24022 Ladera Ranch San Antonio, TX 78261

Bulverde Village NeighborhoodEstimated Value: $891,000 - $1,031,000

3

Beds

4

Baths

3,920

Sq Ft

$251/Sq Ft

Est. Value

About This Home

This home is located at 24022 Ladera Ranch, San Antonio, TX 78261 and is currently estimated at $983,984, approximately $251 per square foot. 24022 Ladera Ranch is a home located in Bexar County with nearby schools including Cibolo Green Elementary School, David Lee "Tex" Hill Middle School, and Johnson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 5, 2017

Sold by

Hartt Timothy A

Bought by

Hartt Lyudmula V

Current Estimated Value

Purchase Details

Closed on

Oct 28, 2011

Sold by

Craighead Estate Homes Ltd

Bought by

Hartt Timothy A and Hartt Lyudmila

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$704,220

Interest Rate

4.13%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 26, 2011

Sold by

Forestar Usa Real Estate Group Inc

Bought by

Don Craighead Homes Ltd

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$704,220

Interest Rate

4.13%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hartt Lyudmula V | -- | First American Title | |

| Hartt Timothy A | -- | Presidio Title | |

| Don Craighead Homes Ltd | -- | Presidio Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Hartt Timothy A | $704,220 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $20,787 | $965,151 | $161,910 | $803,241 |

| 2024 | $20,787 | $974,900 | $161,910 | $812,990 |

| 2023 | $20,787 | $892,290 | $161,910 | $776,850 |

| 2022 | $16,165 | $811,173 | $135,010 | $706,280 |

| 2021 | $15,253 | $737,430 | $117,390 | $620,040 |

| 2020 | $15,334 | $726,710 | $113,970 | $612,740 |

| 2019 | $15,473 | $717,890 | $113,970 | $603,920 |

| 2018 | $14,664 | $678,990 | $90,000 | $588,990 |

| 2017 | $14,781 | $677,330 | $90,000 | $587,330 |

| 2016 | $14,754 | $676,100 | $90,000 | $586,100 |

| 2015 | $21,374 | $720,610 | $90,000 | $630,610 |

| 2014 | $21,374 | $758,810 | $0 | $0 |

Source: Public Records

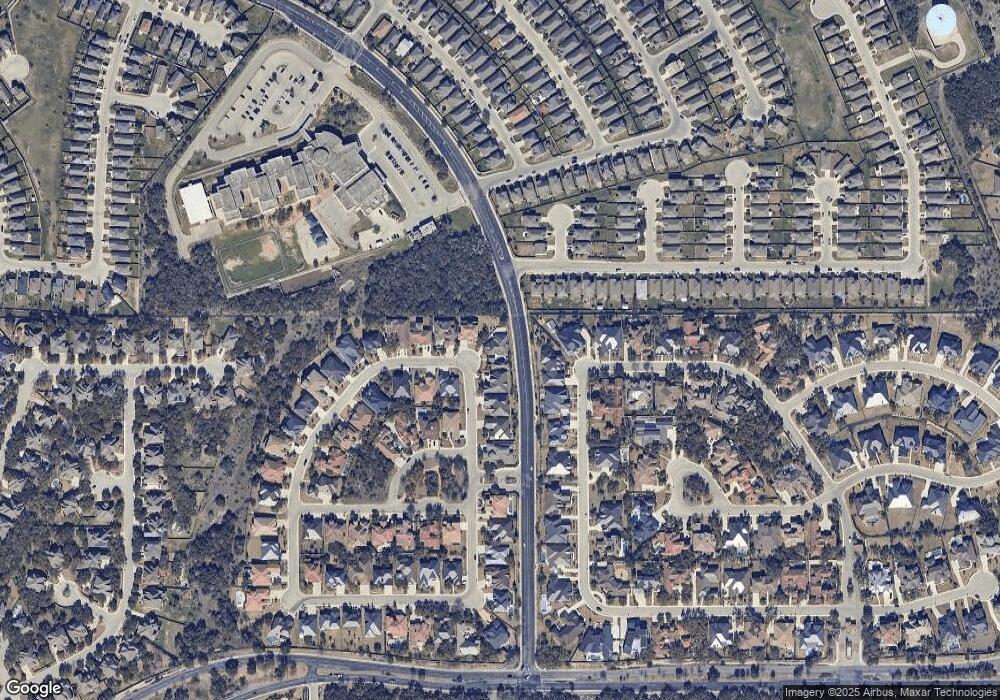

Map

Nearby Homes

- 24215 Desert Ash

- 3826 Luz Del Faro

- 3823 Luz Del Faro

- 3738 Las Casitas

- 4023 Ashleaf Pecan

- 3930 Ashleaf Pecan

- 3839 Torey Mesquite

- 3902 Ashleaf Pecan

- 4016 Abasolo

- 23204 Fossil Peak

- 3950 Bent Grass

- 4022 Abasolo

- 24230 Invitation Oak

- 24222 Waterwell Oaks

- 4035 Abasolo

- 3831 Ironwood Ash

- 24703 Maple Crest

- 3623 Pinnacle Dr

- 22914 Fossil Peak

- 3419 Ashleaf Wells

- 24051 La Tapiceria

- 24018 Ladera Ranch

- 24047 La Tapiceria

- 24014 Ladera Ranch

- 3802 Luz Del Faro

- 24046 La Tapiceria

- 3802 Bent Grass

- 24043 La Tapiceria

- 3806 Bent Grass

- 24042 Gran Palacio

- 24010 Ladera Ranch

- 24042 La Tapiceria

- 3806 Luz Del Faro

- 3810 Bent Grass

- 24023 Asoleado

- 24039 La Tapiceria

- 3814 Bent Grass

- 24019 Asoleado

- 24203 Flagstone Cove

- 24038 La Tapiceria