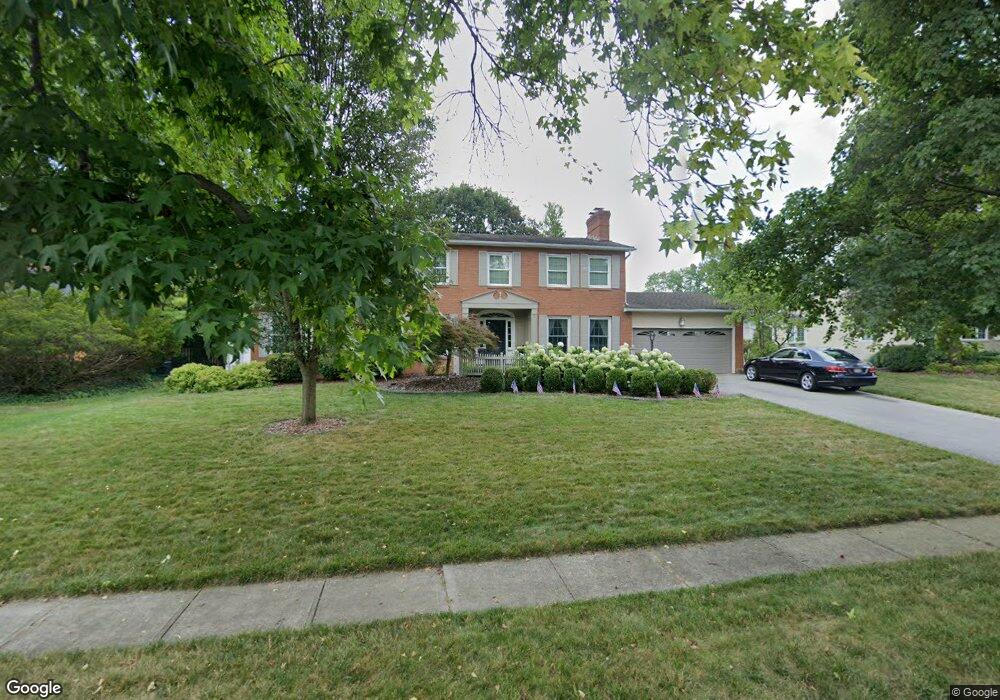

2396 Wimbledon Rd Columbus, OH 43220

Estimated Value: $799,500 - $869,000

4

Beds

3

Baths

2,838

Sq Ft

$293/Sq Ft

Est. Value

About This Home

This home is located at 2396 Wimbledon Rd, Columbus, OH 43220 and is currently estimated at $832,625, approximately $293 per square foot. 2396 Wimbledon Rd is a home located in Franklin County with nearby schools including Windermere Elementary School, Hastings Middle School, and Upper Arlington High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 26, 2003

Sold by

Chidester William T and Chidester Martha L

Bought by

Huey D Timothy and Huey Karen J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,600

Outstanding Balance

$59,950

Interest Rate

6.01%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$772,675

Purchase Details

Closed on

Jun 30, 2000

Sold by

Brown Helen P

Bought by

Chidester William T and Chidester Martha L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,700

Interest Rate

8.64%

Purchase Details

Closed on

Mar 25, 1994

Bought by

Brown Helen P Tr

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Huey D Timothy | $372,000 | Chicago Title | |

| Chidester William T | $380,000 | Chicago Title | |

| Brown Helen P Tr | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Huey D Timothy | $297,600 | |

| Closed | Chidester William T | $252,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,166 | $210,140 | $81,480 | $128,660 |

| 2024 | $12,166 | $210,140 | $81,480 | $128,660 |

| 2023 | $12,015 | $210,140 | $81,480 | $128,660 |

| 2022 | $12,872 | $182,070 | $55,440 | $126,630 |

| 2021 | $11,262 | $182,070 | $55,440 | $126,630 |

| 2020 | $11,163 | $182,070 | $55,440 | $126,630 |

| 2019 | $10,483 | $151,170 | $55,440 | $95,730 |

| 2018 | $9,569 | $151,170 | $55,440 | $95,730 |

| 2017 | $10,402 | $151,170 | $55,440 | $95,730 |

| 2016 | $8,722 | $131,920 | $46,730 | $85,190 |

| 2015 | $8,715 | $131,920 | $46,730 | $85,190 |

| 2014 | $8,725 | $131,920 | $46,730 | $85,190 |

| 2013 | $4,167 | $119,945 | $42,490 | $77,455 |

Source: Public Records

Map

Nearby Homes

- 2626 Chartwell Rd

- 2200 Nayland Rd

- 2533 Middlesex Rd

- 2158 Sandston Rd

- 3900 Hillview Dr

- 5000 Slate Run Woods Ct

- 1594 Lafayette Dr Unit 1594

- 1883 Willoway Cir N Unit 1883

- 3055 Carriage Ln

- 2458 Edgevale Rd

- 1512 Lafayette Dr Unit B

- 2668 Edgevale Rd

- 2413 Edgevale Rd

- 4803 Wynwood Ct

- 5233 Brandy Oaks Ln Unit 5233

- 3701 Reed Rd

- 3830 Riverview Dr

- 5273 Brandy Oaks Ln

- 2480 Shrewsbury Rd

- 4025 Dublin Rd

- 2380 Wimbledon Rd

- 2408 Wimbledon Rd

- 2395 Haverford Rd

- 2381 Haverford Rd

- 4440 Harborough Rd

- 2370 Wimbledon Rd

- 4381 Braunton Rd

- 2407 Wimbledon Rd

- 2371 Haverford Rd

- 2434 Wimbledon Rd

- 2345 Pinebrook Rd

- 4365 Braunton Rd

- 4380 Braunton Rd

- 4384 Harborough Rd

- 2435 Haverford Rd

- 2335 Pinebrook Rd

- 2349 Haverford Rd

- 2396 Haverford Rd

- 2435 Wimbledon Rd

- 2380 Haverford Rd

Your Personal Tour Guide

Ask me questions while you tour the home.