230 Everett Rd Ringgold, GA 30736

Estimated Value: $187,000 - $247,000

3

Beds

2

Baths

1,080

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 230 Everett Rd, Ringgold, GA 30736 and is currently estimated at $213,989, approximately $198 per square foot. 230 Everett Rd is a home located in Catoosa County with nearby schools including Ringgold Primary School, Ringgold Elementary School, and Heritage Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 24, 2012

Sold by

Branch Banking & Trust C

Bought by

Johnson Richard W

Current Estimated Value

Purchase Details

Closed on

Jul 3, 2012

Sold by

Babb Properties Llc

Bought by

Branch Banking And Trust Company

Purchase Details

Closed on

Feb 15, 2008

Sold by

Novastar Mtg Inc

Bought by

Babb Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,900

Interest Rate

5.65%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 2, 2007

Sold by

Not Provided

Bought by

Babb Properties Llc

Purchase Details

Closed on

Jul 25, 2005

Sold by

Not Provided

Bought by

Babb Properties Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Richard W | $35,915 | -- | |

| Branch Banking And Trust Company | -- | -- | |

| Babb Properties Llc | $63,500 | -- | |

| Babb Properties Llc | -- | -- | |

| Babb Properties Llc | $99,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Babb Properties Llc | $74,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,463 | $77,042 | $12,000 | $65,042 |

| 2024 | $1,586 | $74,353 | $12,000 | $62,353 |

| 2023 | $1,151 | $53,952 | $10,000 | $43,952 |

| 2022 | $961 | $42,925 | $10,000 | $32,925 |

| 2021 | $898 | $42,925 | $10,000 | $32,925 |

| 2020 | $883 | $38,179 | $10,000 | $28,179 |

| 2019 | $893 | $38,179 | $10,000 | $28,179 |

| 2018 | $866 | $35,037 | $8,000 | $27,037 |

| 2017 | $859 | $34,788 | $8,000 | $26,788 |

| 2016 | $830 | $31,940 | $8,000 | $23,940 |

| 2015 | -- | $31,940 | $8,000 | $23,940 |

| 2014 | -- | $31,940 | $8,000 | $23,940 |

| 2013 | -- | $31,820 | $8,000 | $23,820 |

Source: Public Records

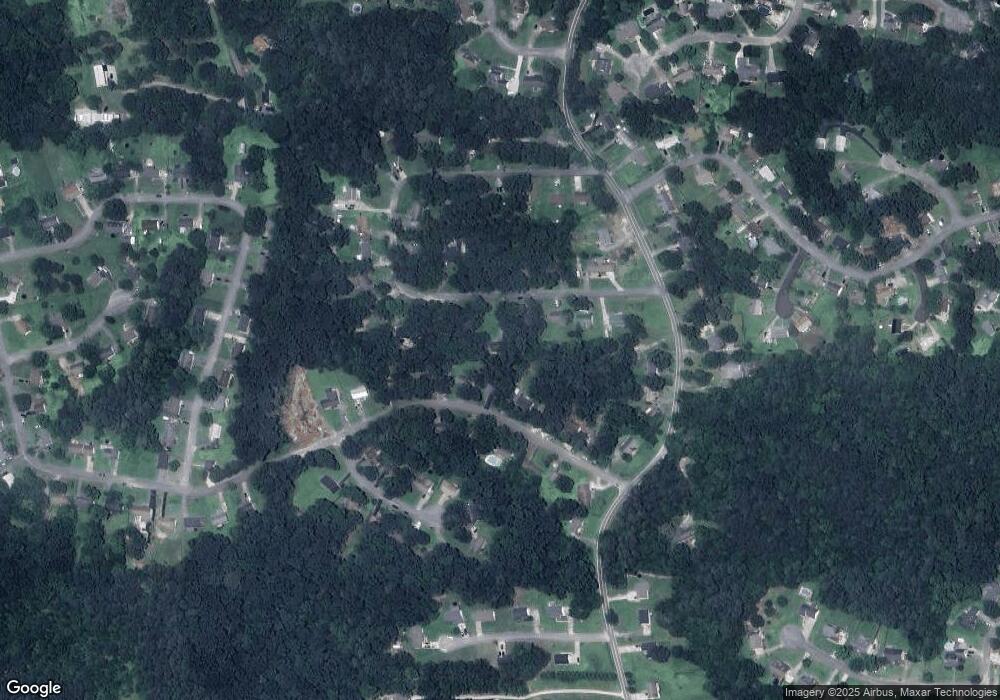

Map

Nearby Homes

- 405 Chambers Ln

- 54 Apple Ln

- 516 Hill St

- 66 Kristy Ln

- 288 Garden Terrace

- 63 Sunset Dr

- 155 Willowbrook Dr

- 184 Peachtree Cir

- 151 Peachtree Cir

- 158 Smoketree Cir

- 74 W Cove Rd

- 81 Shrader Ln

- 95 Cove Ln

- 141 Harbour Ln

- 348 Baggett Rd

- 8 E Sharon Cir

- 905 Live Oak Rd

- 322 Baggett Rd

- 198 Hickory Cir

- 294 Running Oak Dr

Your Personal Tour Guide

Ask me questions while you tour the home.