23830 Seal Rd Richland, MO 65556

Estimated Value: $203,000 - $260,708

Studio

1

Bath

1,564

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 23830 Seal Rd, Richland, MO 65556 and is currently estimated at $235,569, approximately $150 per square foot. 23830 Seal Rd is a home located in Pulaski County with nearby schools including Laquey R-V Elementary School, Laquey R-V Middle School, and Laquey R-V High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 25, 2014

Sold by

Erick L Erick L and Enneking Dasha L

Bought by

Pirtle Robin D and Pirtle Judy Lee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Outstanding Balance

$60,310

Interest Rate

4.43%

Estimated Equity

$175,259

Purchase Details

Closed on

Dec 18, 2012

Sold by

Bank Of Crocker

Bought by

Enneking Erick and Brown Dasha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,500

Interest Rate

6%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 1, 2006

Sold by

Helm Richard L

Bought by

Enneking Erick L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,261

Interest Rate

6.64%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pirtle Robin D | -- | -- | |

| Enneking Erick | -- | None Available | |

| Enneking Erick L | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pirtle Robin D | $80,000 | |

| Previous Owner | Enneking Erick | $27,500 | |

| Previous Owner | Enneking Erick L | $119,261 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,062 | $28,500 | $5,267 | $23,233 |

| 2024 | $11 | $25,510 | $4,389 | $21,121 |

| 2023 | $1,061 | $25,510 | $4,389 | $21,121 |

| 2022 | $984 | $25,510 | $4,389 | $21,121 |

| 2021 | $984 | $25,510 | $4,389 | $21,121 |

| 2020 | $950 | $24,504 | $0 | $0 |

| 2019 | $950 | $24,504 | $0 | $0 |

| 2018 | $303 | $7,809 | $0 | $0 |

| 2017 | $303 | $6,205 | $0 | $0 |

| 2016 | $303 | $7,810 | $0 | $0 |

| 2015 | -- | $7,810 | $0 | $0 |

| 2014 | $685 | $20,310 | $0 | $0 |

Source: Public Records

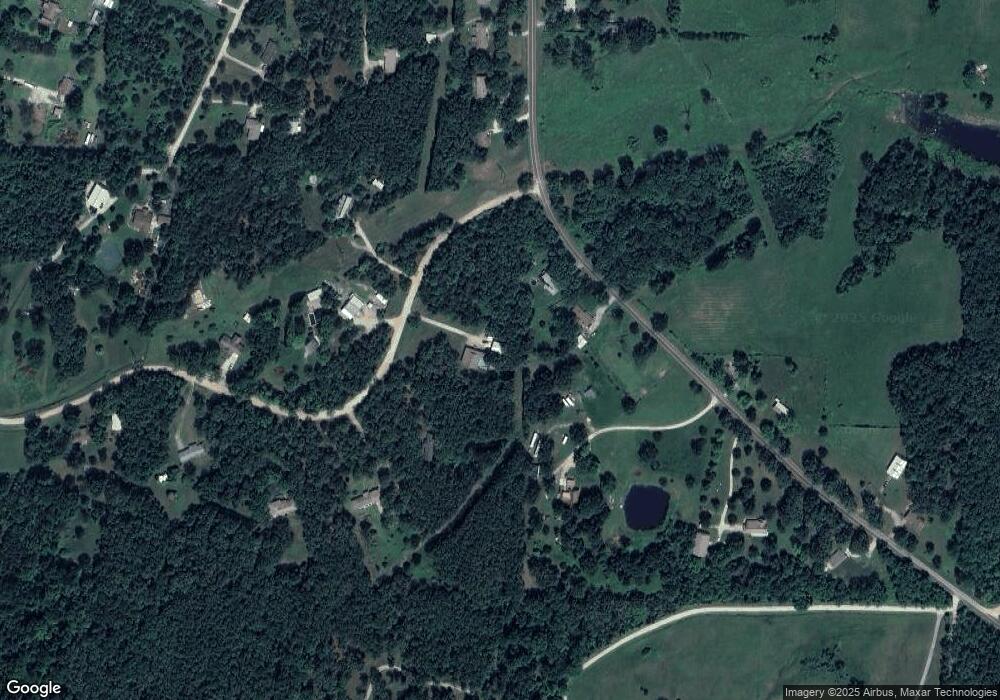

Map

Nearby Homes

- 27180 State Highway Nn

- 27110 Stoddard Dr

- 27655 Sandy Dr

- 28345 Sapphire Dr

- 23985 Richland Ln

- 22818 Spruce Rd

- 26954 Savery Ln

- 26012 Satellite Rd

- 26184 Silver Ln

- 1 Firehouse Dr

- 198 Firehouse Dr

- 25715 Missouri 17

- 25715 Missouri 17 Unit 25625

- 26899 Stephanie Ln

- 000 Firehouse Dr

- 25682 Starlite Dr

- Lot 7 Stereo Ln

- 000 Stanton Rd

- 000 Raceway Rd

- 25840 Rim Dr

- 27311 Highway Nn

- 27355 Highway Nn

- 23835 Seal Rd

- 23850 Seal Rd

- 27375 Highway H

- 23870 Seal Rd

- 27225 State Highway Nn

- 27225 Highway Nn

- 23825 Seal Rd

- 27380 Highway Nn

- 27201 Highway Nn

- 23890 Seal Rd

- 23925 Seal Rd

- 27300 Sparrow Ln

- 27185 Highway Nn

- 27385 Highway Nn

- 27185 Highway H

- 27360 Sparrow Ln

- 23930 Seal Rd

- 27460 Highway Nn

Your Personal Tour Guide

Ask me questions while you tour the home.