23519 Lori Way Unit 1 San Antonio, TX 78258

Estimated Value: $730,000 - $841,000

4

Beds

3

Baths

3,791

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 23519 Lori Way Unit 1, San Antonio, TX 78258 and is currently estimated at $776,113, approximately $204 per square foot. 23519 Lori Way Unit 1 is a home located in Bexar County with nearby schools including Hardy Oak Elementary School, José M Lopez Middle School, and Reagan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2003

Sold by

Bank One Na

Bought by

Ramirez Ramiro and Ramirez Raquel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,000

Outstanding Balance

$108,176

Interest Rate

5.86%

Estimated Equity

$681,501

Purchase Details

Closed on

Jul 2, 2002

Sold by

Garcia Mark J and Garcia Jennifer L

Bought by

Chase Manhattan Mtg Corp

Purchase Details

Closed on

Mar 25, 1998

Sold by

Scott Felder Ltd Partnership

Bought by

Garcia Mark J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$261,600

Interest Rate

7.04%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramirez Ramiro | -- | -- | |

| Chase Manhattan Mtg Corp | $276,461 | -- | |

| Garcia Mark J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ramirez Ramiro | $252,000 | |

| Previous Owner | Garcia Mark J | $261,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,422 | $714,800 | $193,970 | $520,830 |

| 2024 | $10,422 | $714,800 | $193,970 | $520,830 |

| 2023 | $10,422 | $670,730 | $193,970 | $476,760 |

| 2022 | $15,099 | $611,885 | $147,110 | $516,550 |

| 2021 | $14,211 | $556,259 | $134,040 | $432,050 |

| 2020 | $13,114 | $505,690 | $74,920 | $430,770 |

| 2019 | $13,372 | $502,070 | $74,920 | $427,150 |

| 2018 | $12,974 | $485,920 | $74,920 | $411,000 |

| 2017 | $12,376 | $459,270 | $74,920 | $384,350 |

| 2016 | $11,335 | $420,640 | $74,920 | $345,720 |

| 2015 | $10,769 | $421,510 | $74,920 | $346,590 |

| 2014 | $10,769 | $397,560 | $0 | $0 |

Source: Public Records

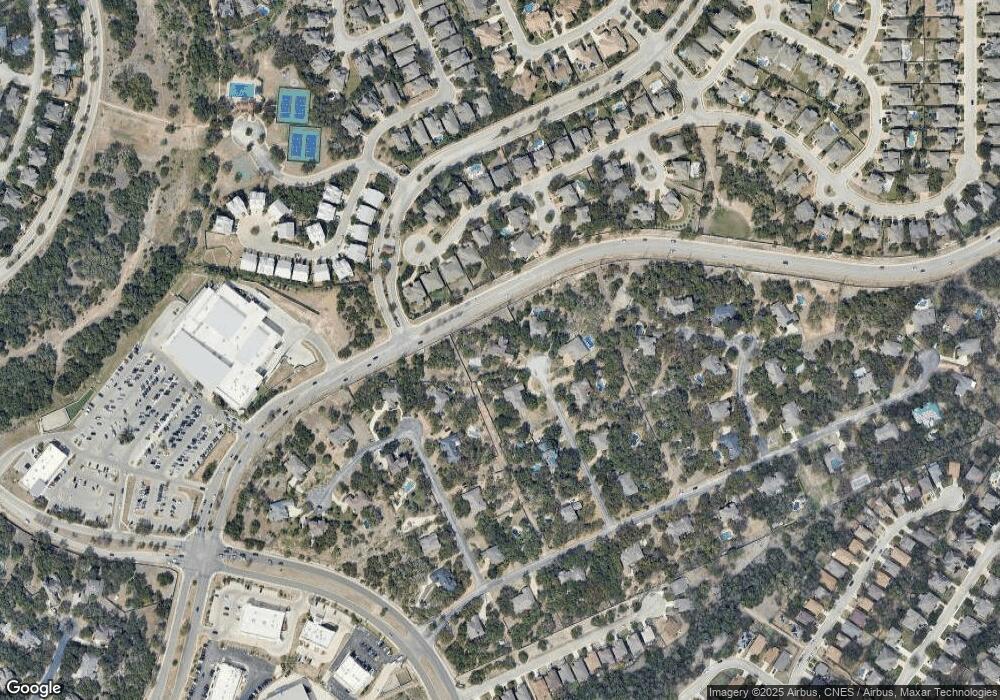

Map

Nearby Homes

- 23943 Stately Oaks

- 23802 Stately Oaks

- 24114 Stately Oaks

- 302 Tranquil Oak

- 165 Red Hawk Ridge

- 322 Tranquil Oak

- 403 Rio Springs

- 418 Texas Point

- 24139 Vecchio

- 24031 Canyon Row

- 210 Sable Falls

- 419 Salado Mist

- 611 Oxalis

- 430 Chimney Tops

- 24131 Canyon Row

- 438 Chimney Tops

- 23539 Enchanted Fall

- 614 Walder Trail

- 23003 Tornillo Dr

- 24002 Viento Oaks

- 23520 Lori Way

- 23513 Lori Way

- 23516 Majestic View

- 110 Evans Oak Ln

- 23516 Lori Way

- 114 Evans Oak Ln

- 102 Evans Oak Ln

- 106 Evans Oak Ln

- 118 Evans Oak Ln

- 23512 Majestic View

- 23903 Poppy Cir

- 23512 Lori Way

- 23520 Majestic View

- 23509 Lori Way

- 115 Evans Oak Ln

- 23907 Poppy Cir

- 23519 Flowing Mist

- 23508 Majestic View

- 23519 Majestic View

- 123 Evans Oak Ln