2403 Cactus Ct Unit 4 Plainfield, IL 60586

Fall Creek NeighborhoodEstimated Value: $278,000 - $309,000

2

Beds

2

Baths

1,600

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 2403 Cactus Ct Unit 4, Plainfield, IL 60586 and is currently estimated at $290,906, approximately $181 per square foot. 2403 Cactus Ct Unit 4 is a home located in Will County with nearby schools including Meadow View Elementary School, Aux Sable Middle School, and Plainfield South High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2017

Sold by

Fusco Andrea

Bought by

Morgan Nicholas

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,404

Outstanding Balance

$127,633

Interest Rate

3.99%

Mortgage Type

FHA

Estimated Equity

$163,273

Purchase Details

Closed on

May 13, 2011

Sold by

Hercl Kelly M

Bought by

Fusco Andrea M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,200

Interest Rate

4.91%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 6, 2005

Sold by

Clary Debra and Gacek Debra

Bought by

Hercl Kelly M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,500

Interest Rate

5.77%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 26, 2002

Sold by

Montalbano Builders Inc

Bought by

Gacek Debi L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,261

Interest Rate

7.18%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morgan Nicholas | $160,000 | First American Title | |

| Fusco Andrea M | $97,000 | First American Title | |

| Hercl Kelly M | $146,500 | First American Title | |

| Gacek Debi L | $136,500 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morgan Nicholas | $151,404 | |

| Previous Owner | Fusco Andrea M | $58,200 | |

| Previous Owner | Hercl Kelly M | $106,500 | |

| Previous Owner | Gacek Debi L | $134,261 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,788 | $74,676 | $10,884 | $63,792 |

| 2023 | $4,788 | $67,446 | $9,830 | $57,616 |

| 2022 | $4,286 | $60,576 | $8,829 | $51,747 |

| 2021 | $4,051 | $56,613 | $8,251 | $48,362 |

| 2020 | $3,984 | $55,007 | $8,017 | $46,990 |

| 2019 | $3,836 | $52,413 | $7,639 | $44,774 |

| 2018 | $2,757 | $38,588 | $7,177 | $31,411 |

| 2017 | $2,660 | $36,670 | $6,820 | $29,850 |

| 2016 | $2,592 | $34,974 | $6,505 | $28,469 |

| 2015 | $2,423 | $32,763 | $6,094 | $26,669 |

| 2014 | $2,423 | $31,606 | $5,879 | $25,727 |

| 2013 | $2,423 | $31,606 | $5,879 | $25,727 |

Source: Public Records

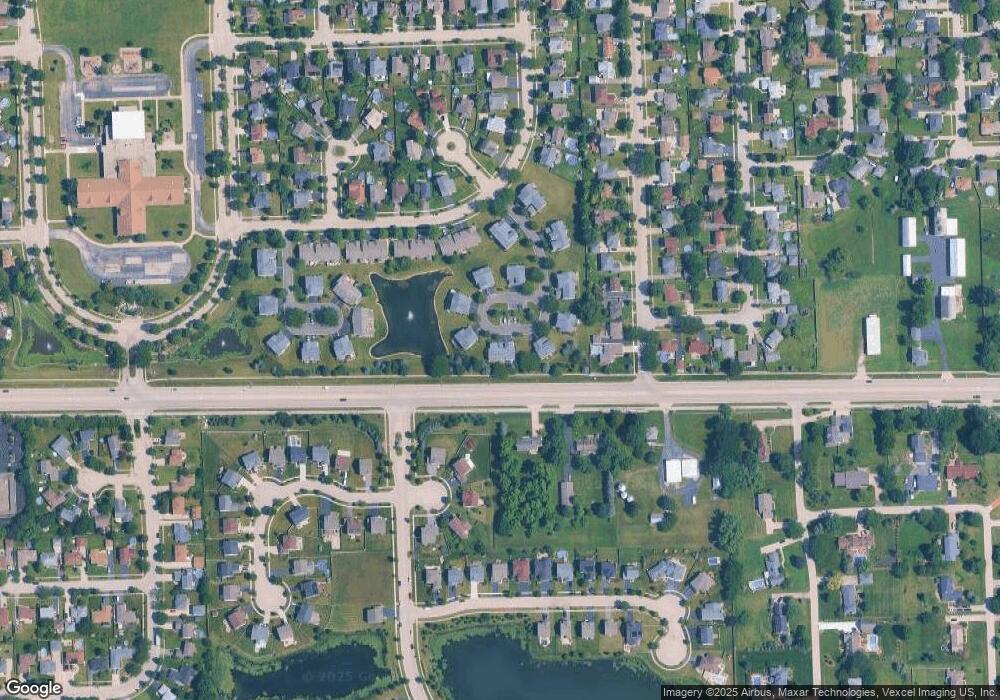

Map

Nearby Homes

- BELLAMY Plan at Ashford Place

- COVENTRY Plan at Ashford Place

- HENLEY Plan at Ashford Place

- HOLCOMBE Plan at Ashford Place

- HAVEN Plan at Ashford Place

- 2509 Ruth Fitzgerald Dr

- 2042 Legacy Pointe Blvd

- 2617 Ruth Fitzgerald Dr Unit 7

- 0001 S State Route 59

- 0002 S State Route 59

- 7221 Bradley Dr

- 1810 Legacy Pointe Blvd

- 6702 Buchanan Cir

- 6704 Buchanan Cir

- 6708 Buchanan Cir

- 6706 Buchanan Cir

- 1816 Overland Dr

- 1812 Overland Dr

- 2017 Lilyana Ln

- 1817 Overland Dr

- 2405 Cactus Ct Unit 4

- 2401 Cactus Ct Unit 4

- 2407 Cactus Ct

- 2402 Cactus Ct Unit 4

- 2409 Cactus Ct

- 2404 Cactus Ct

- 2404 Cactus Ct Unit 1

- 2411 Cactus Ct

- 2406 Cactus Ct Unit 4

- 2413 Cactus Ct

- 2413 Cactus Ct Unit 2413

- 2415 Cactus Ct

- 2419 Cactus Ct

- 2417 Cactus Ct

- 2408 Cactus Ct

- 2421 Cactus Ct Unit 4

- 2421 Cactus Ct Unit B

- 2410 Cactus Ct

- 2412 Cactus Ct

- 25941 Caton Farm Rd