Estimated Value: $453,000 - $487,000

2

Beds

3

Baths

2,133

Sq Ft

$220/Sq Ft

Est. Value

About This Home

This home is located at 238 Fox Run, Exton, PA 19341 and is currently estimated at $469,192, approximately $219 per square foot. 238 Fox Run is a home located in Chester County with nearby schools including Mary C Howse Elementary School, E.N. Peirce Middle School, and Henderson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 15, 2023

Sold by

Nyland Brad P

Bought by

Nyland Dorothy J

Current Estimated Value

Purchase Details

Closed on

Jan 24, 2003

Sold by

Arnette Susan L

Bought by

Nyland Brad P and Hankinson Dorothy J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,000

Interest Rate

5.95%

Purchase Details

Closed on

Sep 6, 1994

Sold by

Bodo Louis and Bodo Gizella

Bought by

Arnette Susan L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,650

Interest Rate

5.75%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nyland Dorothy J | $11,275 | None Listed On Document | |

| Nyland Brad P | $230,000 | -- | |

| Arnette Susan L | $152,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Nyland Brad P | $184,000 | |

| Previous Owner | Arnette Susan L | $114,650 | |

| Closed | Nyland Brad P | $34,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,974 | $137,090 | $23,440 | $113,650 |

| 2024 | $3,974 | $137,090 | $23,440 | $113,650 |

| 2023 | $3,798 | $137,090 | $23,440 | $113,650 |

| 2022 | $3,746 | $137,090 | $23,440 | $113,650 |

| 2021 | $3,691 | $137,090 | $23,440 | $113,650 |

| 2020 | $3,667 | $137,090 | $23,440 | $113,650 |

| 2019 | $3,614 | $137,090 | $23,440 | $113,650 |

| 2018 | $3,533 | $137,090 | $23,440 | $113,650 |

| 2017 | $3,453 | $137,090 | $23,440 | $113,650 |

| 2016 | $2,921 | $137,090 | $23,440 | $113,650 |

| 2015 | $2,921 | $137,090 | $23,440 | $113,650 |

| 2014 | $2,921 | $137,090 | $23,440 | $113,650 |

Source: Public Records

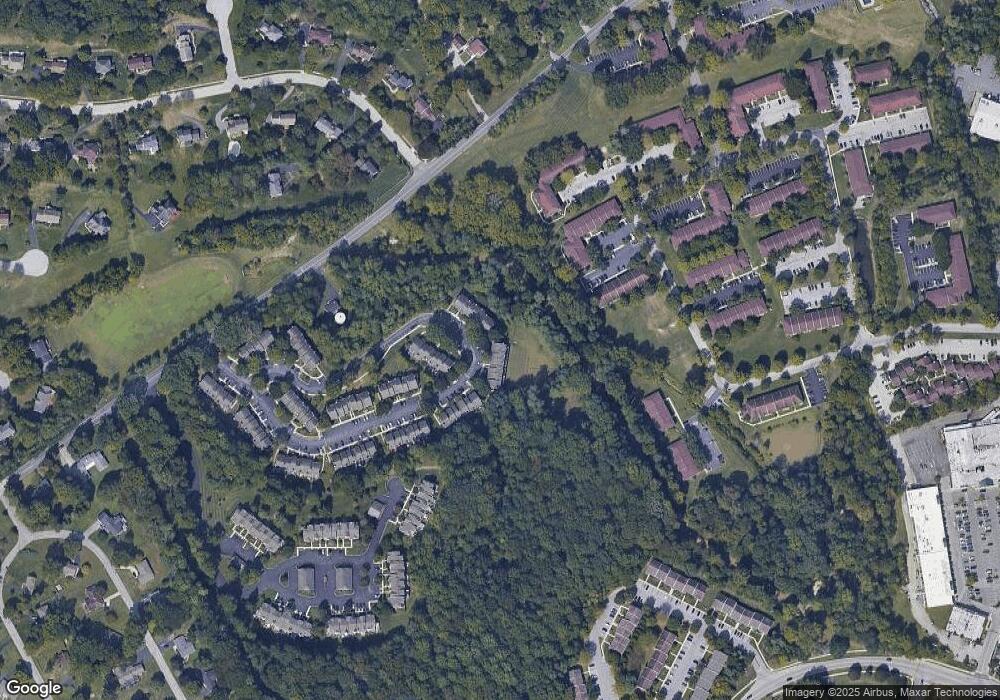

Map

Nearby Homes

- 261 Watch Hill Rd

- 315 Oak Ln W

- 447 Lee Place

- 208 Morris Rd

- 218 Hendricks Ave

- 510 Woodview Dr

- 524 E Saxony Dr Unit 524

- 167 Brazier Ln

- 432 Carmarthen Ct

- 577 Pewter Dr

- 420 Oakland Dr

- 208 Lucy Cir

- 108 Mountain View Dr

- 913 Grandview Dr

- 207 Lucy Cir

- Santorini Plan at Worthington Farm - Luxury Single-Family Homes

- Monaco Plan at Worthington Farm - Luxury Single-Family Homes

- Lisbon Plan at Worthington Farm - Luxury Single-Family Homes

- 316 Longs Peak Way

- 603 Coach Hill Ct Unit B