2305 Us Highway 42 West Jefferson, OH 43162

Estimated Value: $441,000 - $562,147

2

Beds

2

Baths

1,344

Sq Ft

$377/Sq Ft

Est. Value

About This Home

This home is located at 2305 Us Highway 42, West Jefferson, OH 43162 and is currently estimated at $506,049, approximately $376 per square foot. 2305 Us Highway 42 is a home located in Madison County with nearby schools including Norwood Elementary School, West Jefferson Middle School, and West Jefferson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2020

Sold by

Byerly Cody A

Bought by

Byerly Patrick A and Byerly Joann

Current Estimated Value

Purchase Details

Closed on

Jun 16, 2014

Sold by

Byerly William W and Byerly Rana

Bought by

Byerly Cody A

Purchase Details

Closed on

May 24, 2014

Sold by

Byerly Mark A and Byerly Patrick A

Bought by

Byerly Cody A

Purchase Details

Closed on

Dec 19, 2013

Sold by

Estate Of Diana L Corney

Bought by

Corney Levi H

Purchase Details

Closed on

Dec 4, 2012

Sold by

Estate Of William W Byerly

Bought by

Byerly Mark A and Corney Diana L

Purchase Details

Closed on

Oct 2, 2006

Sold by

Estate Of Shirley M Byerly

Bought by

Byerly William W and Byerly William Wayne

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Byerly Patrick A | $73,400 | Midland Title | |

| Byerly Cody A | $138,200 | Attorney | |

| Byerly Cody A | -- | Attorney | |

| Corney Levi H | -- | Attorney | |

| Byerly Mark A | -- | None Available | |

| Byerly William W | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,778 | $149,610 | $26,810 | $122,800 |

| 2023 | $6,778 | $73,890 | $26,810 | $47,080 |

| 2022 | $2,652 | $54,410 | $19,740 | $34,670 |

| 2021 | $2,663 | $54,410 | $19,740 | $34,670 |

| 2020 | $2,710 | $54,410 | $19,740 | $34,670 |

| 2019 | $2,198 | $43,460 | $17,770 | $25,690 |

| 2018 | $2,047 | $43,460 | $17,770 | $25,690 |

| 2017 | $1,804 | $43,460 | $17,770 | $25,690 |

| 2016 | $1,804 | $37,450 | $17,770 | $19,680 |

| 2015 | $3,032 | $37,450 | $17,770 | $19,680 |

| 2014 | $3,032 | $37,450 | $17,770 | $19,680 |

| 2013 | -- | $36,970 | $14,810 | $22,160 |

Source: Public Records

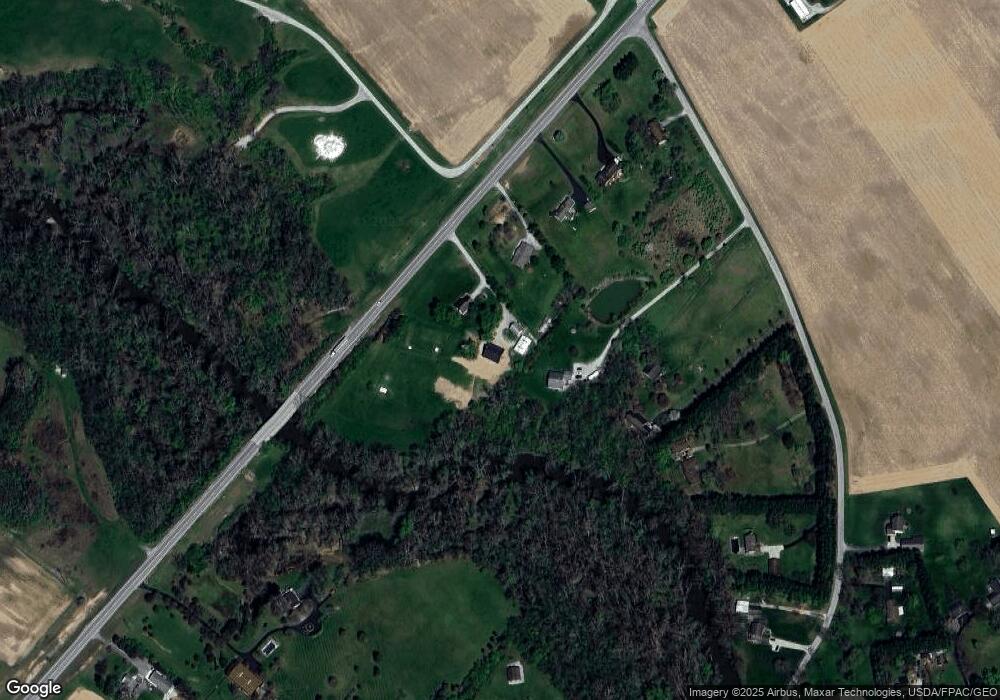

Map

Nearby Homes

- 2915 US Highway 42 NE

- 6270 South Rd

- 4 Thorn Locust Ln

- 3980 Us-40

- 7 Thorn Locust Ln

- 13 Thorn Locust Ln

- 41 Thorn Locust Ln

- 23 Thorn Locust Ln

- 24 Thorn Locust Ln

- 33 Thorn Locust Ln

- 37 Thorn Locust Ln

- 161 Maplewood Ln

- 158 Maplewood Ln

- 156 Maplewood Ln

- 177 Thorn Locust Ln

- 183 Thorn Locust Ln

- 269 Thorn Locust Ln

- 2209 Grewell Rd

- 1000 W Main St Unit Lot 13

- 85 Middle St SE

- 2300 Byerly Mill Rd

- 2313 Us Rte 42

- 2313 Us Highway 42

- 2301 Us Highway 42

- 2345 Us Highway 42

- 2250 Byerly Mill Rd

- 2377 Us Highway 42

- 2200 Byerly Mill Rd

- 2360 Byerly Mill Rd

- 2140 Byerly Mill Rd

- 2135 Us Highway 42

- 2060 Byerly Mill Rd

- 2060 Byerly Mill Rd

- 2050 Us Highway 42

- 2135 Byerly Mill Rd

- 1920 Byerly Mill Rd

- 2095 Byerly Mill Rd

- 4400 Goodson Rd

- 1930 Byerly Mill Rd

- 2093 Us Hwy NE Unit 42