2337 N Sycamore Ln Franktown, CO 80116

Estimated Value: $1,010,000 - $1,282,000

4

Beds

4

Baths

4,521

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 2337 N Sycamore Ln, Franktown, CO 80116 and is currently estimated at $1,136,520, approximately $251 per square foot. 2337 N Sycamore Ln is a home located in Douglas County with nearby schools including Franktown Elementary School, Sagewood Middle School, and Ponderosa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2013

Sold by

Carlson Brent T and Carlson Nancy

Bought by

Hawkins Lynn Alan and Hawkins Hope Renee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Outstanding Balance

$109,790

Interest Rate

4.46%

Mortgage Type

New Conventional

Estimated Equity

$1,026,730

Purchase Details

Closed on

Jul 10, 1996

Sold by

The Mildred F Stephenson Revocable Trust

Bought by

Carlson Brent T and Carlson Nancy

Purchase Details

Closed on

Oct 28, 1987

Sold by

Stephenson Mildred F Schopman

Bought by

Mildred F Stephenson Trust

Purchase Details

Closed on

Sep 28, 1967

Sold by

Soderberg Land Co

Bought by

Schopman Mildred F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hawkins Lynn Alan | $550,000 | Fidelity National Title Insu | |

| Carlson Brent T | $38,000 | -- | |

| Mildred F Stephenson Trust | -- | -- | |

| Schopman Mildred F | $1,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hawkins Lynn Alan | $417,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,542 | $67,980 | $18,820 | $49,160 |

| 2023 | $5,604 | $67,980 | $18,820 | $49,160 |

| 2022 | $4,040 | $48,250 | $9,750 | $38,500 |

| 2021 | $4,186 | $48,250 | $9,750 | $38,500 |

| 2020 | $3,546 | $41,820 | $9,220 | $32,600 |

| 2019 | $3,563 | $41,820 | $9,220 | $32,600 |

| 2018 | $3,309 | $38,160 | $6,370 | $31,790 |

| 2017 | $3,081 | $38,160 | $6,370 | $31,790 |

| 2016 | $3,114 | $37,810 | $6,290 | $31,520 |

| 2015 | $3,184 | $37,810 | $6,290 | $31,520 |

| 2014 | $3,020 | $33,510 | $4,860 | $28,650 |

Source: Public Records

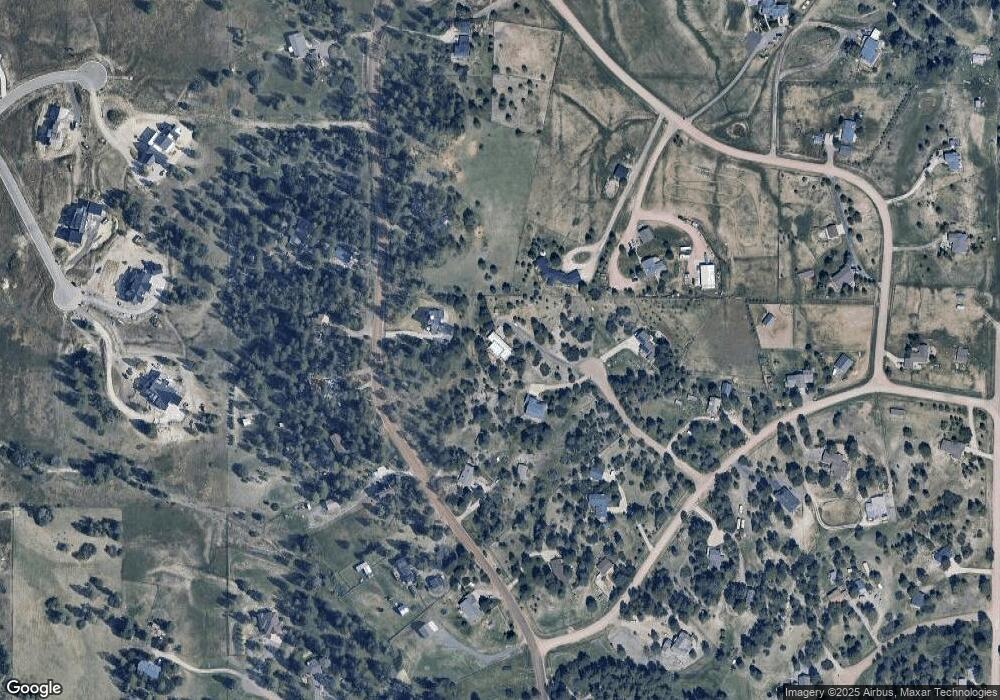

Map

Nearby Homes

- 11790 Huckleberry Dr

- 2395 Fox View Trail

- 78 Evening Hunt Rd

- 77 Evening Hunt Rd

- 76 Evening Hunt Rd

- 11491 Evening Hunt Rd

- 2442 Fox View Trail

- 75 Evening Hunt Rd

- 2568 Fox View Trail Unit 38

- 11168 Wild Chase Place

- 121 County Road 146

- 11115 Evening Hunt Rd

- 2622 Fox View Trail

- 2705 Fox View Trail

- 2741 Morning Run Ct

- 11840 Elkhorn Dr

- 2898 Flintwood Rd

- 372 Stagecoach Trail

- 0 Ponderosa Ln

- 2630 Frontier Ln

- 2338 Ponderosa Rd

- 2313 N Sycamore Ln

- 11784 Crabapple Dr

- 2256 Ponderosa Rd

- 2426 Ponderosa Rd

- 2332 N Sycamore Ln

- 11842 Crabapple Dr

- 2357 Ponderosa Rd

- 2265 Ponderosa Rd

- 2323 Ponderosa Rd

- 11805 Huckleberry Dr

- 2293 Ponderosa Rd

- 11849 Huckleberry Dr

- 2212 Ponderosa Rd

- 2417 Ponderosa Rd

- 2233 Ponderosa Rd

- 2195 Ponderosa Rd

- 11897 Huckleberry Dr

- 11816 Huckleberry Dr

- 2538 Ponderosa Rd