23255 Redbud Rd Oronogo, MO 64855

Estimated Value: $218,647 - $269,000

Studio

--

Bath

1,320

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 23255 Redbud Rd, Oronogo, MO 64855 and is currently estimated at $237,662, approximately $180 per square foot. 23255 Redbud Rd is a home with nearby schools including Jasper County Elementary School and Jasper High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2026

Sold by

Mark Michael and Mark Pamella

Bought by

Cawyer Nathan and Cawyer Rayme

Current Estimated Value

Purchase Details

Closed on

Aug 13, 2010

Sold by

A & J Investments Of Joplin Llc

Bought by

Hashtroudi Alireza and Hashtroudi Judy I

Purchase Details

Closed on

Jun 9, 2004

Sold by

Hadley Gary Mitchell

Bought by

Cawyer Nathan and Cawyer Rayme

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,000

Interest Rate

6.02%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 19, 2004

Sold by

Hadley Ronald J and Hadley Traci Ann

Bought by

Doss David I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,000

Interest Rate

6.02%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cawyer Nathan | -- | None Listed On Document | |

| Hashtroudi Alireza | -- | Jct | |

| Cawyer Nathan | -- | -- | |

| Doss David I | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cawyer Nathan | $46,000 | |

| Previous Owner | Doss David I | $141,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $845 | $19,830 | $2,310 | $17,520 |

| 2024 | $845 | $17,730 | $2,310 | $15,420 |

| 2023 | $845 | $17,730 | $2,310 | $15,420 |

| 2022 | $857 | $18,060 | $2,310 | $15,750 |

| 2021 | $798 | $18,060 | $2,310 | $15,750 |

| 2020 | $771 | $16,760 | $2,310 | $14,450 |

| 2019 | $764 | $16,760 | $2,310 | $14,450 |

| 2018 | $728 | $15,940 | $0 | $0 |

| 2017 | $661 | $15,560 | $0 | $0 |

| 2016 | $110 | $2,590 | $0 | $0 |

| 2015 | $103 | $2,590 | $0 | $0 |

| 2014 | $103 | $2,550 | $0 | $0 |

Source: Public Records

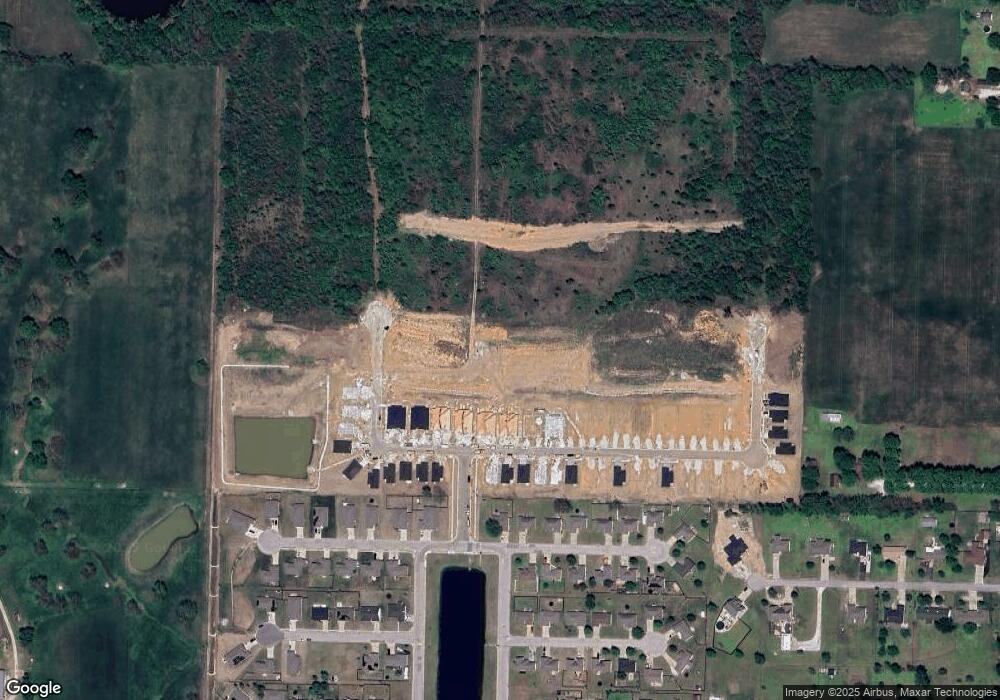

Map

Nearby Homes

- 209 Earl St

- 21810 Nimble Ln

- 209 N Earl St

- 1191 SW 80th Rd

- 26785 Neutral Ln

- 301 W High St

- 13106 County Lane 268

- 112 Orchard St

- 106 S Fox St

- 000 Cr 290

- 000 290 Cr

- 0000 Cr 170 and H Hwy

- 13786 County Road 270

- 10970 County Road 240

- 24811 Kafir Rd

- 12529 County Road 180 (120 Acres)

- 12529

- 1106 Pawpaw Place

- 1384 Missouri 126

- 9742 County Road 260

- 23545 Redbud Rd

- 22915 Redbud Rd

- 23697 Redbud Rd

- 23534 Sumac Rd

- 22547 Redbud Rd Unit 1

- 22547 Redbud Rd

- 22734 Sumac Rd

- 18029 State Highway 43

- 17985 State Highway 43

- 18426 State Highway 43

- 22465 Redbud Rd

- 18578 State Highway 43

- 18423 State Highway 43

- 18624 State Highway 43

- 17492 State Highway 43

- 19075 County Road 230

- 23745 Base Line Blvd

Your Personal Tour Guide

Ask me questions while you tour the home.