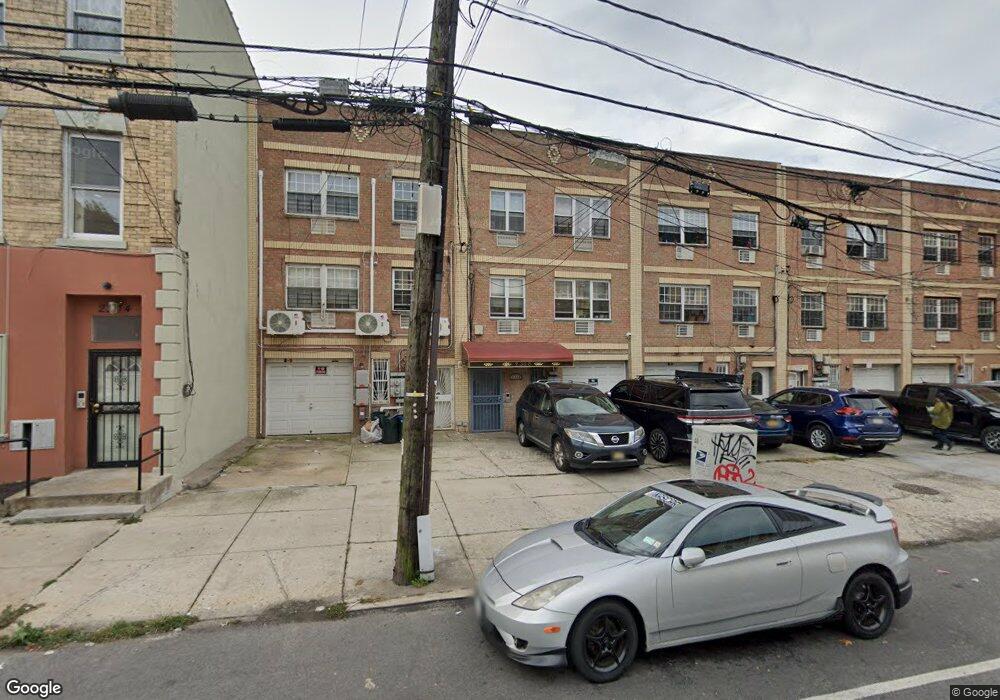

2308 Pitkin Ave Unit 1 Brooklyn, NY 11207

East New York NeighborhoodEstimated Value: $860,469 - $1,367,000

1

Bed

1

Bath

3,120

Sq Ft

$371/Sq Ft

Est. Value

About This Home

This home is located at 2308 Pitkin Ave Unit 1, Brooklyn, NY 11207 and is currently estimated at $1,157,367, approximately $370 per square foot. 2308 Pitkin Ave Unit 1 is a home located in Kings County with nearby schools including P.S. 158 Warwick, J.H.S 292 Margaret S. Douglas, and Achievement First Apollo Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2021

Sold by

Gonzalez Nathaniel

Bought by

Afrin Tanjina and Uddin Main

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$609,000

Outstanding Balance

$551,374

Interest Rate

2.9%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$605,993

Purchase Details

Closed on

Mar 12, 2015

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Gonzalez Nathaniel

Purchase Details

Closed on

Jun 23, 2014

Sold by

Wells Fargo Bank N A

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

May 16, 2014

Sold by

Manzolillo Marco A

Bought by

Wells Fargo Bank N A

Purchase Details

Closed on

Dec 14, 2007

Sold by

G F Pitkin Inc

Bought by

Manzolillo Marco A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$624,000

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Afrin Tanjina | $870,000 | -- | |

| Gonzalez Nathaniel | $409,900 | -- | |

| Federal Home Loan Mortgage Corp | -- | -- | |

| Wells Fargo Bank N A | $622,708 | -- | |

| Manzolillo Marco A | $780,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Afrin Tanjina | $609,000 | |

| Previous Owner | Manzolillo Marco A | $624,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,653 | $53,880 | $10,080 | $43,800 |

| 2024 | $7,653 | $49,320 | $10,080 | $39,240 |

| 2023 | $7,680 | $49,560 | $10,080 | $39,480 |

| 2022 | $7,122 | $41,160 | $10,080 | $31,080 |

| 2021 | $7,083 | $35,880 | $10,080 | $25,800 |

| 2020 | $3,322 | $45,540 | $10,080 | $35,460 |

| 2019 | $6,642 | $45,540 | $10,080 | $35,460 |

| 2018 | $6,424 | $31,512 | $6,287 | $25,225 |

| 2017 | $6,060 | $29,729 | $8,174 | $21,555 |

| 2016 | $5,607 | $28,047 | $7,919 | $20,128 |

| 2015 | $4,151 | $26,460 | $9,660 | $16,800 |

| 2014 | $4,151 | $26,460 | $9,660 | $16,800 |

Source: Public Records

Map

Nearby Homes

- 2321 Pitkin Ave

- 396 Barbey St

- 576 Glenmore Ave

- 633 Glenmore Ave

- 572 Glenmore Ave

- 389 Warwick St

- 323 Barbey St

- 374 Ashford St

- 563 Belmont Ave

- 632 Belmont Ave

- 303 Hendrix St

- 279 van Siclen Ave

- 412 Hendrix St

- 295 Ashford St

- 278 Ashford St

- 597 Liberty Ave

- 599 Liberty Ave

- 508 Warwick St

- 2210 Pitkin Ave

- 346 van Siclen Ave

- 2308 Pitkin Ave

- 2310 Pitkin Ave

- 2306 Pitkin Ave

- 2304 Pitkin Ave

- 2314 Pitkin Ave

- 2302 Pitkin Ave

- 2316 Pitkin Ave

- 2316 Pitkin Ave

- 2302-2304 Pitkin Ave

- 2316 Pitkin Ave

- 401 Barbey St

- 358 Jerome St

- 407 Barbey St

- 360 Jerome St

- 360 Jerome St Unit 2

- 362 Jerome St

- 2318 Pitkin Ave

- 2300 Pitkin Ave

- 405 Barbey St