2346 Roundhouse Rd Unit N1 Sparks, NV 89431

Downtown Sparks NeighborhoodEstimated Value: $241,000 - $268,000

2

Beds

2

Baths

1,092

Sq Ft

$233/Sq Ft

Est. Value

About This Home

This home is located at 2346 Roundhouse Rd Unit N1, Sparks, NV 89431 and is currently estimated at $254,928, approximately $233 per square foot. 2346 Roundhouse Rd Unit N1 is a home located in Washoe County with nearby schools including Kate M Smith Elementary School, Sparks Middle School, and Sparks High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 14, 2025

Sold by

Halen Kenneth L

Bought by

Kenneth L Halen Trust and Halen

Current Estimated Value

Purchase Details

Closed on

Dec 13, 2004

Sold by

Marble Noell

Bought by

Halen Kenneth L and Halen Diane R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,115

Interest Rate

5.64%

Mortgage Type

VA

Purchase Details

Closed on

Feb 14, 1997

Sold by

Marble Noell and Marble Patricia

Bought by

Marble Noell and Marble Patricia

Purchase Details

Closed on

Sep 19, 1994

Sold by

Holt Max A and Holt Delia

Bought by

Marble Noell and Marble Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$39,750

Interest Rate

6.62%

Purchase Details

Closed on

May 2, 1994

Sold by

Holt Max Allen and Holt Delia G

Bought by

Holt Max A and Holt Delia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kenneth L Halen Trust | -- | None Listed On Document | |

| Halen Kenneth L | $155,000 | Western Title Incorporated | |

| Marble Noell | -- | -- | |

| Marble Noell | $53,000 | First Centennial Title Co | |

| Holt Max A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Halen Kenneth L | $160,115 | |

| Previous Owner | Marble Noell | $39,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $567 | $40,485 | $21,455 | $19,030 |

| 2024 | $567 | $41,560 | $21,455 | $20,105 |

| 2023 | $551 | $35,636 | $17,535 | $18,101 |

| 2022 | $536 | $28,917 | $13,160 | $15,757 |

| 2021 | $519 | $26,844 | $10,850 | $15,994 |

| 2020 | $500 | $27,262 | $10,850 | $16,412 |

| 2019 | $490 | $26,755 | $10,430 | $16,325 |

| 2018 | $472 | $21,198 | $6,055 | $15,143 |

| 2017 | $462 | $21,425 | $5,950 | $15,475 |

| 2016 | $451 | $20,611 | $4,445 | $16,166 |

| 2015 | $449 | $19,981 | $3,885 | $16,096 |

| 2014 | $437 | $13,816 | $3,080 | $10,736 |

| 2013 | -- | $11,474 | $1,960 | $9,514 |

Source: Public Records

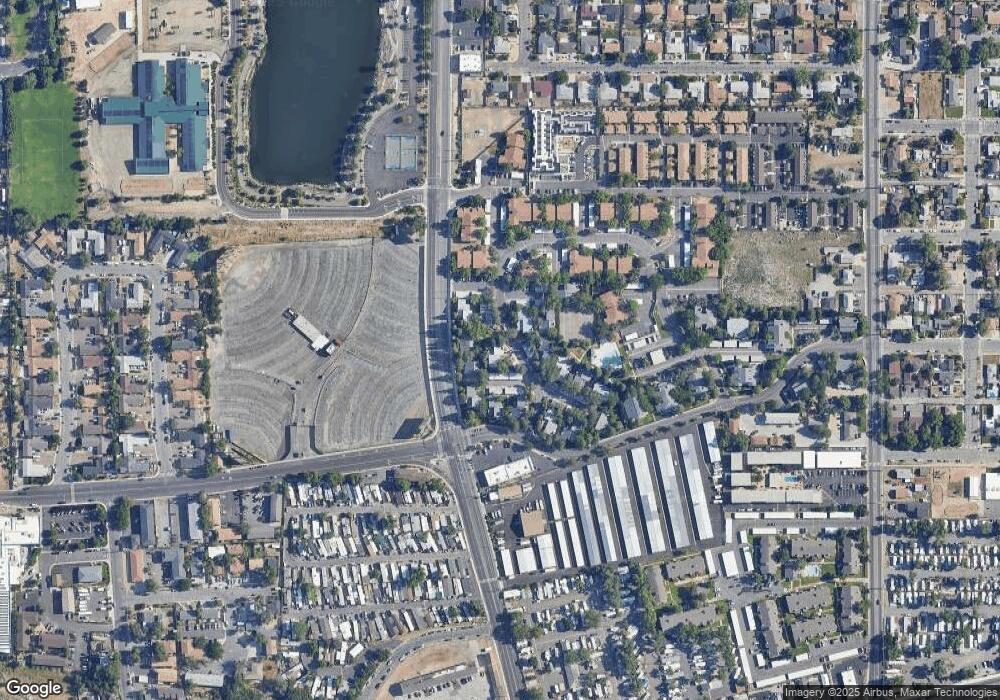

Map

Nearby Homes

- 2342 Roundhouse Rd Unit M1

- 2344 Roundhouse Rd

- 2340 Roundhouse Rd Unit A

- 2360 Roundhouse Rd

- 2356 Roundhouse Rd

- 2334 Roundhouse Rd

- 2338 Roundhouse Rd

- 2354 Roundhouse Rd

- 2350 Roundhouse Rd

- 2348 Roundhouse Rd

- 2352 Roundhouse Rd

- 2358 Roundhouse Rd

- 2362 Roundhouse Rd Unit P2

- 2333 Roundhouse Rd Unit D

- 2345 Roundhouse Rd Unit N1

- 2337 Roundhouse Rd Unit E

- 2343 Roundhouse Rd

- 2339 Roundhouse Rd

- 2332 Roundhouse Rd Unit A

- 2330 Roundhouse Rd