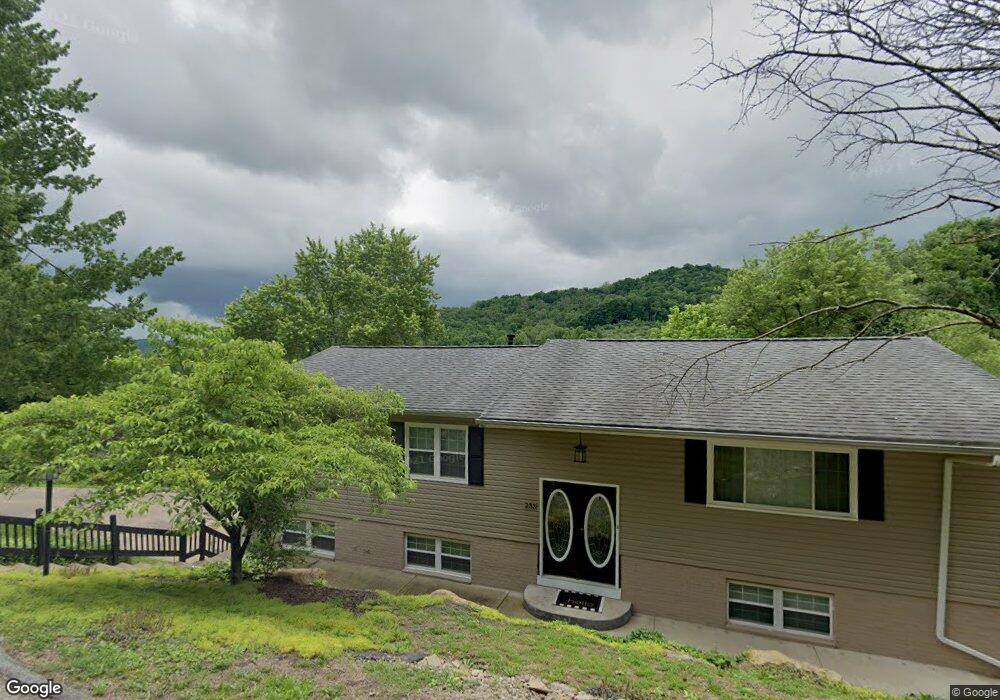

233 Paula Blvd Clarksburg, WV 26301

Estimated Value: $219,000 - $252,597

3

Beds

3

Baths

2,206

Sq Ft

$107/Sq Ft

Est. Value

About This Home

This home is located at 233 Paula Blvd, Clarksburg, WV 26301 and is currently estimated at $235,399, approximately $106 per square foot. 233 Paula Blvd is a home located in Harrison County with nearby schools including Mother Goose Land Kindergarten, St. Mary's Grade School, and Emmanuel Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 22, 2023

Sold by

Williams Scott

Bought by

Richards Darrell R and Richards Frances C

Current Estimated Value

Purchase Details

Closed on

Jun 11, 2019

Sold by

Wade Keith Lindsey L and Wade Keith Roger

Bought by

Williams Scott and Williams Rachel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

3.9%

Purchase Details

Closed on

Mar 8, 2019

Sold by

Lefevre Timothy A and Lefevre Amy L

Bought by

Wade Keith Lindsey L and Wade Keith Roger

Purchase Details

Closed on

Feb 3, 2016

Sold by

Harris Joshua A

Bought by

Lefevre Timothy A and Lefevre Amy L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Richards Darrell R | $1,000 | None Listed On Document | |

| Williams Scott | $185,000 | None Available | |

| Wade Keith Lindsey L | -- | None Available | |

| Lefevre Timothy A | $165,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Williams Scott | $186,144 | |

| Previous Owner | Williams Scott | $185,000 | |

| Previous Owner | Harris Joshua A | $137,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,580 | $97,200 | $14,400 | $82,800 |

| 2023 | $1,479 | $90,420 | $14,400 | $76,020 |

| 2022 | $1,413 | $90,960 | $14,400 | $76,560 |

| 2021 | $1,385 | $89,940 | $14,400 | $75,540 |

| 2020 | $1,376 | $90,060 | $14,400 | $75,660 |

| 2019 | $1,024 | $67,020 | $3,360 | $63,660 |

| 2018 | $1,022 | $67,080 | $3,360 | $63,720 |

| 2017 | $1,000 | $65,880 | $3,360 | $62,520 |

| 2016 | $987 | $65,640 | $3,360 | $62,280 |

| 2015 | $968 | $64,080 | $3,360 | $60,720 |

| 2014 | $967 | $64,080 | $3,360 | $60,720 |

Source: Public Records

Map

Nearby Homes

- 196 Buena Vista Ave

- 0 Buena Vista Ave

- 0 Worley Ave

- 512 Jessie St

- 95 Cimarron Rd

- 309 Hedge St

- 305 Saint Clair St

- 417 Spring Ave

- 144 Seneca Dr

- 136 Harrison St

- 0 E B Saunders Way

- 114 Lang Ave

- 179 Elliot St

- 134 Pennsylvania Ave

- 113 Buckhannon Ave

- 611 E Main St

- 615 E Main St

- 503 E Main St

- 243 1/2 S Maple Ave

- 227 Carr Ave

- 43 Charla Ln

- 303 Charla Ln

- 231 Paula Blvd

- 400 Woodside Cir

- 230 Paula Blvd

- 46 Charla Ln

- 228 Paula Blvd

- 401 Woodside Cir

- 229 Paula Blvd

- 406 Woodside Cir

- 227 Paula Blvd

- 238 Paula Blvd

- 226 Paula Blvd

- 305 Michael St

- 407 Woodside Cir

- 302 Michael St

- 600 Skyview Dr

- 600 Skyview Dr

- 600 Skyview Dr

- 225 Paula Blvd