24 Hampton Ln Cincinnati, OH 45208

Hyde Park NeighborhoodEstimated Value: $1,241,705 - $1,621,000

3

Beds

4

Baths

4,018

Sq Ft

$346/Sq Ft

Est. Value

About This Home

This home is located at 24 Hampton Ln, Cincinnati, OH 45208 and is currently estimated at $1,391,676, approximately $346 per square foot. 24 Hampton Ln is a home located in Hamilton County with nearby schools including Kilgour Elementary School, Clark Montessori High School, and Shroder High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 15, 2011

Sold by

Graziano Steven M and Graziano Karen B

Bought by

Maguire Lorraine L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

2.99%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Sep 22, 2009

Sold by

Mahoney William and Mahoney Rosanna

Bought by

Graziano Steven M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

5.38%

Mortgage Type

Unknown

Purchase Details

Closed on

Jul 27, 1995

Sold by

Atrium Marketing Services Inc

Bought by

Mahoney William D and Mahoney Rosanna H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maguire Lorraine L | $677,050 | None Available | |

| Graziano Steven M | $750,000 | Chicago Title Insurance Co | |

| Mahoney William D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Maguire Lorraine L | $300,000 | |

| Previous Owner | Graziano Steven M | $417,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,891 | $323,750 | $130,200 | $193,550 |

| 2024 | $19,285 | $323,750 | $130,200 | $193,550 |

| 2023 | $21,777 | $357,483 | $130,200 | $227,283 |

| 2022 | $19,609 | $288,750 | $125,860 | $162,890 |

| 2021 | $18,886 | $288,750 | $125,860 | $162,890 |

| 2020 | $22,859 | $339,511 | $125,860 | $213,651 |

| 2019 | $21,540 | $292,681 | $108,500 | $184,181 |

| 2018 | $21,573 | $292,681 | $108,500 | $184,181 |

| 2017 | $20,496 | $292,681 | $108,500 | $184,181 |

| 2016 | $17,273 | $243,208 | $105,245 | $137,963 |

| 2015 | $15,569 | $243,208 | $105,245 | $137,963 |

| 2014 | $15,680 | $243,208 | $105,245 | $137,963 |

| 2013 | $15,955 | $243,208 | $108,500 | $134,708 |

Source: Public Records

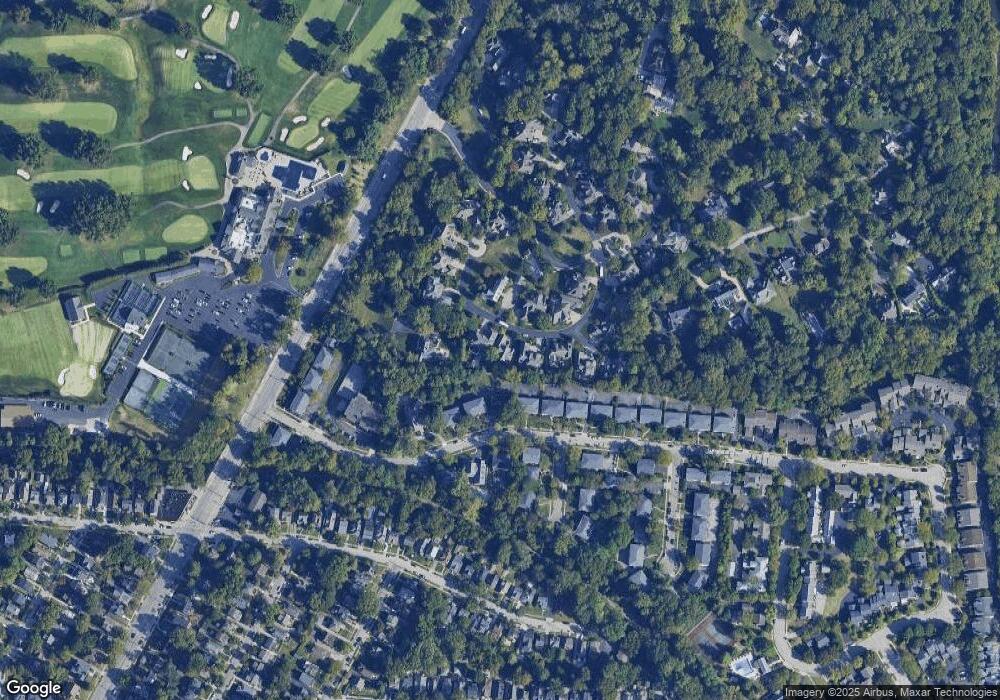

Map

Nearby Homes

- 3635 Ault Park Ave

- 3437 Traskwood Cir

- 3474 Forestoak Ct

- 3615 Old Red Bank Rd

- 3649 Herschel Ave

- 3431 Pape Ave

- 3407 Aston Ct Unit 4

- 3613 Herschel Ave

- 4422 Canyon Oak Ct

- 4418 Canyon Oak Ct

- 2947 Iron Oak Ln

- 3460 Custer Ave

- 3414 Oak Ln

- 4115 Paxton Woods Dr

- 3443 Ault View Ave

- 3806 Brotherton Rd

- 4153 Paxton Woods Ln

- 3508 Tarpis Ave

- 3709 Brotherton Rd

- 3509 Tarpis Ave

- 24 Hampton Ln

- 25 Hampton Ln

- 23 Hampton Ln

- 23 Hampton Ln

- 3676 Ashworth Dr

- 33 Hampton Ln

- 22 Hampton Ln

- 33 Hampton Ln

- 22 Hampton Ln

- 3684 Ashworth Dr Unit 3684A

- 3684 Ashworth Dr Unit 3684B

- 3684 Ashworth Dr Unit 3684C

- 3684 Ashworth Dr Unit D

- 3684 Ashworth Dr Unit C

- 3684 Ashworth Dr Unit B

- 3684 Ashworth Dr Unit A

- 3670 Ashworth Dr Unit 3670B

- 3670 Ashworth Dr Unit 3670C

- 3670 Ashworth Dr Unit 3670A

- 3670 Ashworth Dr Unit C