24 Oswego Ave Oakland, NJ 07436

Estimated Value: $540,963 - $599,000

--

Bed

--

Bath

1,144

Sq Ft

$503/Sq Ft

Est. Value

About This Home

This home is located at 24 Oswego Ave, Oakland, NJ 07436 and is currently estimated at $575,491, approximately $503 per square foot. 24 Oswego Ave is a home located in Bergen County with nearby schools including Heights Elementary School, Valley Middle School, and Indian Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 4, 2013

Sold by

,Richard Hetherington and ,Richard James,Etal

Bought by

Hetherington Hetherington R and Hetherington J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$282,500

Outstanding Balance

$211,117

Interest Rate

4.36%

Mortgage Type

New Conventional

Estimated Equity

$364,374

Purchase Details

Closed on

Aug 31, 2000

Sold by

Kogge Raymond C

Bought by

Ketherington Richard J and Greenfield Mindy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,400

Interest Rate

8%

Purchase Details

Closed on

May 7, 1999

Sold by

Warsak Robert M and Warsak Kelly A

Bought by

Kogge Raymond C

Purchase Details

Closed on

May 15, 1997

Sold by

Warsak Robert W and Warsak Kelly A

Bought by

Kogge Raymond C and Kogge Allison M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

8.08%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hetherington Hetherington R | -- | -- | |

| Ketherington Richard J | $256,000 | -- | |

| Kogge Raymond C | $200,000 | -- | |

| Kogge Raymond C | $200,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hetherington Hetherington R | $282,500 | |

| Previous Owner | Ketherington Richard J | $230,400 | |

| Previous Owner | Kogge Raymond C | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,120 | $479,900 | $292,900 | $187,000 |

| 2024 | $9,983 | $440,000 | $263,300 | $176,700 |

| 2023 | $9,634 | $420,500 | $252,200 | $168,300 |

| 2022 | $9,634 | $409,600 | $246,000 | $163,600 |

| 2021 | $9,612 | $313,100 | $192,300 | $120,800 |

| 2020 | $9,390 | $313,100 | $192,300 | $120,800 |

| 2019 | $9,061 | $313,100 | $192,300 | $120,800 |

| 2018 | $8,870 | $313,100 | $192,300 | $120,800 |

| 2017 | $8,754 | $313,100 | $192,300 | $120,800 |

| 2016 | $8,516 | $313,100 | $192,300 | $120,800 |

| 2015 | $8,347 | $313,100 | $192,300 | $120,800 |

| 2014 | $8,175 | $313,100 | $192,300 | $120,800 |

Source: Public Records

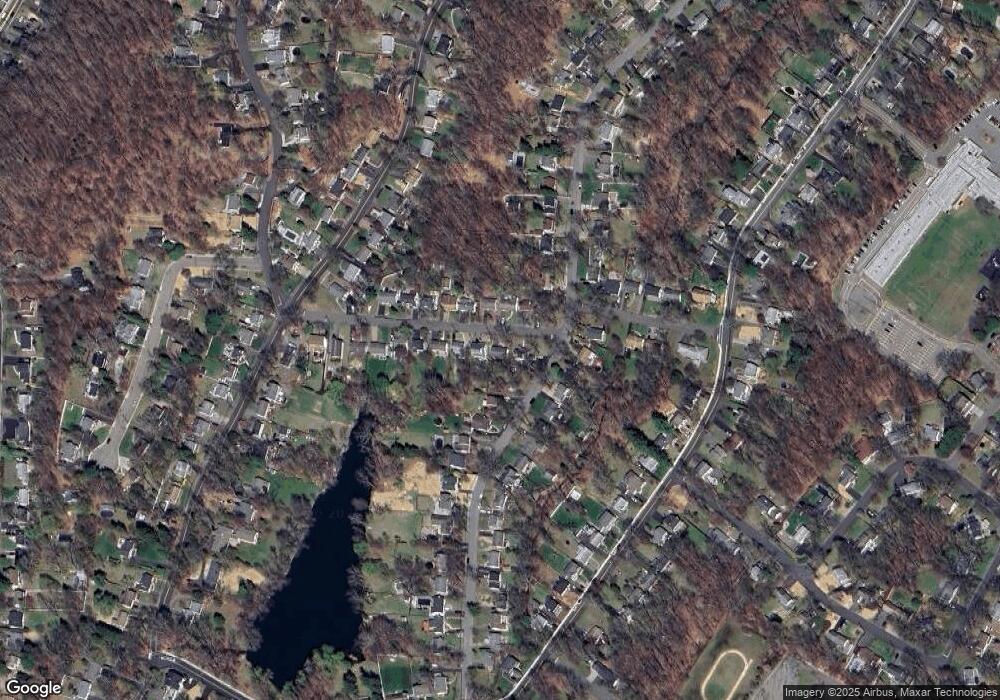

Map

Nearby Homes

- 22 Calumet Ave

- 28 Minnehaha Blvd

- 509 Ramapo Valley Rd

- 11 Loyola Place

- 12 Fordham Rd

- 632 Ramapo Valley Rd

- 21 Cardinal Dr

- 37 Lakeshore Dr

- 31 Lakeshore Dr

- 39 Powdermill Ln

- 29 Manito Ave

- 2 Rock Ledge

- 83 Oneida Ave

- 29 Thackeray Rd

- 96 Roosevelt Blvd

- 47 Allen Dr

- 10 2nd St

- Shaffer Plan at The Ridings at Oakland

- 14 Arlington Place

- 14 Valley View Ave