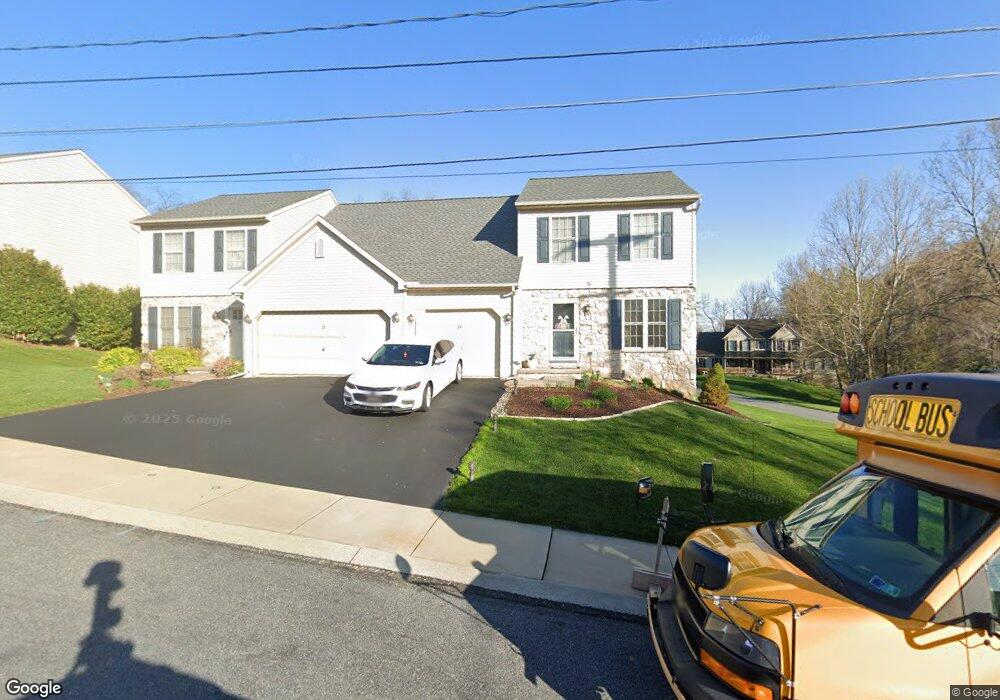

24 Pleasure Rd Ephrata, PA 17522

Estimated Value: $274,000 - $335,630

3

Beds

2

Baths

1,356

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 24 Pleasure Rd, Ephrata, PA 17522 and is currently estimated at $304,158, approximately $224 per square foot. 24 Pleasure Rd is a home located in Lancaster County with nearby schools including Fulton El School, Ephrata Intermediate School, and Ephrata Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2018

Sold by

Wolf George D

Bought by

Wolf George D and Wolf Phyllis L

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2003

Sold by

Smoker Matthew M and Smoker Corinne L

Bought by

Smoker Matthew M and Smoker Corinne L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,950

Interest Rate

5.91%

Purchase Details

Closed on

Mar 22, 2001

Sold by

Weaver Clair N and Landmark Builders Inc

Bought by

Smoker Matthew M and Smoker Raymond Corinne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$107,255

Interest Rate

6.96%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wolf George D | -- | None Available | |

| Smoker Matthew M | -- | -- | |

| Smoker Matthew M | $112,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Smoker Matthew M | $104,950 | |

| Closed | Smoker Matthew M | $107,255 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,834 | $166,700 | $43,300 | $123,400 |

| 2024 | $3,834 | $166,700 | $43,300 | $123,400 |

| 2023 | $3,736 | $166,700 | $43,300 | $123,400 |

| 2022 | $3,651 | $166,700 | $43,300 | $123,400 |

| 2021 | $3,556 | $166,700 | $43,300 | $123,400 |

| 2020 | $3,556 | $166,700 | $43,300 | $123,400 |

| 2019 | $3,506 | $166,700 | $43,300 | $123,400 |

| 2018 | $2,826 | $166,700 | $43,300 | $123,400 |

| 2017 | $2,837 | $110,600 | $31,400 | $79,200 |

| 2016 | $2,826 | $110,600 | $31,400 | $79,200 |

| 2015 | $565 | $110,600 | $31,400 | $79,200 |

| 2014 | $2,168 | $110,600 | $31,400 | $79,200 |

Source: Public Records

Map

Nearby Homes

- 259 Heatherwood Dr

- 708 Primrose Ln

- 112 Sycamore Rd

- 11 E Sunset Ave

- 146 Gregg Cir

- 1059 Henn Ave

- 1127 S State St

- 144 Niss Ave

- 538 E Main St

- 124 Washington Ave

- 00 Wyndale Dr

- 35 Hilldale Dr

- 331 Spring Garden St

- 308 Washington Ave

- 992 Hammon Ave

- 323 Lincoln Ave

- 244 Miller Rd

- 335 Lincoln Ave

- 628 Fulton St

- 111 Ridge Ave