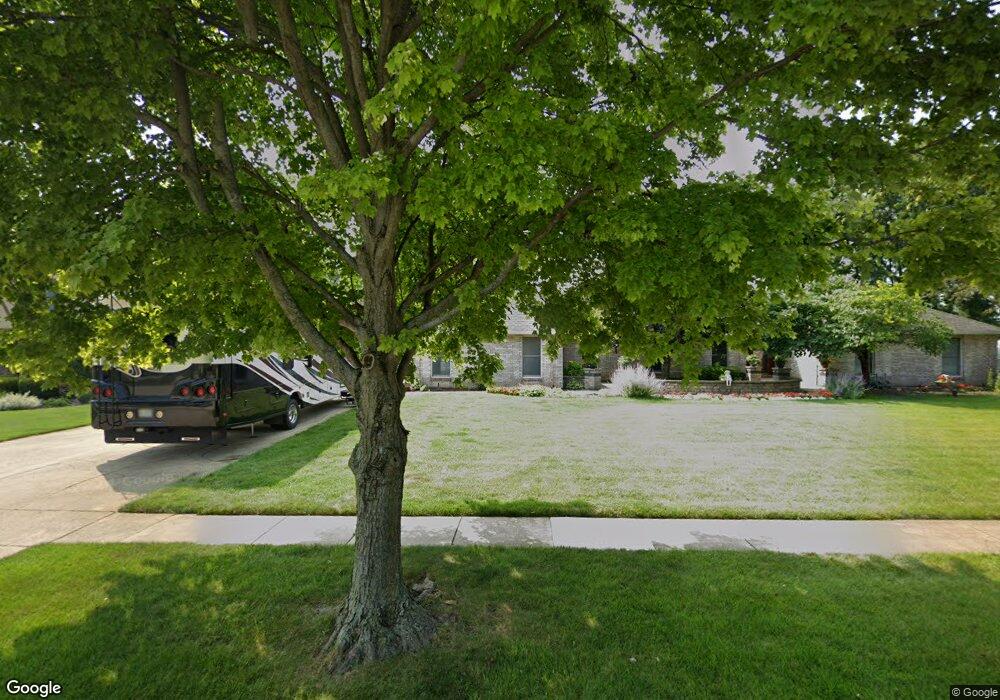

23851 Douglas Dr Unit 2 Plainfield, IL 60585

North Plainfield NeighborhoodEstimated Value: $596,300 - $625,000

4

Beds

3

Baths

3,200

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 23851 Douglas Dr Unit 2, Plainfield, IL 60585 and is currently estimated at $610,575, approximately $190 per square foot. 23851 Douglas Dr Unit 2 is a home located in Will County with nearby schools including Liberty Elementary School, John F Kennedy Middle School, and Plainfield East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2020

Sold by

Strappazon Peter J and Strappazon Janice M

Bought by

Strappazon Peter J and Strappazon Janice M

Current Estimated Value

Purchase Details

Closed on

Aug 16, 2011

Sold by

Jones Gilbert G and Jones Linda L Jarchow

Bought by

Strappazon Peter J and Strappazon Janice M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$12,381

Interest Rate

4.55%

Mortgage Type

New Conventional

Estimated Equity

$598,194

Purchase Details

Closed on

May 12, 2003

Sold by

Jones Linda L Jarchow and Jones Gilbert G

Bought by

Jones Gilbert G and Jones Linda L Jarchow

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Interest Rate

5.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 8, 1999

Sold by

Jones Gilbert G and Jones Linda L

Bought by

Jones Linda L Jarchow and Jones Gilbert G

Purchase Details

Closed on

Aug 29, 1997

Sold by

Hinojosa Domingo and Hinojosa Alicia

Bought by

Jones Gilbert G and Jones Linda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,000

Interest Rate

7.51%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Strappazon Peter J | -- | None Available | |

| Strappazon Peter J | $330,000 | First American Title | |

| Jones Gilbert G | -- | Chicago Title Insurance Comp | |

| Jones Linda L Jarchow | -- | -- | |

| Jones Gilbert G | $287,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Strappazon Peter J | $150,000 | |

| Previous Owner | Jones Gilbert G | $165,000 | |

| Previous Owner | Jones Gilbert G | $230,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,641 | $181,073 | $25,941 | $155,132 |

| 2023 | $10,641 | $159,958 | $22,916 | $137,042 |

| 2022 | $10,042 | $147,070 | $21,679 | $125,391 |

| 2021 | $9,683 | $140,067 | $20,647 | $119,420 |

| 2020 | $9,695 | $137,848 | $20,320 | $117,528 |

| 2019 | $9,563 | $147,698 | $19,747 | $127,951 |

| 2018 | $9,772 | $133,963 | $19,312 | $114,651 |

| 2017 | $9,752 | $130,504 | $18,813 | $111,691 |

| 2016 | $9,802 | $127,695 | $18,408 | $109,287 |

| 2015 | -- | $132,234 | $17,700 | $114,534 |

| 2014 | -- | $113,333 | $17,700 | $95,633 |

| 2013 | -- | $123,660 | $17,700 | $105,960 |

Source: Public Records

Map

Nearby Homes

- 13142 Cathy Ln

- 13360 Vicky St

- 24331 Norwood Dr

- 23308 W Tenny St

- 12929 S Platte Trail

- 12750 S Kerry Ln

- 23406 W 135th St

- 23253 W Tenny St

- 12939 S Platte Trail

- 23250 W Tenny St

- 23242 W Tenny St

- 12843 Bradford Ln Unit 2

- 12746 S Kerry Ln

- 23236 W Tenny St

- 12928 S Kerry Ln

- 23231 W Tenny St

- 12740 S Kerry Ln

- 23217 W Tenny St

- 13026 S Slate Ln

- 12629 S Potomac Dr

- 23839 Douglas Dr

- 2411 Douglas Dr

- 23861 Douglas Dr

- 13239 Cathy Ln

- 13110 Paul Cir

- 23827 Douglas Dr

- 13225 Cathy Ln

- 13251 Cathy Ln

- 13209 Cathy Ln

- 13153 Cathy Ln

- 13133 Cathy Ln

- 23813 Douglas Dr

- 13062 Paul Cir

- 13057 Paul Cir

- 13273 Cathy Ln

- 13101 Cathy Ln

- 23801 Douglas Dr

- 13313 Cathy Ln

- 13053 Paul Cir

- 13236 Cathy Ln

Your Personal Tour Guide

Ask me questions while you tour the home.