235 River Landing Dr Unit 2 Roswell, GA 30075

Estimated Value: $671,000 - $745,640

4

Beds

5

Baths

2,762

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 235 River Landing Dr Unit 2, Roswell, GA 30075 and is currently estimated at $709,160, approximately $256 per square foot. 235 River Landing Dr Unit 2 is a home located in Fulton County with nearby schools including Jackson Elementary School, Holcomb Bridge Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 24, 2017

Sold by

Richters Gregory S

Bought by

Agramonte Kent Joseph and Agramonte Natasha Marie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$331,500

Outstanding Balance

$275,050

Interest Rate

4.19%

Mortgage Type

New Conventional

Estimated Equity

$434,110

Purchase Details

Closed on

Oct 27, 1994

Sold by

Astren Teri A

Bought by

Richters Gregory S Joan E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,000

Interest Rate

6.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Agramonte Kent Joseph | $390,000 | -- | |

| Richters Gregory S Joan E | $216,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Agramonte Kent Joseph | $331,500 | |

| Previous Owner | Richters Gregory S Joan E | $162,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $656 | $194,000 | $101,400 | $92,600 |

| 2023 | $5,629 | $199,440 | $86,600 | $112,840 |

| 2022 | $2,505 | $136,040 | $32,240 | $103,800 |

| 2021 | $2,988 | $138,520 | $43,960 | $94,560 |

| 2020 | $3,035 | $141,880 | $38,720 | $103,160 |

| 2019 | $506 | $124,680 | $41,560 | $83,120 |

| 2018 | $2,841 | $121,760 | $40,600 | $81,160 |

| 2017 | $2,478 | $96,880 | $24,600 | $72,280 |

| 2016 | $2,520 | $98,360 | $24,600 | $73,760 |

| 2015 | $3,067 | $98,360 | $24,600 | $73,760 |

| 2014 | $2,287 | $87,360 | $21,840 | $65,520 |

Source: Public Records

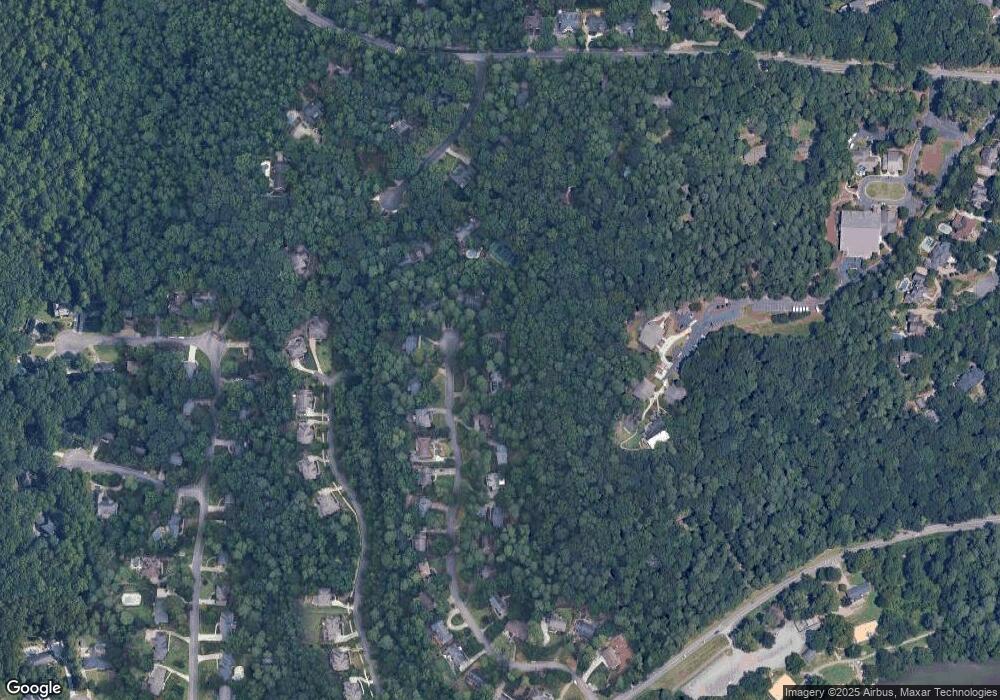

Map

Nearby Homes

- 1010 Taimen Dr

- 670 Riverside Rd

- 2104 Queen Anne Ct

- 1010 Wedgewood Way

- 303 Brandywine Cir Unit 303

- 306 Brandywine Cir

- 502 Brandywine Cir

- 9925 La View Cir

- 55 Serendipity Way

- 102 River Run Dr

- 300 Cedar Knoll Ct

- 2020 Rivermont Way

- 3600 Cedar Knoll Dr

- 206 River Run Dr

- 704 River Run Dr Unit 704

- 1063 Merrivale Chase Ln

- 120 Emerson Ct

- 375 Winding River Dr

- 2046 Heathermere Way

- 650 Corbin Lake Ct

- 225 River Landing Dr

- 245 River Landing Dr

- 215 River Landing Dr Unit 1

- 250 River Landing Dr Unit 2

- 230 River Landing Dr

- 205 River Landing Dr

- 220 River Landing Dr Unit 1

- 635 Grimes Bridge Landing

- 210 River Landing Dr

- 195 River Landing Dr Unit 1

- 645 Grimes Bridge Landing

- 200 River Landing Dr

- 750 Grimes Bridge Rd

- 185 River Landing Dr

- N River Landing Dr

- 190 River Landing Dr

- 625 Grimes Bridge Landing

- 1020 Taimen Dr

- 175 River Landing Dr Unit 25

- 175 River Landing Dr