | |

| Mattison Virginia S | -- | -- | |

| Mattison Verne S | $278,000 | Industrial Valley Title Inc | |

| Venn Michael F | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brown Edward D | $340,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,950 | $266,760 | $84,710 | $182,050 |

| 2024 | $9,950 | $266,760 | $84,710 | $182,050 |

| 2023 | $9,303 | $266,760 | $84,710 | $182,050 |

| 2022 | $9,049 | $266,760 | $84,710 | $182,050 |

| 2021 | $8,853 | $266,760 | $84,710 | $182,050 |

| 2020 | $8,606 | $266,760 | $84,710 | $182,050 |

| 2019 | $8,367 | $266,760 | $84,710 | $182,050 |

| 2018 | $8,222 | $266,760 | $84,710 | $182,050 |

| 2017 | $8,036 | $266,760 | $84,710 | $182,050 |

| 2016 | -- | $266,760 | $84,710 | $182,050 |

| 2015 | -- | $266,760 | $84,710 | $182,050 |

| 2014 | -- | $266,760 | $84,710 | $182,050 |

Source: Public Records

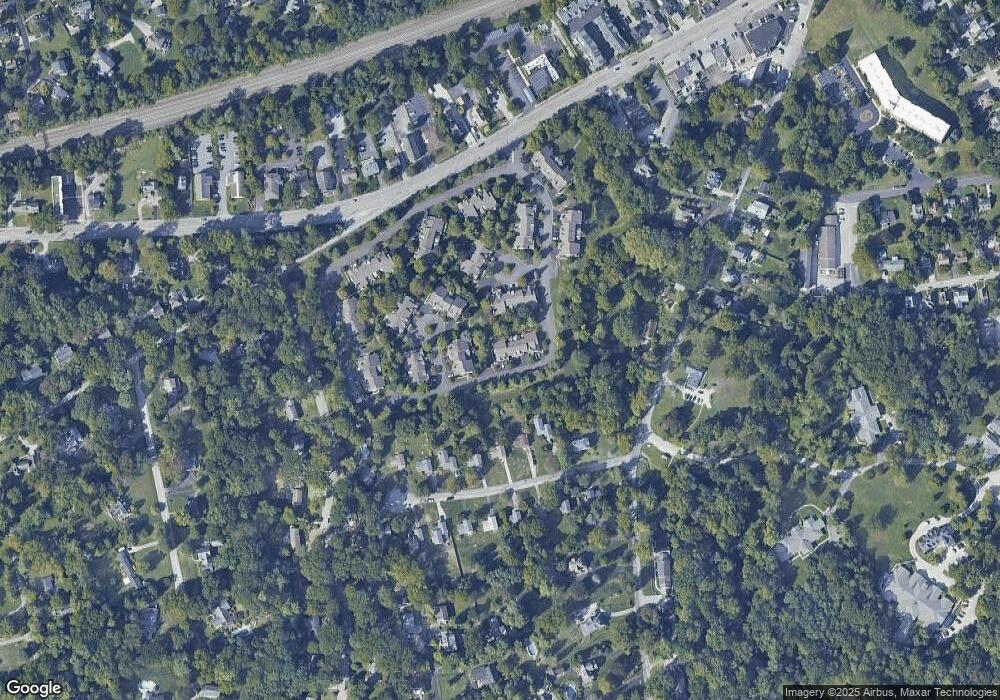

Map

Nearby Homes

- 32 Manchester Ct

- 91 Central Ave

- 896 Conestoga Rd

- 327 Stoney Knoll Lane - Lot 5

- 1242 Old Lancaster Rd

- 119 Waterloo Ave

- 553 Woodside Ave

- 211 Wooded Way

- 1441 Berwyn Paoli Rd

- 5 Kent Ln

- 320 Landsende Rd

- Lot 8 Rose Glenn

- Lot 6 Rose Glenn

- 6 Wingstone Ln

- Lot 3 Rose Glenn

- 521 Foxwood Ln

- 2 Ile Dhuyere Unit 2

- 9 Avignon

- 6 Avignon Unit 6

- 109 Vincent Rd

- 22 Manchester Ct Unit F22

- 21 Manchester Ct

- 20 Manchester Ct Unit F20

- 25 Manchester Ct Unit 1

- 25 Manchester Ct

- 24 Manchester Ct Unit 24

- 26 Manchester Ct Unit C26

- 16 Manchester Ct Unit E16

- 17 Manchester Ct Unit E17

- 19 Manchester Ct Unit E19

- 28 Manchester Ct Unit H28

- 29 Manchester Ct Unit H29

- 34 Manchester Ct

- 15 Manchester Ct Unit 6

- 15 Manchester Ct Unit D15

- 35 Manchester Ct

- 33 Manchester Ct Unit J33

- 1115 Sheffield Dr

- 1111 Sheffield Dr

- 14 Manchester Ct Unit D14