Estimated Value: $242,481 - $289,000

4

Beds

2

Baths

1,884

Sq Ft

$143/Sq Ft

Est. Value

About This Home

This home is located at 230 Summerstone Bend Unit 42, Byron, GA 31008 and is currently estimated at $268,620, approximately $142 per square foot. 230 Summerstone Bend Unit 42 is a home located in Houston County with nearby schools including Eagle Springs Elementary School, Thomson Middle School, and Northside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 20, 2023

Sold by

Woodward Norman Allen

Bought by

Woodward Norman Allen and Woodward Barbara J

Current Estimated Value

Purchase Details

Closed on

Nov 30, 2021

Sold by

Woodward Norman Allen

Bought by

Woodward Norman Allen and Woodward Barbara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,846

Interest Rate

3.11%

Mortgage Type

VA

Purchase Details

Closed on

Aug 5, 2011

Sold by

Copa Daniel Mark

Bought by

Copa Daniel Mark and Copa Angela Renee

Purchase Details

Closed on

Jul 11, 2008

Sold by

Randle Home Builders Inc

Bought by

Copa Daniel M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,481

Interest Rate

6.03%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 5, 2007

Sold by

Madison Place Investments Llc

Bought by

Randle Home Builders Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Woodward Norman Allen | -- | -- | |

| Woodward Norman Allen | -- | None Available | |

| Woodward Norman Allen | $224,000 | None Available | |

| Copa Daniel Mark | -- | None Available | |

| Copa Daniel M | $163,000 | None Available | |

| Randle Home Builders Inc | $28,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Woodward Norman Allen | $225,846 | |

| Previous Owner | Copa Daniel M | $160,481 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,389 | $86,680 | $12,000 | $74,680 |

| 2023 | $2,518 | $76,360 | $10,000 | $66,360 |

| 2022 | $1,749 | $76,080 | $10,000 | $66,080 |

| 2021 | $1,253 | $56,200 | $10,000 | $46,200 |

| 2020 | $1,237 | $55,240 | $10,000 | $45,240 |

| 2019 | $1,237 | $55,240 | $10,000 | $45,240 |

| 2018 | $1,237 | $55,240 | $10,000 | $45,240 |

| 2017 | $1,238 | $55,240 | $10,000 | $45,240 |

| 2016 | $1,240 | $55,240 | $10,000 | $45,240 |

| 2015 | -- | $55,240 | $10,000 | $45,240 |

| 2014 | -- | $55,240 | $10,000 | $45,240 |

| 2013 | -- | $55,160 | $10,000 | $45,160 |

Source: Public Records

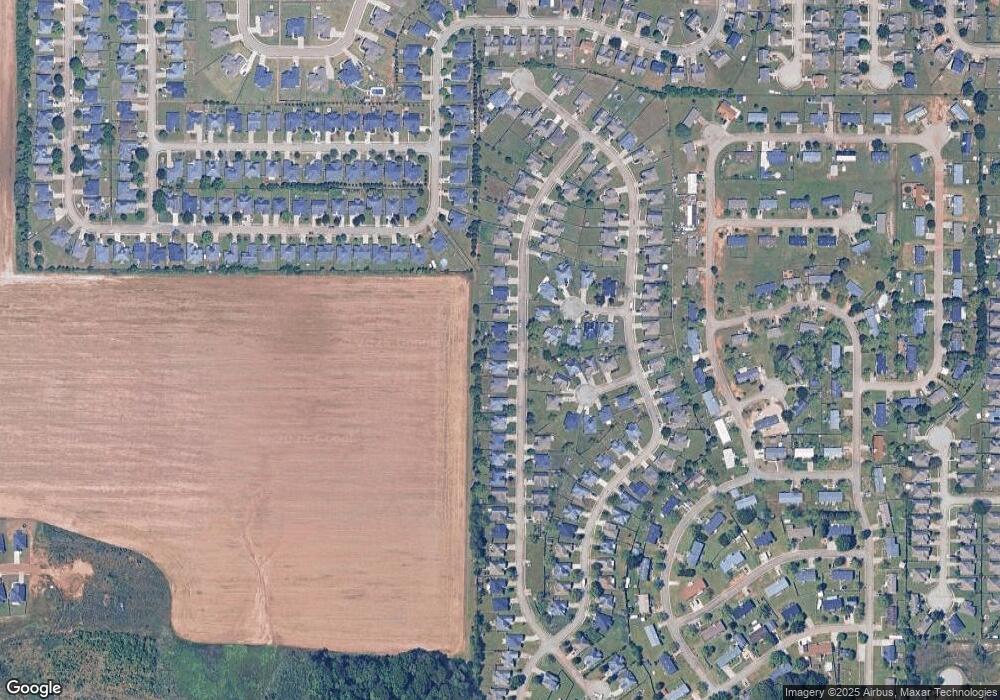

Map

Nearby Homes

- 105 Vineyard Trace

- 508 Timberwind Dr

- 205 Burr Dr

- 217 Caleb Way

- 417 Covington Cove

- 260 Caleb Way

- 422 Lamplight Dr

- 412 Lamplight Dr

- 104 Monroe Ct

- 102 Monroe Ct

- 100 Monroe Ct

- 508 Georgian Walk

- 107 Monroe Ct

- 502 Georgian Walk

- The Coleman Plan at Cobblestone Crossing

- The Phoenix Plan at Cobblestone Crossing

- The Crawford Plan at Cobblestone Crossing

- The Piedmont Plan at Cobblestone Crossing

- The Bradley Plan at Cobblestone Crossing

- The Caldwell Plan at Cobblestone Crossing

- 230 Summerstone Bend

- 228 Summerstone Bend

- 232 Summerstone Bend

- 226 Summerstone Bend

- 234 Summerstone Bend

- 106 Carlyle Ct

- 224 Summerstone Bend

- 236 Summerstone Bend

- 108 Carlyle Ct

- 107 Madison Walk

- 222 Summerstone Bend

- 238 Summerstone Bend

- 105 Madison Walk

- 104 Carlyle Ct

- 108 Madison Walk

- 107 Carlyle Ct

- 220 Summerstone Bend

- 103 Madison Walk

- 102 Carlyle Ct

- 105 Carlyle Ct