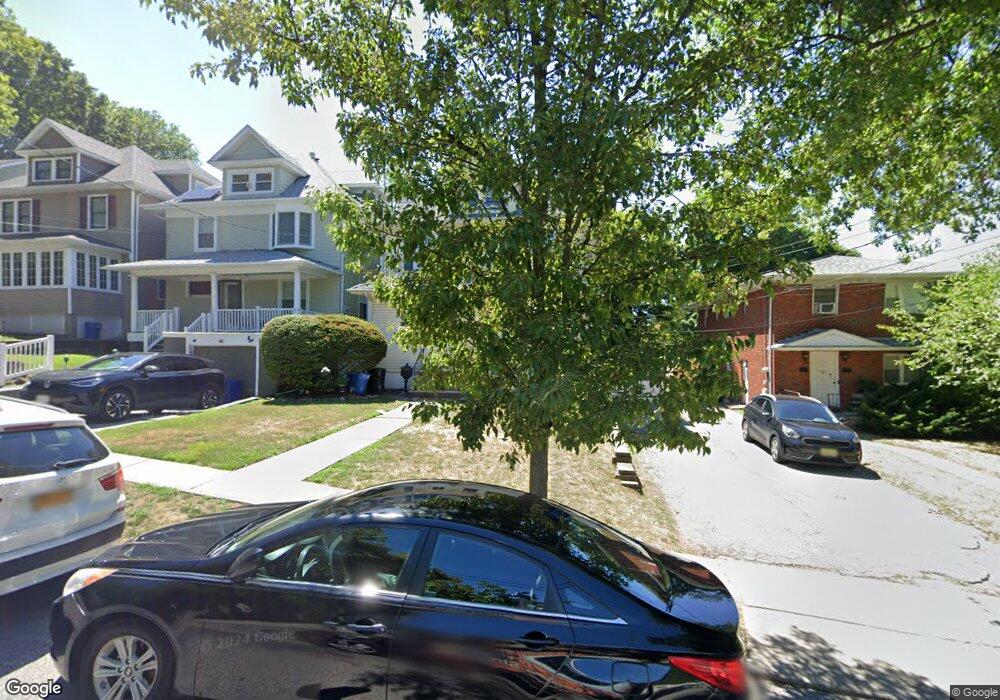

24 N Mada Ave Staten Island, NY 10310

Randall Manor NeighborhoodEstimated Value: $788,000 - $995,000

--

Bed

4

Baths

2,064

Sq Ft

$423/Sq Ft

Est. Value

About This Home

This home is located at 24 N Mada Ave, Staten Island, NY 10310 and is currently estimated at $873,815, approximately $423 per square foot. 24 N Mada Ave is a home located in Richmond County with nearby schools including P.S. 45 John Tyler, Is 61 William A Morris, and Curtis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2019

Sold by

Sweeney Patricia A and Sweeney Mark P

Bought by

Thomson Gregg and Thomson Shannon

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$492,000

Outstanding Balance

$429,889

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$443,926

Purchase Details

Closed on

May 21, 2004

Sold by

Acer Anne H

Bought by

Sweeney Mark P and Sweeney Patricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.01%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thomson Gregg | $615,000 | Boro Wide Abstract Corp | |

| Sweeney Mark P | $318,000 | Commonwealth Land Title Insu |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thomson Gregg | $492,000 | |

| Previous Owner | Sweeney Mark P | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,560 | $47,400 | $12,578 | $34,822 |

| 2024 | $7,560 | $50,580 | $11,385 | $39,195 |

| 2023 | $7,212 | $35,512 | $10,361 | $25,151 |

| 2022 | $6,741 | $42,660 | $15,300 | $27,360 |

| 2021 | $6,834 | $35,340 | $15,300 | $20,040 |

| 2020 | $6,873 | $39,060 | $15,300 | $23,760 |

| 2019 | $6,561 | $42,360 | $15,300 | $27,060 |

| 2018 | $6,033 | $29,593 | $13,872 | $15,721 |

| 2017 | $5,736 | $28,140 | $15,300 | $12,840 |

| 2016 | $5,100 | $27,060 | $15,300 | $11,760 |

| 2015 | $4,711 | $27,706 | $14,174 | $13,532 |

| 2014 | $4,711 | $26,139 | $14,961 | $11,178 |

Source: Public Records

Map

Nearby Homes

- 244 Delafield Ave

- 335 Oakland Ave

- 331 Oakland Ave

- 432 Pelton Ave

- 20 Baker Place

- 253 Elm St

- 486 Henderson Ave

- 112 Delafield Ave

- 585 Castleton Ave Unit 1c

- 125 Walbrooke Ave

- 943 Castleton Ave

- 60 Westbury Ave

- 11 Curtis Ct

- 44 Westbury Ave

- 72 Gregg Place

- 386 N Burgher Ave

- 67 Lawrence Ave

- 225 N Burgher Ave

- 605 Bard Ave

- 175 Bement Ave