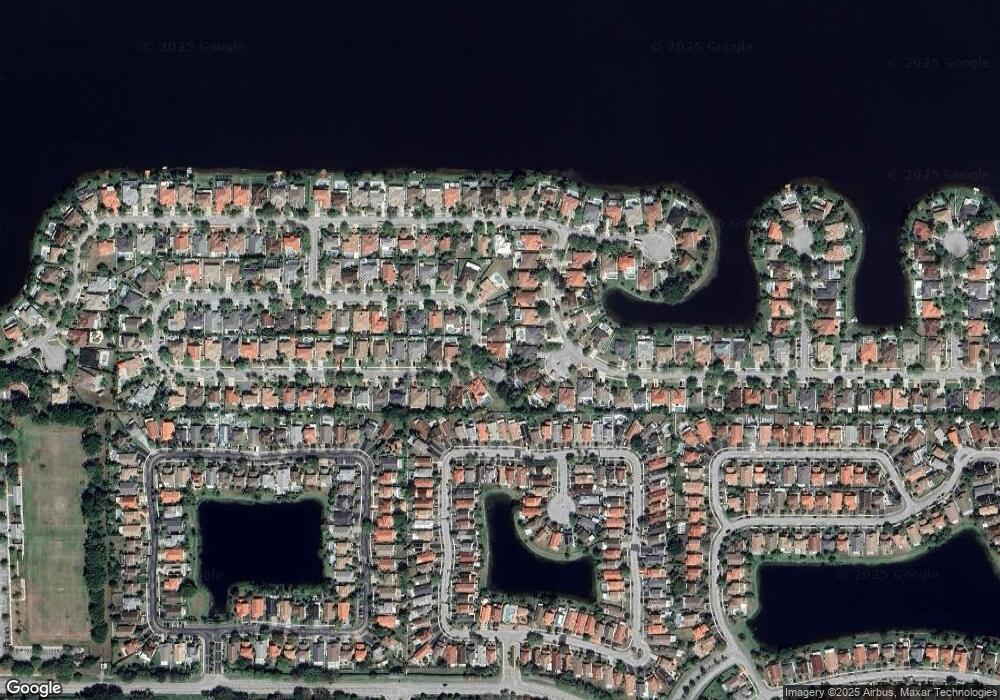

2315 NW 190th Ave Pembroke Pines, FL 33029

Chapel Trail NeighborhoodEstimated Value: $688,707 - $755,000

4

Beds

2

Baths

2,000

Sq Ft

$364/Sq Ft

Est. Value

About This Home

This home is located at 2315 NW 190th Ave, Pembroke Pines, FL 33029 and is currently estimated at $727,927, approximately $363 per square foot. 2315 NW 190th Ave is a home located in Broward County with nearby schools including Chapel Trail Elementary School, Silver Trail Middle School, and West Broward High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2016

Sold by

Miori Jose and Diaz Vanesa

Bought by

Miori Jose and Diaz Vanesa

Current Estimated Value

Purchase Details

Closed on

Aug 12, 2010

Sold by

Cain Kennth W and Ramos Ricardo A

Bought by

Miori Jose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,947

Outstanding Balance

$202,248

Interest Rate

4.87%

Mortgage Type

FHA

Estimated Equity

$525,679

Purchase Details

Closed on

Jan 12, 2010

Sold by

Mejia Rafael D

Bought by

Cain Kenneth W and Ramos Ricardo A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$299,450

Interest Rate

4.94%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 27, 1997

Sold by

Westbrooke At Pembroke Pines Inc

Bought by

Mejia Rafael D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,850

Interest Rate

7.55%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 17, 1997

Sold by

Available Not

Bought by

Available Not

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,850

Interest Rate

7.55%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miori Jose | $134,500 | None Available | |

| Miori Jose | $306,000 | Watson Title Ins Agency Inc | |

| Cain Kenneth W | $305,000 | Sunbelt Title Agency | |

| Mejia Rafael D | $162,400 | -- | |

| Available Not | $162,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Miori Jose | $300,947 | |

| Previous Owner | Cain Kenneth W | $299,450 | |

| Previous Owner | Mejia Rafael D | $154,500 | |

| Previous Owner | Mejia Rafael D | $17,796 | |

| Previous Owner | Mejia Rafael D | $129,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,941 | $287,710 | -- | -- |

| 2024 | $4,790 | $278,860 | -- | -- |

| 2023 | $4,790 | $270,740 | $0 | $0 |

| 2022 | $4,515 | $262,860 | $0 | $0 |

| 2021 | $4,426 | $255,210 | $0 | $0 |

| 2020 | $4,379 | $251,690 | $0 | $0 |

| 2019 | $4,300 | $246,040 | $0 | $0 |

| 2018 | $4,137 | $241,460 | $0 | $0 |

| 2017 | $4,085 | $236,500 | $0 | $0 |

| 2016 | $4,066 | $231,640 | $0 | $0 |

| 2015 | $4,124 | $230,030 | $0 | $0 |

| 2014 | $4,118 | $228,210 | $0 | $0 |

| 2013 | -- | $238,670 | $62,400 | $176,270 |

Source: Public Records

Map

Nearby Homes

- 18840 NW 23rd Place

- 18961 NW 22nd St

- 19077 NW 23rd Ct

- 1960 NW 188th Ave

- 19173 NW 23rd St

- 19253 NW 22nd St

- 2031 SW 185th Ave

- 18581 NW 23rd St

- 19257 NW 14th St

- 2176 NW 184th Way

- 2130 NW 184th Way

- 18456 NW 22nd St

- 19190 NW 24th Place

- 18551 NW 14th St

- 2002 NW 184th Way

- 18446 NW 21st St

- 1210 NW 193rd Ave

- 18506 NW 24th Place

- 18411 NW 18th St

- 2411 NW 184th Terrace

- 2319 NW 190th Ave

- 2311 NW 190th Ave

- 2314 NW 189th Ave

- 2310 NW 189th Ave

- 2318 NW 189th Ave

- 2323 NW 190th Ave

- 19002 NW 23rd St

- 2322 NW 189th Ave

- 19010 NW 23rd Ct

- 19008 NW 23rd St

- 2326 NW 189th Ave

- 19021 NW 23rd St

- 18890 NW 23rd St

- 2327 NW 190th Ave

- 19022 NW 23rd Ct

- 19020 NW 23rd St

- 2330 NW 189th Ave

- 18931 NW 22nd St

- 18941 NW 22nd St

- 19031 NW 23rd St