Estimated Value: $333,000 - $356,000

3

Beds

2

Baths

1,504

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 2360 Daniel St, Niles, MI 49120 and is currently estimated at $344,748, approximately $229 per square foot. 2360 Daniel St is a home located in Berrien County with nearby schools including Ottawa Elementary School, Moccasin Elementary School, and Buchanan Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2024

Sold by

Foust Aaron Edward

Bought by

Foust Aaron Edward and Foust Cloey Ann

Current Estimated Value

Purchase Details

Closed on

Jul 12, 2024

Sold by

Foust Tasha Nicole

Bought by

Foust Aaron Edward

Purchase Details

Closed on

Jun 24, 2022

Sold by

Roberts Brian L and Roberts Brenda R

Bought by

Foust Aaron Edward and Foust Tasha Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

5.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 22, 1998

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Foust Aaron Edward | -- | None Listed On Document | |

| Foust Aaron Edward | -- | None Listed On Document | |

| Foust Aaron Edward | -- | None Listed On Document | |

| Foust Aaron Edward | $305,000 | Mollison Law Offices Pc | |

| -- | $22,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Foust Aaron Edward | $210,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,643 | $141,600 | $0 | $0 |

| 2024 | $1,453 | $134,900 | $0 | $0 |

| 2023 | $1,391 | $129,200 | $0 | $0 |

| 2022 | $906 | $115,100 | $0 | $0 |

| 2021 | $2,178 | $111,900 | $10,300 | $101,600 |

| 2020 | $2,149 | $103,500 | $0 | $0 |

| 2019 | $2,110 | $91,100 | $10,300 | $80,800 |

| 2018 | $2,058 | $91,100 | $0 | $0 |

| 2017 | $2,041 | $84,400 | $0 | $0 |

| 2016 | $2,029 | $84,400 | $0 | $0 |

| 2015 | $2,026 | $78,800 | $0 | $0 |

| 2014 | $790 | $73,300 | $0 | $0 |

Source: Public Records

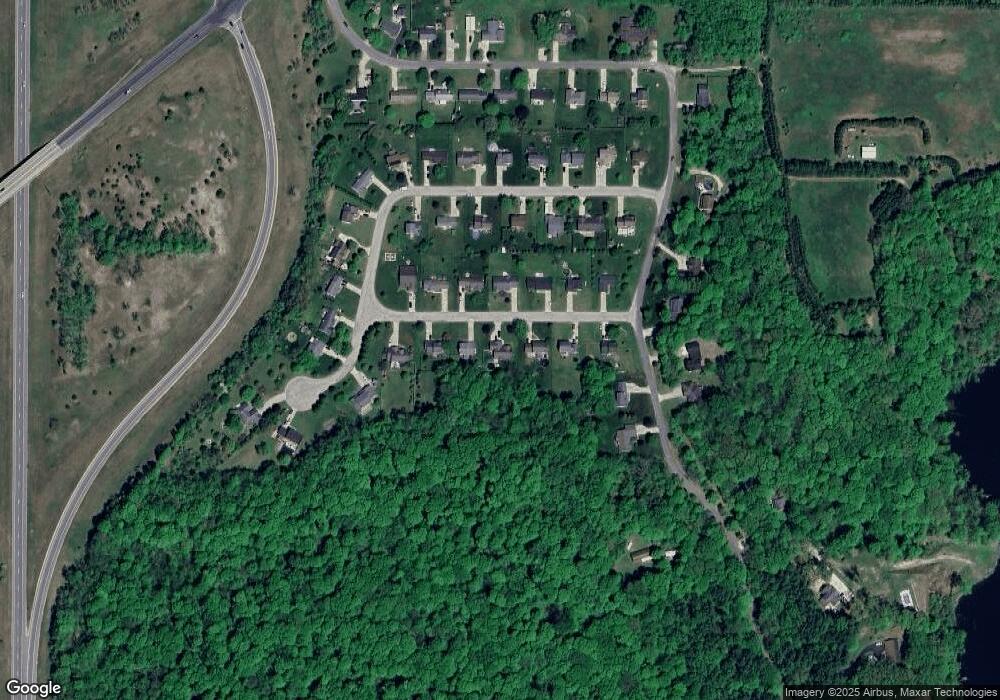

Map

Nearby Homes

- 1919 Jay St

- 2434 Jeffery Ln

- 1209 Morris Dr

- 1836 Platt St

- 1705 N Philip Rd

- 1551 Walling Ln

- 0 Rd

- 824 N Philip Rd

- 1491 Valley View Dr

- 2103 Niles Buchanan Rd

- 0 Drew Dr Unit Lot 31

- 0 Drew Dr Unit Lot 29

- 0 Drew Dr Unit Lot 22

- 103 Lexington Pointe Dr

- 134 Turfway Park

- 218 Arlington Ln

- V/L Mead Rd

- 219 Arlington Ln

- 43 Longmeadow Ln

- 15902 Meadowview Dr

Your Personal Tour Guide

Ask me questions while you tour the home.