2343 Lexington Village Ln Unit 2 Colorado Springs, CO 80916

Gateway Park NeighborhoodEstimated Value: $214,000 - $250,000

2

Beds

2

Baths

1,036

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 2343 Lexington Village Ln Unit 2, Colorado Springs, CO 80916 and is currently estimated at $238,936, approximately $230 per square foot. 2343 Lexington Village Ln Unit 2 is a home located in El Paso County with nearby schools including Bricker Elementary School, Panorama Middle School, and Sierra High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2004

Sold by

Franko Sharon O and Franko Malinda

Bought by

Franko Lori Sue

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,000

Outstanding Balance

$31,613

Interest Rate

5.38%

Mortgage Type

Unknown

Estimated Equity

$207,323

Purchase Details

Closed on

Mar 15, 1996

Sold by

Mcgrath David P and Mcgrath Anita A

Bought by

Franko Sharon O and Franko Malinda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,750

Interest Rate

7.02%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 1, 1987

Bought by

Franko Lori Sue

Purchase Details

Closed on

Jun 1, 1984

Bought by

Franko Lori Sue

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Franko Lori Sue | $90,000 | Fahtco | |

| Franko Sharon O | -- | -- | |

| Franko Lori Sue | -- | -- | |

| Franko Lori Sue | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Franko Lori Sue | $68,000 | |

| Closed | Franko Sharon O | $69,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $804 | $19,520 | -- | -- |

| 2024 | $590 | $17,790 | $3,450 | $14,340 |

| 2023 | $590 | $17,790 | $3,450 | $14,340 |

| 2022 | $667 | $12,370 | $2,450 | $9,920 |

| 2021 | $712 | $12,720 | $2,520 | $10,200 |

| 2020 | $581 | $8,920 | $1,360 | $7,560 |

| 2019 | $564 | $8,920 | $1,360 | $7,560 |

| 2018 | $432 | $6,580 | $940 | $5,640 |

| 2017 | $330 | $6,580 | $940 | $5,640 |

| 2016 | $301 | $5,630 | $720 | $4,910 |

| 2015 | $300 | $5,630 | $720 | $4,910 |

| 2014 | $338 | $6,250 | $800 | $5,450 |

Source: Public Records

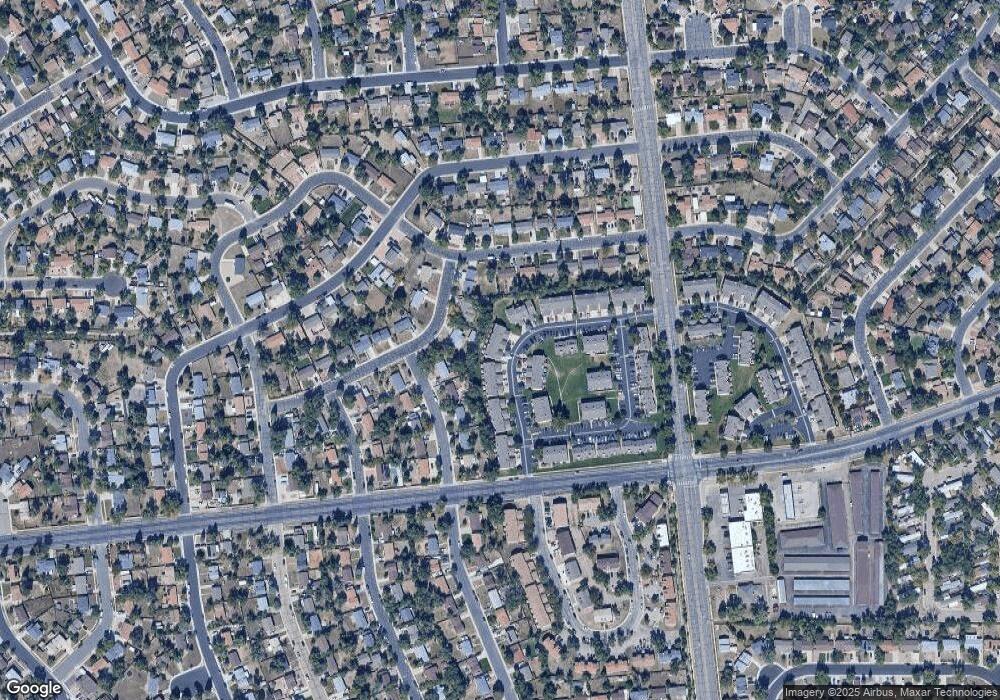

Map

Nearby Homes

- 4485 Carolyn Dr

- 2321 Lexington Village Ln

- 4505 Lamplighter Cir Unit 6

- 4509 Lamplighter Cir

- 4527 Lamplighter Cir Unit 3

- 4585 Gatewood Dr

- 2455 Lexington Village Ln Unit 3

- 2512 Barkman Dr

- 4731 Astrozon Blvd

- 2467 Lexington Village Ln Unit G3

- 2522 Astrozon Cir

- 2233 Farnsworth Dr

- 4530 London Ln

- 4150 Shining Way

- 4475 London Ln

- 4243 Gatewood Dr

- 4130 Shining Way

- 4255 Morley Dr

- 2418 Payne Cir W

- 2335 Cather Cir

- 2347 Lexington Village Ln Unit 4

- 2341 Lexington Village Ln Unit 1

- 2345 Lexington Village Ln Unit 3

- 2339 Lexington Village Ln

- 2337 Lexington Village Ln Unit 5

- 2349 Lexington Village Ln Unit 5

- 2335 Lexington Village Ln Unit 4

- 2351 Lexington Village Ln

- 2333 Lexington Village Ln Unit 3

- 2333 Lexington Village Ln

- 2331 Lexington Village Ln Unit 2

- 2329 Lexington Village Ln Unit 1

- 2355 Lexington Village Ln Unit 2

- 2353 Lexington Village Ln

- 2340 Lexington Village Ln Unit 1

- 2338 Lexington Village Ln Unit 2

- 2336 Lexington Village Ln Unit 3

- 2334 Lexington Village Ln

- 2357 Lexington Village Ln Unit 3

- 2327 Lexington Village Ln