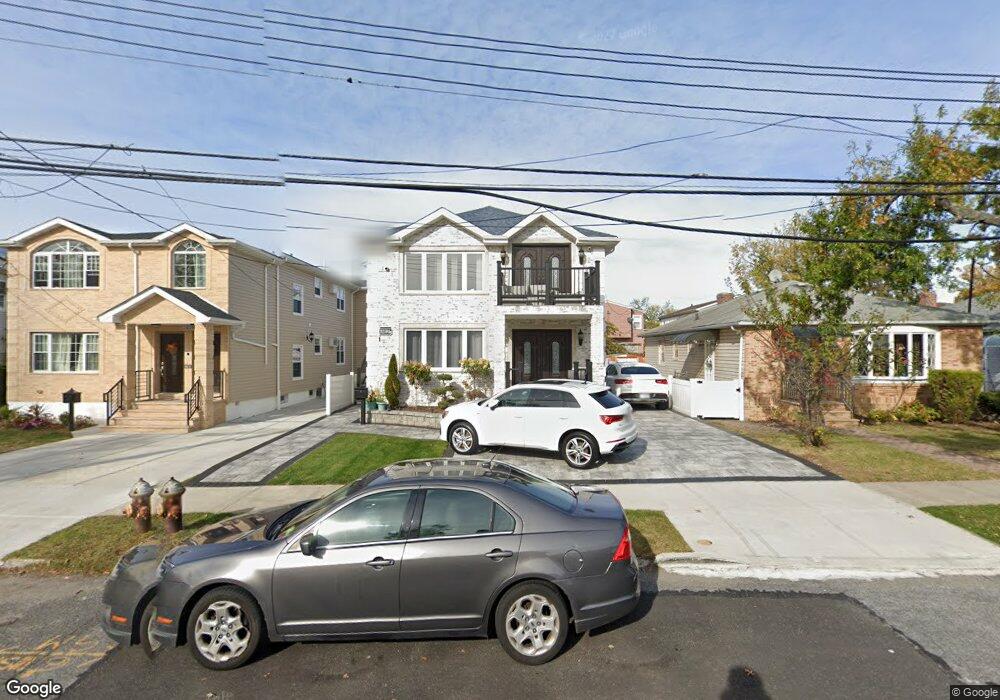

23823 149th Ave Rosedale, NY 11422

Rosedale NeighborhoodEstimated Value: $810,000 - $1,421,579

--

Bed

--

Bath

2,394

Sq Ft

$498/Sq Ft

Est. Value

About This Home

This home is located at 23823 149th Ave, Rosedale, NY 11422 and is currently estimated at $1,192,145, approximately $497 per square foot. 23823 149th Ave is a home located in Queens County with nearby schools including P.S. 181 Brookfield, Collaborative Arts Middle School, and Success Academy Charter School - Rosedale.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 14, 2024

Sold by

Moran Madeena and Persaud Rajkumar

Bought by

Sanchez Acosta Jose E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$687,500

Outstanding Balance

$680,395

Interest Rate

6.44%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$511,750

Purchase Details

Closed on

Apr 14, 2021

Sold by

Persaud Pauline and Persaud Rajkumar

Bought by

Moran Madeena and Persaud Rajkumar

Purchase Details

Closed on

Mar 28, 2018

Sold by

April Kinloch As Trustee and Arpil Womack As Trustee

Bought by

Persaud Pauline and Persaud Rajkumar

Purchase Details

Closed on

Aug 19, 2014

Sold by

Womack Ronald

Bought by

Ronald Womack Irrevocable Trust and Womack

Purchase Details

Closed on

Aug 14, 2013

Sold by

Womack Ronald and Womack Sondra

Bought by

Womack Ronald

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sanchez Acosta Jose E | $1,375,000 | -- | |

| Moran Madeena | -- | -- | |

| Moran Madeena | -- | -- | |

| Persaud Pauline | $425,000 | -- | |

| Persaud Pauline | $425,000 | -- | |

| Ronald Womack Irrevocable Trust | -- | -- | |

| Ronald Womack Irrevocable Trust | -- | -- | |

| Womack Ronald | -- | -- | |

| Womack Ronald | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sanchez Acosta Jose E | $687,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,738 | $53,462 | $7,442 | $46,020 |

| 2024 | $10,738 | $53,462 | $8,919 | $44,543 |

| 2023 | $10,700 | $53,273 | $8,390 | $44,883 |

| 2022 | $10,325 | $51,720 | $9,780 | $41,940 |

| 2021 | $9,995 | $48,900 | $9,780 | $39,120 |

| 2020 | $4,139 | $29,820 | $9,780 | $20,040 |

| 2019 | $4,090 | $25,560 | $9,780 | $15,780 |

| 2018 | $3,941 | $20,794 | $6,806 | $13,988 |

| 2017 | $3,699 | $19,617 | $8,241 | $11,376 |

| 2016 | $3,390 | $19,617 | $8,241 | $11,376 |

| 2015 | $2,517 | $17,460 | $8,160 | $9,300 |

| 2014 | $2,517 | $17,460 | $8,160 | $9,300 |

Source: Public Records

Map

Nearby Homes

- 238-47 148th Dr

- 238-11 148th Dr

- 240-24 149th Ave

- 24112 148th Ave

- 241-12 148th Ave

- 241-23 148th Ave

- 241-49 148th Dr

- 23514 147th Dr

- 23915 147th Rd

- 26 240th St

- 147-11 232nd St

- 24519 147th Dr

- 245-39 147th Dr

- 24533 147th Rd

- 147-50 231st St

- 14848 231st St

- 14632 Huxley St

- 245-47 148th Dr

- 23027 148th Ave

- 146-15 243rd St

- 238-23 149th Ave

- 23827 149th Ave

- 238-19 149th Ave

- 23819 149th Ave

- 238-39 149 Ave

- 23831 149th Ave

- 23815 149th Ave

- 23824 148th Dr

- 23828 148th Dr

- 23820 148th Dr

- 23835 149th Ave

- 23835 149th Ave

- 23832 148th Dr

- 238-32 148th Dr

- 238-32 148th Dr Unit 2

- 23811 149th Ave

- 23816 148th Dr

- 23816 148th Dr

- 23816 148th Dr

- 23836 148th Dr Unit Second floor