2390 Mathews Ave Fort Lupton, CO 80621

Estimated Value: $736,000 - $1,005,000

5

Beds

3

Baths

1,472

Sq Ft

$565/Sq Ft

Est. Value

About This Home

This home is located at 2390 Mathews Ave, Fort Lupton, CO 80621 and is currently estimated at $831,103, approximately $564 per square foot. 2390 Mathews Ave is a home located in Weld County with nearby schools including Weld Central Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 6, 2023

Sold by

Jn Blair Family Trust

Bought by

Landers Charles Bruce and Landers Rikki Lynn

Current Estimated Value

Purchase Details

Closed on

Jan 10, 2022

Sold by

Blair Justin R and Blair Natasha R

Bought by

The Jn Blair Family Trust

Purchase Details

Closed on

Jun 21, 2021

Sold by

Haffner Kyle E and Haffner Krista L

Bought by

Blair Justin R and Blair Natasha R

Purchase Details

Closed on

Mar 28, 1997

Sold by

Mitchell Thomas S and Mitchell Cheryl L

Bought by

Rupp Carole D and Rupp Edwin M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.65%

Purchase Details

Closed on

Jun 7, 1990

Sold by

Criscoe Ray

Bought by

Mitchell Thomas S and Mitchell Cheryl L

Purchase Details

Closed on

Jun 10, 1988

Sold by

Mosher Malvin D

Bought by

Criscoe Ray

Purchase Details

Closed on

Jan 23, 1976

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Landers Charles Bruce | -- | Land Title Guarantee | |

| The Jn Blair Family Trust | -- | None Available | |

| The Jn Blair Family Trust | -- | None Available | |

| Blair Justin R | $212,000 | Heritage Title Co | |

| Blair Justin R | $212,000 | Heritage Title Co | |

| Rupp Carole D | $239,900 | -- | |

| Mitchell Thomas S | $69,500 | -- | |

| Criscoe Ray | $24,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rupp Carole D | $100,000 | |

| Closed | Rupp Carole D | $63,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,407 | $44,050 | $19,000 | $25,050 |

| 2024 | $2,407 | $44,050 | $19,000 | $25,050 |

| 2023 | $2,263 | $50,730 | $19,760 | $30,970 |

| 2022 | $1,863 | $35,930 | $14,520 | $21,410 |

| 2021 | $1,619 | $36,970 | $14,940 | $22,030 |

| 2020 | $1,178 | $30,150 | $7,010 | $23,140 |

| 2019 | $1,890 | $42,230 | $7,010 | $35,220 |

| 2018 | $1,266 | $30,140 | $6,390 | $23,750 |

| 2017 | $1,222 | $30,140 | $6,390 | $23,750 |

| 2016 | $936 | $25,390 | $5,710 | $19,680 |

| 2015 | $768 | $25,390 | $5,710 | $19,680 |

| 2014 | $636 | $14,180 | $5,270 | $8,910 |

Source: Public Records

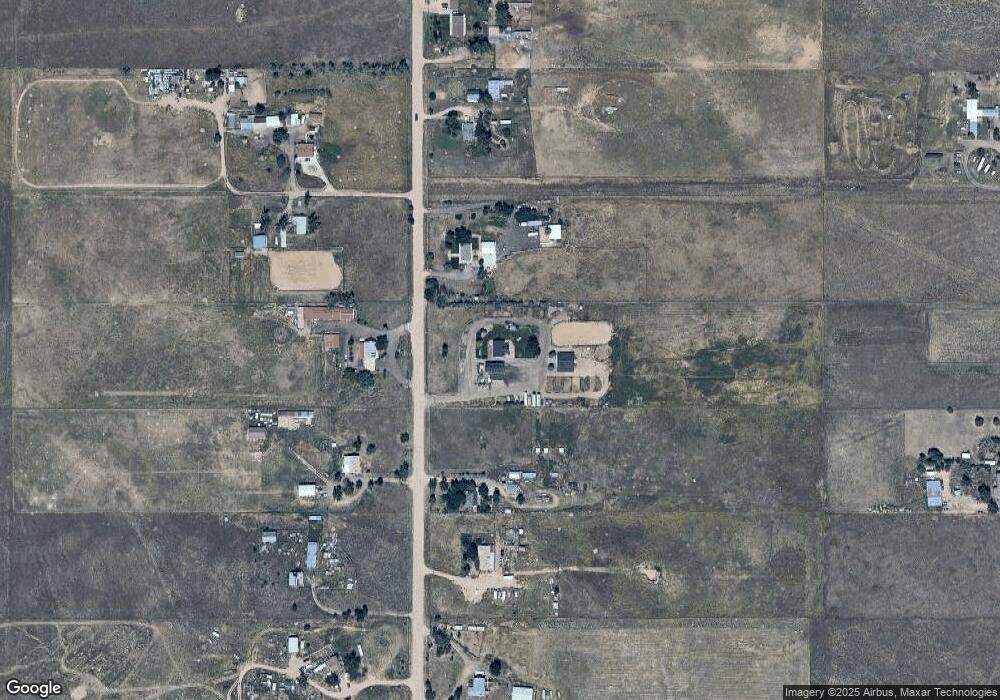

Map

Nearby Homes

- 2269 Mathews Ave

- 2869 Mathews Ave

- 17445 County Road 6

- 15000 County Road 8

- 567 Xavier Dr

- 15087 County Road 8

- 1836 Taos St

- The Livingston | Residence 39103 Plan at Bella Vista

- The Cimarron Plan at Bella Vista

- The Powell | Residence 39206 Plan at Bella Vista

- The Ontario | Residence 39205 Plan at Bella Vista

- The Mackenzie Plan at Bella Vista

- The Marion | Residence 39208 Plan at Bella Vista

- 541 Park Blvd

- 370 Mesa Ave

- 489 Reserve Ave

- 2065 Wildwood St

- 307 Hunter Ave

- 302 Horizon Ave

- 362 Westin Ave

- 2450 Mathews Ave

- 2389 Mathews Ave

- 2330 Mathews Ave

- 2889 Mathews Ave

- 2329 Mathews Ave

- 2270 Mathews Ave

- 2510 Mathews Ave

- 16016 Bruno St

- 16016 Bruno St

- 16015 Bruno St

- 2570 Mathews Ave

- 2210 Mathews Ave

- 2209 Mathews Ave

- 2150 Mathews Ave

- 2149 Mathews Ave

- 2630 Mathews Ave

- 2629 Mathews Ave

- 2331 Tate Ave

- 16405 Bruno St

- 2090 Mathews Ave