2310 Cr359 Stephenville, TX 76401

Estimated Value: $346,811 - $619,000

3

Beds

2

Baths

1,854

Sq Ft

$260/Sq Ft

Est. Value

About This Home

This home is located at 2310 Cr359, Stephenville, TX 76401 and is currently estimated at $481,937, approximately $259 per square foot. 2310 Cr359 is a home located in Erath County with nearby schools including Central Elementary School, Chamberlin Elementary School, and Hook Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 30, 2014

Sold by

Andrews David and Andrews Allison

Bought by

Light James Royce and Light Nikki Nichole

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,200

Interest Rate

4.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 31, 2014

Sold by

Fletcher Donald Scott and Fletcher Lesa Elaine

Bought by

Light James Royce and Light Nikki Nichole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,000

Interest Rate

5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Light James Royce | -- | Lawyers Abstract & Title | |

| Light James Royce | -- | Lawyers Abstract & Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Light James Royce | $27,200 | |

| Previous Owner | Light James Royce | $28,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,264 | $483,350 | $128,550 | $354,800 |

| 2024 | $4,561 | $471,540 | $164,100 | $307,440 |

| 2023 | $4,114 | $407,380 | $174,100 | $233,280 |

| 2022 | $4,264 | $311,740 | $114,400 | $197,340 |

| 2021 | $4,046 | $246,630 | $78,580 | $168,050 |

| 2020 | $4,089 | $220,860 | $65,170 | $155,690 |

| 2019 | $3,686 | $204,950 | $65,170 | $139,780 |

| 2018 | $3,300 | $192,320 | $60,700 | $131,620 |

| 2017 | $3,140 | $182,990 | $56,230 | $126,760 |

| 2016 | $2,993 | $174,420 | $50,760 | $123,660 |

| 2015 | $2,104 | $0 | $0 | $0 |

| 2014 | $2,104 | $0 | $0 | $0 |

Source: Public Records

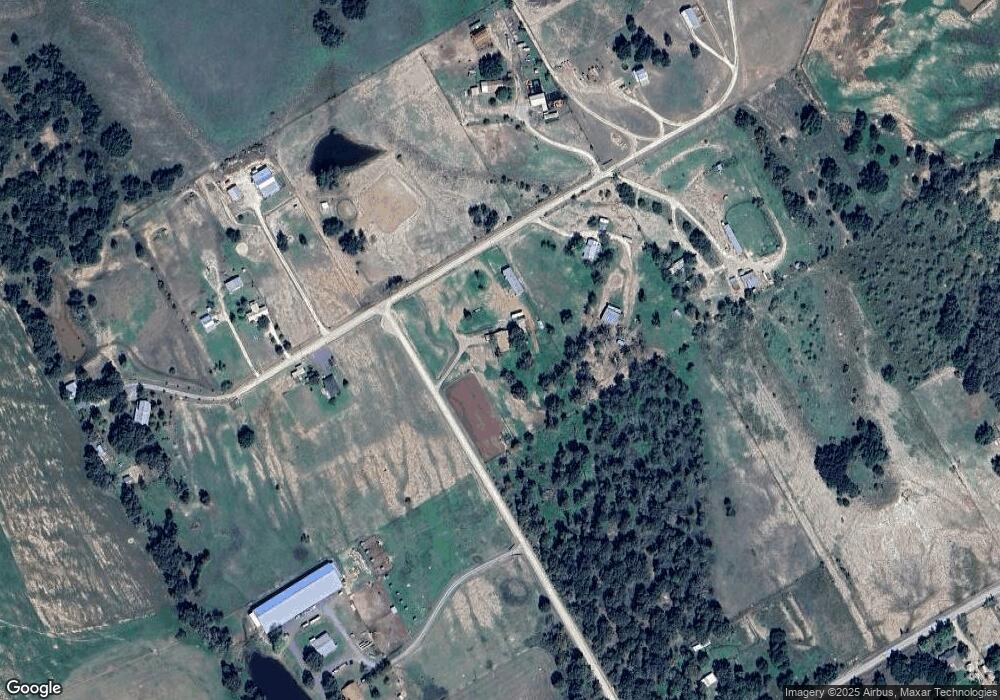

Map

Nearby Homes

- 688 Private Road 1152

- 0 County Road 387 Unit 21994204

- 315 State Ave

- 0 Tbd County Road 387

- 0 Tbd County Road 387 Unit 3 22778625

- 0 County Road 351 Unit 25090958

- 0 County Road 351 Unit 25090966

- 0 County Road 351 Unit 25090974

- 4370 County Road 351

- 1250 County Road 242

- 4560 County Road 351

- 6688 S US Highway 377

- 3891 County Road 351

- TBD County Road 517

- 2036 County Road 242

- 2036 Co Rd 242

- 3130 W Washington St

- 641 County Road 386

- 6000 County Road 351

- 9855 S U S 377

- 2310 County Road 359

- 217 E County Road 519

- 519 W County Road 519

- 000 County Road 519

- 122 E Cr519

- 500 W County Road 519

- 2087 County Road 359

- 2087 Cr359

- 1923 County Road 388

- 1716 County Road 359

- 185 Private Road 1640

- 1701 County Road 388

- 1604 County Road 359

- 343 Private Road 1640

- 439 Private Road 1640

- 162 Private Road 1033

- 1257 County Road 359

- TBD County Road 359

- TBT County Road 359

- 1543 County Road 388