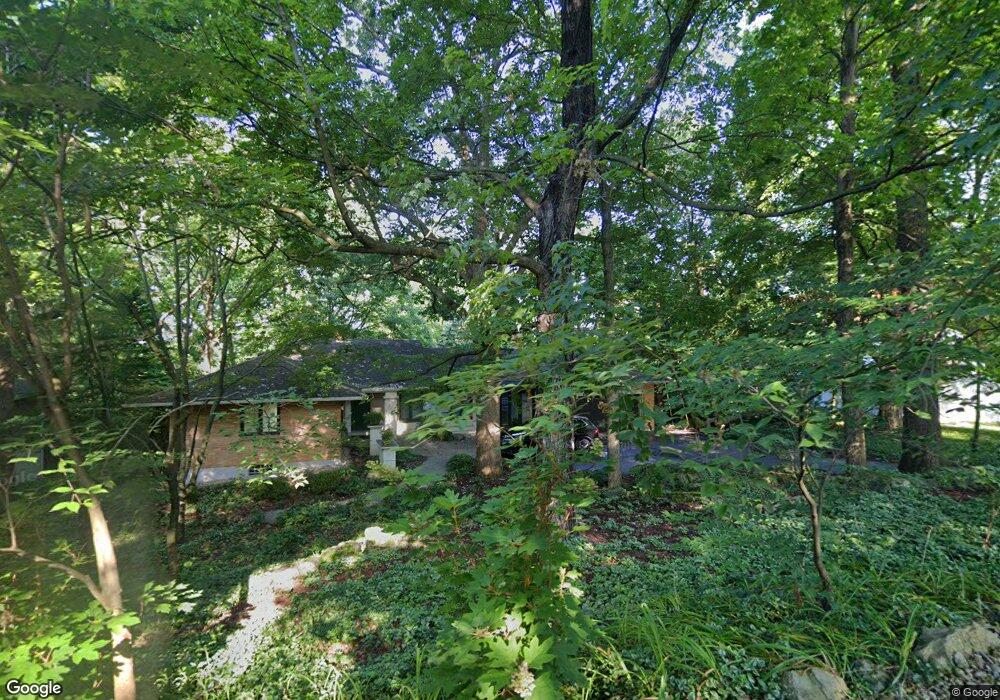

2405 Adirondack Trail Dayton, OH 45409

Estimated Value: $305,000 - $486,000

4

Beds

2

Baths

2,835

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 2405 Adirondack Trail, Dayton, OH 45409 and is currently estimated at $383,149, approximately $135 per square foot. 2405 Adirondack Trail is a home located in Montgomery County with nearby schools including Southdale Elementary School, Van Buren Middle School, and Kettering Fairmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 14, 2020

Sold by

Hashimoto Kenneth J

Bought by

Wootton Robert A and Wootton Rhonda S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$365,700

Interest Rate

2.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 28, 2018

Sold by

Hashimoto Kenneth J and Second Amended And Restated Ag

Bought by

Hashimoto Kenneth J

Purchase Details

Closed on

Mar 2, 2018

Sold by

Hardman Catherine S

Bought by

Hardman Catherine S and Trust For Catherine S Hardman

Purchase Details

Closed on

Sep 27, 2006

Sold by

Hardman Robert P and Hardman Catherine S

Bought by

Hardman Robert P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wootton Robert A | -- | Triad Title Agency Inc | |

| Hashimoto Kenneth J | -- | None Available | |

| Hardman Catherine S | -- | None Available | |

| Hardman Catherine S | -- | None Available | |

| Hardman Robert P | -- | Attorney | |

| Hardman Catherine S | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Wootton Robert A | $365,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,973 | $96,460 | $23,550 | $72,910 |

| 2023 | $5,973 | $96,460 | $23,550 | $72,910 |

| 2022 | $5,540 | $70,740 | $17,310 | $53,430 |

| 2021 | $5,123 | $70,740 | $17,310 | $53,430 |

| 2020 | $5,141 | $70,740 | $17,310 | $53,430 |

| 2019 | $5,077 | $61,800 | $15,740 | $46,060 |

| 2018 | $4,385 | $61,800 | $15,740 | $46,060 |

| 2017 | $4,038 | $61,800 | $15,740 | $46,060 |

| 2016 | $3,837 | $56,100 | $15,740 | $40,360 |

| 2015 | $3,664 | $56,100 | $15,740 | $40,360 |

| 2014 | $3,664 | $56,100 | $15,740 | $40,360 |

| 2012 | -- | $70,000 | $16,440 | $53,560 |

Source: Public Records

Map

Nearby Homes

- 1420 Adirondack Trail

- 1473 Constance Ave Unit 1481

- 2467 S Dixie Dr

- 2230 S Patterson Blvd

- 1615 Carrollton Ave

- 1536 Old Lane Ave

- 1597 Old Lane Ave

- 1211 Runnymede Rd

- 1160 Waving Willow Dr

- 1545 Cardington Rd

- 447 Kramer Rd

- 1364 Elmdale Dr

- 1424 Elmdale Dr

- 1554 Crescent Blvd

- 1129 W Dorothy Ln

- 116 Thruston Blvd W

- 1500 Ridgeway Rd

- 200 Maysfield Rd

- 3060 Regent St

- 0 Pointe Oakwood Way Unit 928860

- 2411 Adirondack Trail

- 2421 Adirondack Trail

- 1350 Springhill Ave

- 1360 Springhill Ave

- 2416 S Patterson Blvd

- 2422 S Patterson Blvd

- 2452 S Patterson Blvd

- 2400 Adirondack Trail

- 2408 S Patterson Blvd

- 2429 Adirondack Trail

- 2468 S Patterson Blvd

- 2400 S Patterson Blvd

- 2476 S Patterson Blvd

- 2422 Adirondack Trail

- 2433 Adirondack Trail

- 2373 Adirondack Trail

- 2441 Adirondack Trail

- 2434 Adirondack Trail

- 1383 Springhill Ave

- 2382 Adirondack Trail