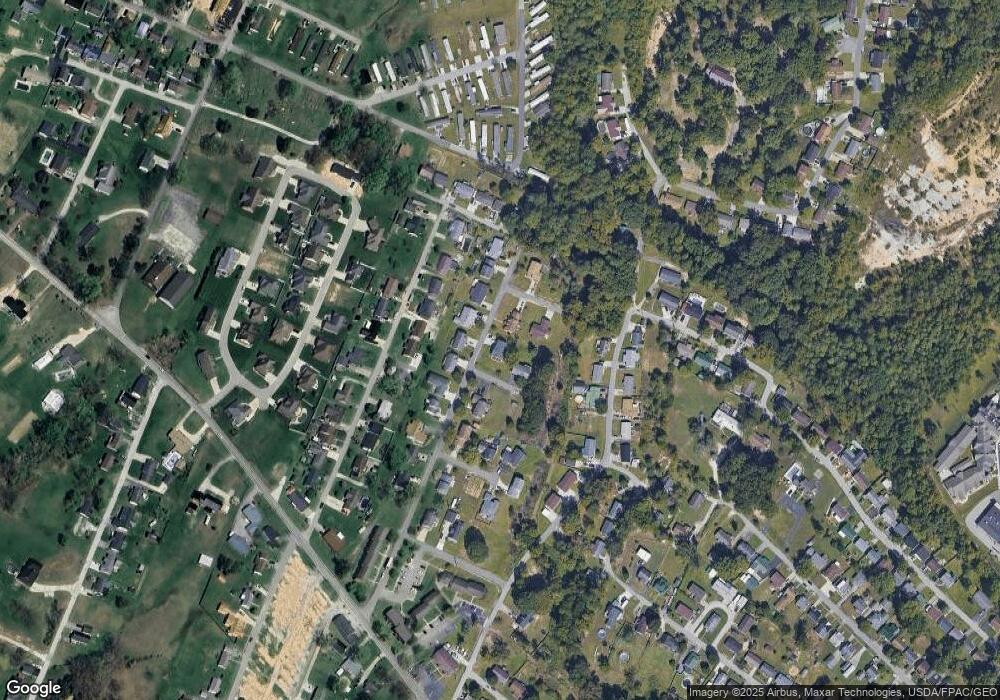

2302 Nolan Dr Flatwoods, KY 41139

Estimated Value: $241,017 - $274,000

3

Beds

2

Baths

2,096

Sq Ft

$124/Sq Ft

Est. Value

About This Home

This home is located at 2302 Nolan Dr, Flatwoods, KY 41139 and is currently estimated at $259,504, approximately $123 per square foot. 2302 Nolan Dr is a home located in Greenup County with nearby schools including Russell Primary School, Russell-McDowell Intermediate School, and Russell Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2017

Sold by

Evans Guy

Bought by

Arthur Shawn and Mullins Erica

Current Estimated Value

Purchase Details

Closed on

Aug 10, 2014

Sold by

Criswell Troy K and Criswell Amber

Bought by

Arthur Shawn

Purchase Details

Closed on

Jan 21, 2009

Sold by

Kistner David and Norris Anthony Scott

Bought by

Criswell Troy K and Criswell Amber

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,500

Interest Rate

5.23%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Arthur Shawn | -- | None Available | |

| Arthur Shawn | $170,000 | -- | |

| Criswell Troy K | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Criswell Troy K | $61,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,328 | $185,000 | $25,000 | $160,000 |

| 2024 | $3,162 | $185,000 | $25,000 | $160,000 |

| 2023 | $3,112 | $185,000 | $25,000 | $160,000 |

| 2022 | $3,102 | $185,000 | $25,000 | $160,000 |

| 2021 | $3,106 | $185,000 | $25,000 | $160,000 |

| 2020 | $2,801 | $170,000 | $20,000 | $150,000 |

| 2019 | $2,787 | $170,000 | $20,000 | $150,000 |

| 2018 | $2,818 | $170,000 | $20,000 | $150,000 |

| 2017 | $2,768 | $170,000 | $20,000 | $150,000 |

| 2016 | $2,768 | $170,000 | $20,000 | $150,000 |

| 2015 | $2,701 | $170,000 | $20,000 | $150,000 |

| 2014 | $2,148 | $141,260 | $15,500 | $125,760 |

| 2011 | -- | $141,260 | $15,500 | $125,760 |

Source: Public Records

Map

Nearby Homes

- Lot 7 Poplar Ridge Dr

- 1215 W Collins St

- 2260 Sloan St

- 1300 Bluegrass St

- 1520 Luci Mae Dr

- 1512 Shady Elm Dr

- 2106 Washington St

- 1000 Powell Ln

- 1006 Raceland Ave

- 1300 Walnut St

- 1020 Olive St

- 3109 Reed St

- 2830 Oakwood Ct

- 2860 Oakwood Ct

- 459 Jessica Dr

- 808 James St

- 903 Federal Way

- Lot #7 Meadow Glen Rd

- Lot #18 Meadow Glen Rd

- Lot 22 Meadow Glen Rd

Your Personal Tour Guide

Ask me questions while you tour the home.