2308 Appalachian Trail Edmond, OK 73003

Thomas Trails NeighborhoodEstimated Value: $310,179 - $334,000

4

Beds

2

Baths

2,006

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 2308 Appalachian Trail, Edmond, OK 73003 and is currently estimated at $320,295, approximately $159 per square foot. 2308 Appalachian Trail is a home located in Oklahoma County with nearby schools including John Ross Elementary School, Cheyenne Middle School, and North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 30, 2020

Sold by

Stewart Betty Lou

Bought by

University Of Oklahoma Foundation Inc

Current Estimated Value

Purchase Details

Closed on

May 12, 2008

Sold by

Tommy Huelskamp Llc

Bought by

Huelskamp Investments Llc

Purchase Details

Closed on

Apr 10, 2006

Sold by

Garrett Development Inc

Bought by

Tommy Huelskamp Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,200

Interest Rate

6.21%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| University Of Oklahoma Foundation Inc | -- | None Listed On Document | |

| University Of Oklahoma Foundation Inc | -- | None Listed On Document | |

| Regens Family Trust | -- | None Listed On Document | |

| Msr Properties Gp | -- | None Listed On Document | |

| Univer/Oklahoma Foundation Inc | -- | None Listed On Document | |

| Univer/Oklahoma Foundation Inc | -- | None Listed On Document | |

| Regens Family Trust | -- | None Listed On Document | |

| Ms & R Properties Llc | -- | None Listed On Document | |

| Huelskamp Investments Llc | -- | Lawyers Title Of Ok City Inc | |

| Tommy Huelskamp Llc | $32,000 | Oklahoma City Abstract & Tit |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Tommy Huelskamp Llc | $175,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,920 | $29,414 | $4,720 | $24,694 |

| 2023 | $2,920 | $28,014 | $4,615 | $23,399 |

| 2022 | $2,792 | $26,680 | $5,123 | $21,557 |

| 2021 | $2,646 | $25,410 | $5,227 | $20,183 |

| 2020 | $2,592 | $24,585 | $4,756 | $19,829 |

| 2019 | $2,528 | $23,870 | $4,756 | $19,114 |

| 2018 | $2,467 | $23,155 | $0 | $0 |

| 2017 | $2,485 | $23,429 | $4,756 | $18,673 |

| 2016 | $2,456 | $23,209 | $4,493 | $18,716 |

| 2015 | $2,432 | $23,003 | $4,493 | $18,510 |

| 2014 | $2,359 | $22,350 | $4,493 | $17,857 |

Source: Public Records

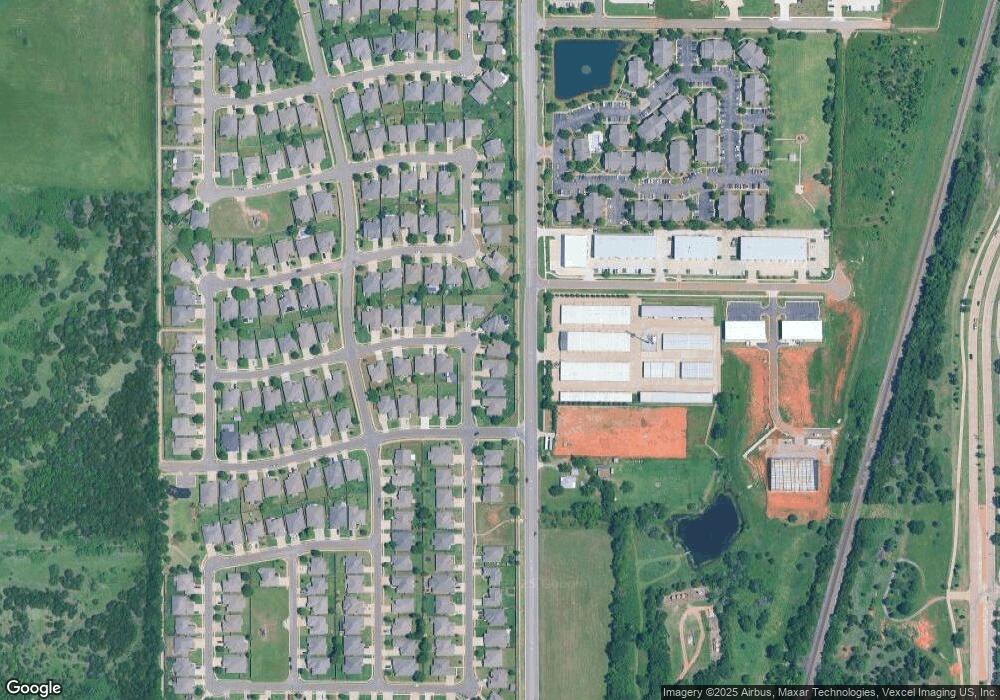

Map

Nearby Homes

- 422 Oregon Trail

- 2026 Appalachian Trail

- 405 Bright Angel Trail

- 326 Bozeman Trail

- 2802 Coldbrook Ln

- 1804 Saint Christopher Dr

- 249 Cobblestone Cir

- 1713 Timber Ridge Rd

- 2901 Stonebrook Rd

- 404 Timber Ridge Rd

- 2824 Stonebrook Rd

- 3006 Meriweather Rd

- 117 Stonebrook Way

- 503 Hunters Ct

- 308 Clermont Dr

- 611 Sunny Brook Dr

- 2101 N Kelly Ave

- 1225 Sequoyah Place Unit D

- 709 Timber Ridge Dr

- 2500 Hidden Hollow Dr

- 2300 Appalachian Trail

- 2316 Appalachian Trail

- 2238 Appalachian Trail

- 307 Pacific Crest Trail

- 322 Pacific Crest Trail

- 2230 Appalachian Trail

- 306 Butterfield Trail

- 321 Oregon Trail

- 323 Pacific Crest Trail

- 314 Butterfield Trail

- 2400 Nez Perce Trail

- 329 Oregon Trail

- 331 Pacific Crest Trail

- 322 Butterfield Trail

- 338 Pacific Crest Trail

- 337 Oregon Trail

- 2222 Appalachian Trail

- 339 Pacific Crest Trail

- 330 Butterfield Trail