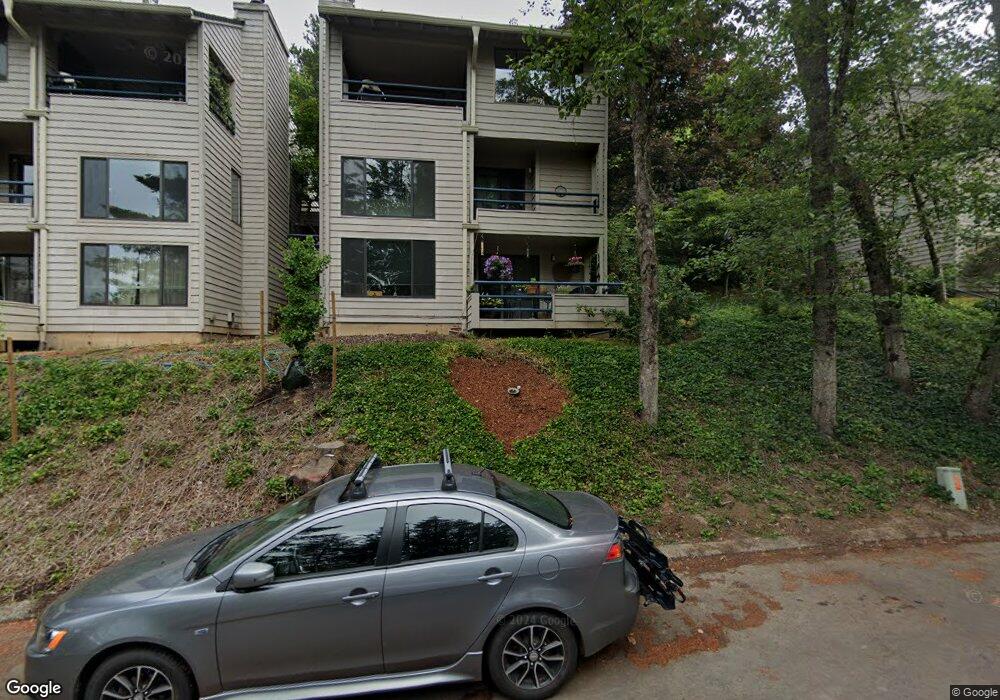

235 Cervantes Unit 18 Lake Oswego, OR 97035

Mountain Park NeighborhoodEstimated Value: $295,139 - $384,000

2

Beds

2

Baths

1,100

Sq Ft

$307/Sq Ft

Est. Value

About This Home

This home is located at 235 Cervantes Unit 18, Lake Oswego, OR 97035 and is currently estimated at $337,535, approximately $306 per square foot. 235 Cervantes Unit 18 is a home located in Multnomah County with nearby schools including Markham Elementary School, Jackson Middle School, and Ida B. Wells-Barnett High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 5, 2016

Sold by

Fremaux Sylvain and Timmons Kathryn Jill

Bought by

Gilliland Family Revocable Trust and Nordland Brady

Current Estimated Value

Purchase Details

Closed on

Dec 11, 2014

Sold by

Timmons Kathryn J and Fremaux Sylvain

Bought by

Fremaux Sylvain and Fremaux Sylvain

Purchase Details

Closed on

May 28, 2013

Sold by

Knobel Philip W and Knobel Jane K

Bought by

Timmons Kathryn Jill and Fremaux Sylvain

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,000

Interest Rate

3.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 8, 2008

Sold by

Knobel Philip and Knobel Jane

Bought by

Knobel Philip W and Knobel Jane K

Purchase Details

Closed on

Sep 26, 2006

Sold by

Lefebvre Brenda Michelle and Lefebvre Michael P

Bought by

Knobel Philip and Knobel Jane

Purchase Details

Closed on

Mar 10, 2003

Sold by

Fenton Jennifer J

Bought by

Lefebvre Michael P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,800

Interest Rate

5.83%

Purchase Details

Closed on

May 22, 2001

Sold by

Locke Donna L

Bought by

Fenton Jennifer J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,850

Interest Rate

7.06%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gilliland Family Revocable Trust | $289,000 | Lawyers Title | |

| Fremaux Sylvain | -- | -- | |

| Timmons Kathryn Jill | $125,000 | Fidelity Natl Title Co Of Or | |

| Knobel Philip W | -- | None Available | |

| Knobel Philip | $182,000 | Ticor Title Insurance Compan | |

| Lefebvre Michael P | $141,000 | Fidelity Natl Title Co Of Or | |

| Fenton Jennifer J | $138,000 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Timmons Kathryn Jill | $55,000 | |

| Previous Owner | Lefebvre Michael P | $112,800 | |

| Previous Owner | Fenton Jennifer J | $133,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,372 | $198,570 | -- | $198,570 |

| 2024 | $4,297 | $192,790 | -- | $192,790 |

| 2023 | $4,198 | $187,180 | $0 | $187,180 |

| 2022 | $4,048 | $181,730 | $0 | $0 |

| 2021 | $3,728 | $176,440 | $0 | $0 |

| 2020 | $3,506 | $171,310 | $0 | $0 |

| 2019 | $3,634 | $166,330 | $0 | $0 |

| 2018 | $3,548 | $161,490 | $0 | $0 |

| 2017 | $3,266 | $156,790 | $0 | $0 |

| 2016 | $2,809 | $152,230 | $0 | $0 |

| 2015 | $2,581 | $147,800 | $0 | $0 |

| 2014 | $2,607 | $143,500 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 225 Cervantes Unit 13

- 218 Cervantes Unit B

- 14 Juarez St

- 304 Cervantes

- 18 Nansen Summit

- 54 Cervantes Cir Unit 8F

- 2 Nansen Summit

- 38 Morningview Cir

- 20 Summit Ridge Ct

- 12 Hidalgo St

- 94 Garibaldi St

- 12 Morningview Ln

- 71 Hidalgo St

- 13070 Princeton Ct

- 168 Oswego Summit Unit 168

- 4407 SW Stephenson St

- 159 Oswego Summit Unit 159

- 4910 SW Vesta St

- 4724 SW Vacuna St

- 4963 Suntree Ln

- 233 Cervantes Unit 17

- 239 Cervantes Unit 20

- 237 Cervantes Unit 19

- 231 Cervantes Unit 16

- 229 Cervantes

- 227 Cervantes

- 241 Cervantes Unit 241

- 228-230 Cervantes

- 228 Cervantes Unit 230

- 224 Cervantes Unit 226

- 223 Cervantes Unit 12

- 221 Cervantes Unit 11

- 232 Cervantes Unit 238

- 247 Cervantes Unit 247

- 247 Cervantes Cr

- 245 Cervantes Unit 245

- 216 Cervantes Unit A

- 220 Cervantes Unit C

- 222 Cervantes Unit D

- 219 Cervantes