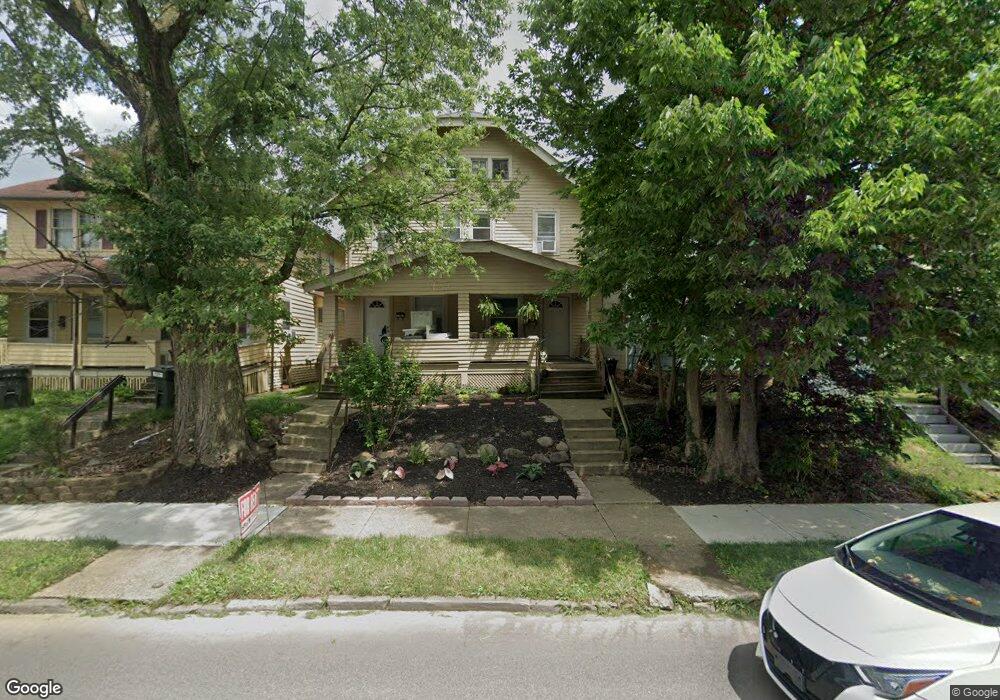

2360 N 4th St Unit 362 Columbus, OH 43202

Old North Columbus NeighborhoodEstimated Value: $401,000 - $461,000

6

Beds

2

Baths

2,916

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 2360 N 4th St Unit 362, Columbus, OH 43202 and is currently estimated at $429,717, approximately $147 per square foot. 2360 N 4th St Unit 362 is a home located in Franklin County with nearby schools including Hubbard Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 2, 2009

Sold by

Us Bank National Association

Bought by

Rsbb Management Llc

Current Estimated Value

Purchase Details

Closed on

Mar 9, 2005

Sold by

Resatka Doris J

Bought by

Resatka Doris J

Purchase Details

Closed on

Feb 7, 2005

Sold by

Resatka Doris J

Bought by

Resatka Doris J

Purchase Details

Closed on

Jun 1, 2004

Sold by

Resatka Richard R

Bought by

Resatka Doris J and Doris J Resatka 2002 Living Trust

Purchase Details

Closed on

Jun 19, 2000

Sold by

Resatka Richard R

Bought by

Resatka Richard R and Richard R Resatka Trust

Purchase Details

Closed on

Feb 12, 1999

Sold by

Hildreth Lewis E and Hildreth Joy L

Bought by

Resatka Richard R

Purchase Details

Closed on

Aug 9, 1983

Bought by

Hildreth Lewis E and Hildreth Joy L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rsbb Management Llc | $38,300 | None Available | |

| Resatka Doris J | -- | Title First | |

| Resatka Doris J | -- | Title First | |

| Resatka Doris J | $445,000 | Title First | |

| Resatka Richard R | -- | -- | |

| Resatka Richard R | $81,000 | Connor Title Co | |

| Hildreth Lewis E | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,750 | $147,280 | $34,020 | $113,260 |

| 2023 | $6,665 | $147,280 | $34,020 | $113,260 |

| 2022 | $5,232 | $98,460 | $20,370 | $78,090 |

| 2021 | $5,242 | $98,460 | $20,370 | $78,090 |

| 2020 | $5,250 | $98,460 | $20,370 | $78,090 |

| 2019 | $4,897 | $78,750 | $16,310 | $62,440 |

| 2018 | $4,059 | $78,750 | $16,310 | $62,440 |

| 2017 | $4,896 | $78,750 | $16,310 | $62,440 |

| 2016 | $3,548 | $52,220 | $6,300 | $45,920 |

| 2015 | $3,230 | $52,220 | $6,300 | $45,920 |

| 2014 | $3,238 | $52,220 | $6,300 | $45,920 |

| 2013 | $1,453 | $47,495 | $5,740 | $41,755 |

Source: Public Records

Map

Nearby Homes

- 2397 Glenmawr Ave Unit 399

- 2433 N 4th St Unit 435

- 2295 N 4th St

- 525-527 E Tompkins St

- 2395 Summit St Unit 397

- 2350 Indiana Ave

- 2230 N 4th St

- 328 Wyandotte Ave Unit 326

- 497 E Oakland Ave

- 381 E Oakland Ave

- 2526 Glenmawr Ave

- 2521 Glenmawr Ave

- 368 Alden Ave Unit 368

- 360-364 E Tompkins St

- 363 E Hudson St Unit 365

- 2251 Indiana Ave

- 377 Alden Ave

- 2241 Indiana Ave

- 241 E Blake Ave

- 2124 N 4th St

- 2362 N 4th St

- 2354 N 4th St

- 2364-2366 N 4th St Unit 66

- 2364-2366 N 4th St

- 2364 N 4th St Unit 366

- 481 Chilcote Ave

- 2350 N 4th St

- 485 Chilcote Ave

- 2346 N 4th St

- 15691 N 4th St

- 2378 N 4th St

- 476 Chicote Ave

- 476-486 Chilcote Ave

- 495 Chilcote Ave

- 2342 N 4th St

- 499 Chilcote Ave

- 2380 N 4th St

- 2363 N 4th St Unit 365

- 2359 N 4th St

- 2334 N 4th St